Teladoc Health (TDOC) is the largest comprehensive virtual healthcare service in the world.

Teladoc is currently enjoying favorable macro trends, boosted by the impacts of the COVID-19 pandemic, including greater consumer usage and use of virtual care by employers, health plans, hospitals, and other providers.

Combined with the continuous expansion of Teladoc’s capabilities, the ongoing trends in the field should continue to present significant opportunities for the company to further penetrate a relatively fragmented market, and grow for years to come.

On the one hand, following the stock’s steep decline from its past highs, shares appear to be more reasonably valued at the moment. However, there are some concerns surrounding Teladoc, including its excessive stock-based compensation and speculative future profitability.

Stock-Based Compensation

While Teladoc has been growing rapidly, investors have disliked the company’s excessive stock-based compensation for years. Stock-based compensation is a great tool to retain great talent and to save on short-term labor expenses. At the same time, it can have negative consequences if misused, with the most damaging one being shareholder dilution.

In its Q3-2021 results, Teladoc reported a very satisfactory growth rate of 81% in its top line, which reached 521.6 million. However, the company also reported losses of $84.3 million. Guess how much of that was related to stock-based compensation – $71.7 million. That number is so high, it accounts for much of the company’s GAAP losses. In fact, the company records positive operating cash flows, excluding such non-cash items (and depreciation/amortization).

Still, with such high stock-based compensation numbers (and last year’s acquisition of Livongo), the company has increased its share count from around 37 million in 2015 to 160 million as of today. Hence, investors have been greatly diluted over the years.

The Valuation

With Teladoc’s investors being rapidly diluted and GAAP profitability unlikely to be met in the next few years, the stock has recently plunged from its past (high-valuation multiple) highs.

Based on expected FY-2022 revenues of around $2 billion, the stock is trading a P/S of around 6 at its current price levels. This multiple sounds rather cheap based on Teladoc’s growth trajectory. Then again, there is great speculation regarding where Teladoc’s future net income prospects stand and how many shares will have been printed by then, making it difficult to derive its future EPS prospects.

Wall Street’s Take

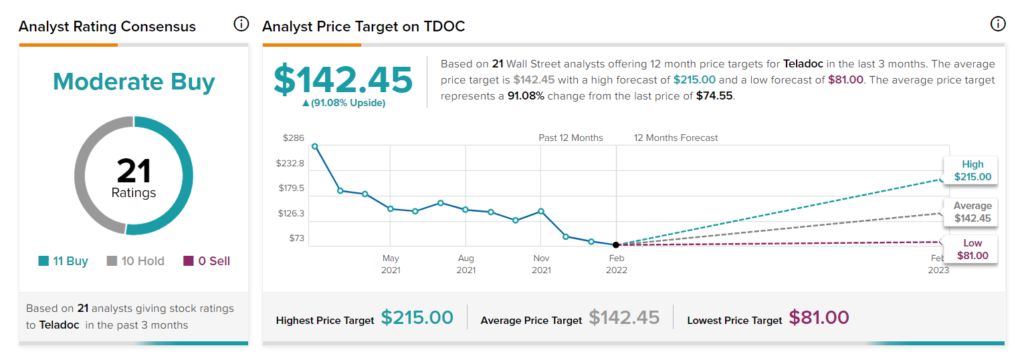

Turning to Wall Street, Teladoc Health has a Moderate Buy consensus rating, based on 11 Buys and ten Holds assigned in the past three months. At $142.45, the average TDOC price target implies 91% upside potential.

Conclusion

Teladoc is certainly disrupting the healthcare industry with its revolutionary product. That said, uncertainty still remains in the per-share value creation prospects of the company. If the company keeps diluting shareholders at its current pace, even if revenue growth remains at sky-high levels, it is quite hard to know how much investors are currently paying against Teladoc’s long-term profitability.

For this reason, investors must be cautious, despite Teladoc being a growth stock with a seemingly attractive valuation. I am neutral on Teladoc stock.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure