Investors in perhaps the leader in telemedicine right now, Teladoc (TDOC), might be feeling like they need a doctor right now themselves. Or at least some kind of ulcer medicine.

Teladoc took a crippling hit, losing 43% in premarket trading on Thursday. Those losses continued into Thursday’s trading session as well. Teladoc’s earnings report emerged, and with its arrival, investors were left scrambling for the exits.

As clear as the use case — and the bull case — for Teladoc actually is, in light of the latest news I have little choice but to retreat to neutral. There is a path forward for Teladoc to win, but it’s going to require some major points going exactly right for the company.

The last year of trading in Teladoc has been on a mostly downward track. So far, the company has lost over two-thirds of its value in the past year.

The latest news will prove little help. The company released its earnings report, which featured a cataclysmic loss for Teladoc. FactSet analysts were expecting Teladoc to post a loss of just $0.60 per share. Teladoc’s actual loss was $41.58 per share. Revenue, however, was a much closer matter. Teladoc posted $565.4 million in revenue, and FactSet projections looked for $568.7 million.

The reason behind the massive discrepancy in loss came from a “non-cash goodwill impairment charge,” said to be connected to the purchase of Livongo Health. Teladoc ended up taking a $6.6-billion charge, which blasted the losses upward from original projections.

Wall Street’s Take

Turning to Wall Street, Teladoc has a Moderate Buy consensus rating. That’s based on 10 Buys and 18 Holds assigned in the past three months. The average Teladoc price target of $64.68 implies 110.2% upside potential.

Analyst price targets range from a low of $30 per share to a high of $141 per share.

Investor Sentiment

Some measures suggest things might be a little better than expected.

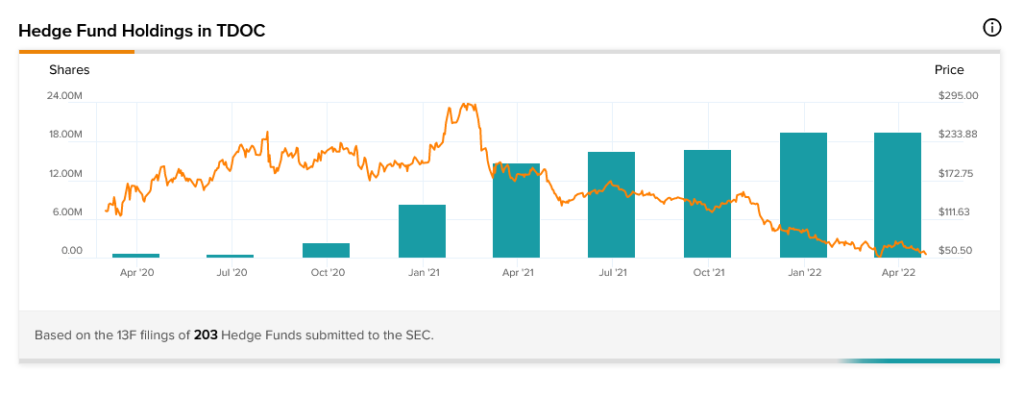

First, there’s the latest word via the TipRanks 13-F Tracker. That word demonstrates an increased interest in the part of hedge funds, and interest that’s been growing steadily for years now.

Hedge funds added an extra 2.6 million shares last quarter. Every quarter witnessed growth in interest in Teladoc since September 2020. The gains may be small, but they are present.

Second, there’s the matter of insider trading. Interestingly, there’s been more buying than selling at Teladoc for the last year. Since January 2022, buy transactions have led sell transactions by a whopping 13 to one. However, for the full year, buyers have led sellers by a very close 28 to 26.

As for retail investors who hold portfolios on TipRanks, they’re also increasingly interested in sticking around. In the last seven days, portfolios with Teladoc are up 1.2%. In the last 30 days, that number expands to 4.5%.

Not Dead Yet

Things look bad for Teladoc. The pandemic is in retraction, and the need for telemedicine is boiling off along with it. There are still plenty of use cases for telemedicine, but for the most part, people seem to be turning back to the old ways of consulting a physician.

Chronic care membership figures at Livongo bear this point out surprisingly well. Expansion rates between the fourth quarter of 2020 and the first quarter of 2021 were at 9.56%.

That slipped to 9.49% gain in the next quarter. The quarter after that, 1.4%. After that, 0.55%. Now, the gain between the fourth quarter of 2021 and the first quarter of 2022 is just 0.27%.

The biggest problem for Teladoc right now seems to be a combination of consumer inertia and major-name competitors. For instance, CVS Health (CVS) has been stepping up its MinuteClinic operations since it acquired Aetna a few years back.

Throw in the growth of Walmart (WMT) Care Clinic operations, and that only darkens the picture. Walmart was on track to open another 4,000 primary care “supercenters” by 2029. Some reports, however, suggest that number will be scaled back a bit.

Half the point of telemedicine operations were to get medical specialties into places that didn’t previously have them. If clinics are going into Walmarts, then there’s a doctor within roughly 15 miles of everyone in the United States.

It’s not all bad news for Teladoc; its BetterHelp platform saw more than 30% growth for the consumer market. It may well stand to benefit from changes on the insurer level as well.

Concluding Views

There’s a path to victory ahead for Teladoc. All it needs to do is get sufficiently on the customers’ side in order to fend off that massive new slug of competition.

When there are multiple paths forward, and most of them ending badly for the stock in question, it’s likely a good idea to stay out. However, with Teladoc stock as low-priced as it is right now — these are the lowest prices per share seen since 2017 — there’s reason enough to take a little risk.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure