Target (NYSE:TGT) stock has been steadily climbing higher since bottoming out in early October, now up more than 75% since those depths. As Target takes aim at intriguing (and pretty creative) new growth drivers, I’m inclined to stay bullish on the stock as it looks to reposition itself in a better spot to take market share away from some of its big retail rivals.

With realistic (and quite conservative) expectations in place, it’s Target’s rivals that I believe will have the target on their back over the coming years as the retailer moves on after a forgettable few years that saw shares tank.

Undoubtedly, Target’s relative bout of underperformance isn’t entirely its fault. Though there’s some blame to bear on management’s part, there’s really no changing the fact that Target is more discretionary compared to many of its better-performing rivals — think Walmart (NYSE:WMT) and Costco (NASDAQ:COST), which have thrived amid the hostile inflationary climate in recent years.

As inflation winds down, consumers heal and become more willing to splurge on the nice-to-haves; Target’s relatively light presence in the grocery section will no longer be a source of weakness. In essence, I expect a reheating up of the American economy to be a driving force for Target that could help it make up for lost time, perhaps at the expense of its more defensive rivals.

Target’s Grocery Game Bound to Improve by Leaps and Bounds

Either way, Target knows that it needs to improve its grocery game if it’s to survive the next period of economic sluggishness or scorching-hot inflation. As the Federal Reserve plays it “safe” (it’s not getting overly dovish, with only three interest rate cuts expected in 2024), I expect that it’s highly unlikely we’ll run into hot inflation again — that is, until the next black swan event brings forth the need for excessive money-printing.

In any case, Target has the desire to beef up its grocery presence and attract those looking to do their weekly grocery hauls.

“We were doing focus groups, and one of our guests said, ‘You know, I know Target sells food and beverage, but it kind of feels like an afterthought.'” said Target’s Executive Vice President Rick Gomez in a sitdown with CNBC.

Indeed, if Target is to take better aim at some of its better-performing rivals, it must prioritize becoming a primary destination for groceries, with its role as a discretionary retailer taking a secondary position.

As the economy begins to heat up, the key will be attracting consumers with competitively-priced food and necessities but getting them to stick around for discretionary goods. Costco has done a marvelous job of getting members to open their wallets for the must-haves and the nice-to-haves. Moving ahead, I think Target could begin to take a page out of the wholesale giant’s playbook as it bolsters its grocery business.

The good news is that Target has taken steps to jolt its grocery department by expanding its grocery section to more locations while also adding items to its private label Good & Gather. These days, lower-cost private labels have been like a secret weapon for retailers seeking to pocket sales and added margins to what would have otherwise gone to a third-party partner.

With around a fifth of overall sales coming from the Grocery segment, I’d argue that Target’s grocery segment has room to run and share to gain versus the likes of Walmart and Costco.

Target Subscription Could be Key to Comeback

Target’s pivot into subscriptions could allow it to better compete with top rivals, most of whom have subscriptions of their own. Indeed, Target may be a tad late to the game with its Circle 360 membership. That said, given the impressive value proposition offered, I think it could draw in some loyal customers away from rivals. Indeed, shopping at Target can be a fun experience. And for those living close to a Target, a membership to Circle 360 may prove even more valuable than a Walmart+ membership.

Target’s subscription offering, which costs $99 annually, grants free delivery and, most intriguingly, rush (same-day) shipping. These days, consumer want their goods, they want them with free shipping, and they don’t want to have to wait too long.

In many ways, Circle 360 seems like a necessity for the modern era of retail, and I have no doubt it’ll be a success as Target looks to hit back at rivals.

Is TGT Stock a Buy, According to Analysts?

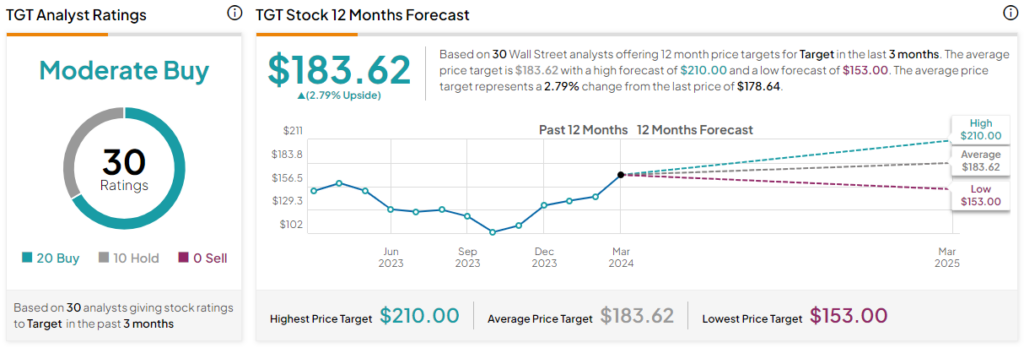

On TipRanks, TGT stock comes in as a Moderate Buy. Out of 30 analyst ratings, there are 20 Buys and 10 Hold recommendations. The average TGT stock price target is $183.62, implying upside potential of 2.8%. Analyst price targets range from a low of $153 per share to a high of $206 per share.

The Bottom Line on Target

As Target looks to finally even the playing field with its rivals, I think the recent relief rally could prove just the start. With an improving grocery presence, a new membership, and the potential for a healing consumer, I view Target stock as one of the bigger bargains in the retail scene right now. At 19.8 times trailing price-to-earnings (P/E), it’s not a mystery why most analysts are bullish on the name.