Target (TGT) just hit the bulls-eye with an across-the-board earnings smasher. The crowds cheered Target’s recent performance on social media, and traders bought Target shares on heavy volume. Nevertheless, Target doesn’t appear to be overvalued, and I am bullish on TGT stock because the company’s results and forward guidance are undeniably positive.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Furthermore, Target owns and operates a vast network of big-box retail stores. Except for the almighty Walmart (WMT), Target is probably America’s most recognizable bricks-and-mortar store chain where you can buy a wide variety of products at fairly reasonable prices.

Moreover, shoppers flocked to Target this year because they sought discounts amid persistent inflation. After all, prices of practically everything are still high nowadays, even if the rate of inflation isn’t as fast as it was in 2022 and 2023. So, let’s see if Target’s strategy of offering a refuge from sky-high product prices paid off in 2024’s second quarter.

Target’s Low-Prices Strategy Doesn’t Crimp Margins

To further support my bullish view on Target, let’s consider the company’s ability to maintain profit margins despite price cuts. One might assume that if Target slashes its product prices, this would necessarily inhibit the company’s profit margins. However, to the company’s credit, Target managed to keep its prices low while also growing its margins.

For example, just take a glance at Target’s second-quarter 2024 financial results, and you’ll see what I’m talking about. Target CEO Brian Cornell told Yahoo Finance that the store chain implemented “price reductions” on “5,000 items.”

Moreover, Cornell concluded that these price cuts “certainly contributed to traffic growth during the quarter,” and he expects this to “continue over the balance of the year.” Notably, Target’s traffic increased 3% year-over-year in the second quarter of 2024, and that’s a lot better than the company’s 4.8% traffic decline reported in 2023’s second quarter.

Interestingly, despite the product price reductions, Target’s margins (or at least, margin rates) actually improved in the second quarter of 2024. Specifically, Target’s operating income margin rate increased from 4.8% in the year-earlier quarter to 6.4% in Q2 of 2024. During the same time frame, Target’s gross margin rate rose from 27% to 28.9%.

In light of these results, large retailers, including Walmart, can take a lesson from Target. Keeping product prices reasonable really can be a win-win scenario for all stakeholders. Businesses don’t have to sacrifice margins in order to get more traffic in stores. Hopefully, Cornell and Target will continue to provide discounts to consumers in the coming months, so keep an eye out for that.

Target’s Positively Surprises Across-the-Board

Beyond the strong margins, Target delivered solid numbers across the board, giving investors exactly what they were hoping for. In fact, Target stock jumped 12% to 13% on Wednesday after the company posted its quarterly results. This kind of market reaction backs up my bullish stance on the stock.

To begin with, Target’s Q2 2024 revenue increased by 2.7% year-over-year to $25.5 billion, surpassing the analysts’ consensus estimate of $25.20 billion. While the beat isn’t substantial, it’s still a solid start.

Next, Target’s operating income grew 36.6% year-over-year to $1.6 billion. This is a pleasant surprise, as are Target’s second-quarter comparable sales of 2%, which came in at the high end of the company’s expectations.

Now, let’s get to Target’s bottom-line Street beat. The company reported Q2 2024 adjusted earnings of $2.57 per share, up 40% year-over-year compared to the $1.80 per share earned in the same quarter last year. This result also exceeded Wall Street’s consensus forecast of $2.19 per share.

Looking to the near-term, Target has guided for third-quarter 2024 adjusted earnings of $2.10 to $2.40 per share. The midpoint of this range is $2.30, which is higher than Wall Street’s consensus estimate of $2.24 per share. This represents another potential “beat,” though there’s no guarantee that Target will meet its current-quarter earnings guidance.

Finally, investors might wonder whether Target shares are overpriced after Wednesday’s stock-price rally. To assess this, I noted that the sector median non-GAAP trailing 12-month price-to-earnings (P/E) ratio is 18.17x.

Using a share price of around $162, I calculated Target’s trailing 12-month P/E ratio as $162 / ($2.10 + $2.98 + $2.03 + $2.57), which equals 16.74x. This is lower than the sector median of 18.17x. Therefore, from a stock-price-versus-earnings perspective, Target doesn’t appear to be overvalued at all. Based on these calculations, I remain bullish on Target’s stock, as it seems well-positioned for potential gains.

Is Target Stock a Buy, According to Analysts?

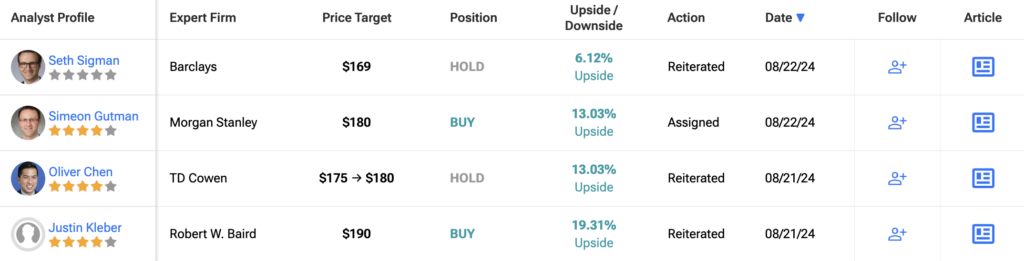

On TipRanks, TGT comes in as a Moderate Buy based on 17 Buys, 10 Holds, and one Sell rating assigned by analysts in the past three months. The average Target stock price target is $173.58, implying a 9% upside potential from current levels.

If you’re wondering which analyst to follow for buying and selling TGT stock, the top-performing analyst covering the stock over a one-year timeframe is Michael Baker of D.A. Davidson, with an average return of 20.84% per rating and a 67% success rate.

Conclusion: Should You Consider Target Stock?

Everybody likes a bargain, including Target’s loyal shoppers. However, value hunters might wonder whether Target shares are still a bargain when the market is pumping up the stock price.

There’s really no need to worry, though. Target’s earnings results appear to justify the company’s share price, even after a quick 13% stock-price pop. Therefore, in light of Target’s excellent quarterly performance and forward-thinking product-price-cutting strategy, I would absolutely consider taking a position in TGT stock.