Target Corporation (NYSE:TGT) will announce its fourth-quarter financial results on Tuesday, February 28. Its Q4 top line could take a hit from the ongoing pressure on consumers’ discretionary spending due to high inflation and interest rates. However, Target’s multi-category portfolio could bring some respite.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Our data shows that the retailer surpassed analysts’ sales forecast 75% of the time in the past 12 months, compared to an industry average of 65.75%. As for Q4, Wall Street expects Target to post sales of $30.67 billion compared to $31 billion reported in the prior-year quarter.

During the Q3 conference call, the company highlighted that consumers are showing signs of stress and are refraining from discretionary purchases. This will negatively impact Target’s discretionary categories like apparel and home, and hurt its margins in the short term, noted Robert Drbul of Guggenheim. Nonetheless, Drbul is bullish about Target owing to its brand strength and customer loyalty.

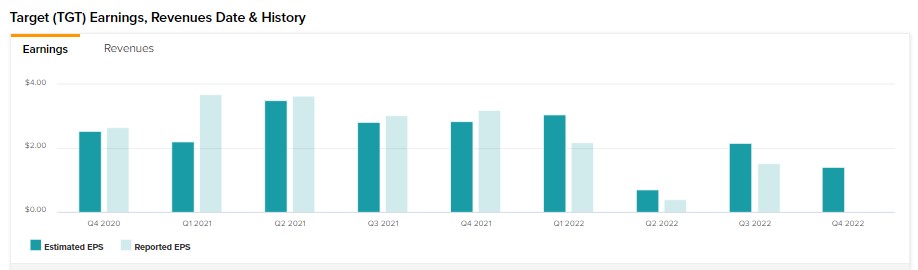

While Target’s top line could stay muted, pressure on margins from higher markdowns and shrink could take a toll on its bottom line. Target has missed analysts’ earnings forecast in the past three consecutive quarters. As for Q4, analysts expect Target to post earnings of $1.40 per share, down from $3.19 in the prior-year quarter.

What is the Future of Target Stock?

With 10 Buy and 10 Hold recommendations from analysts, Target stock has a Moderate Buy consensus rating. Moreover, analysts’ average price target of $181.33 implies 8.61% upside potential.

While analysts are cautiously optimistic, hedge funds sold 82.9K shares of TGT last quarter. Overall, TGT stock has an Outperform Smart Score on TipRanks.

Bottom Line

While near-term sales and margin headwinds could limit the upside in TGT stock, its focus on strengthening its next-day delivery capabilities and multi-category product offerings augur well for growth. Also, its value proposition and the convenience of omnichannel shopping are positives.