Sysco (NYSE:SYY) has a stellar history of dividend payments and growth (more than 25 consecutive years). While this Dividend Aristocrat (learn more about Dividend Aristocrats here) is a reliable bet for earning a worry-free income, SYY stock is also loved by the Top Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Before delving into further details, it’s important to note that TipRanks assesses top analysts based on industry, timeline, and benchmarks. The ranking indicates an analyst’s expertise in delivering higher returns. TipRanks’ algorithms evaluate the statistical significance of each rating, the analysts’ overall success rate, and the average return.

Sysco: A Top Income Stock

Sysco is a leading seller and distributor of food products to restaurants, educational facilities, and healthcare establishments. It has consistently returned substantial cash to its shareholders, thanks to its ability to generate solid earnings. Moreover, it plans to return $16.7 billion via dividends and share buybacks in Fiscal 2024.

What stands out is that Sysco increased its dividends for 53 years in a row, making it a top-income stock. Moreover, it plans to return $16.7 billion via dividends and share buybacks in Fiscal 2024. On April 27, the company increased its quarterly dividend to $0.50 per share from $0.49. Currently, it offers a forward yield of over 2.7%.

Sysco’s ability to drive volumes and operating leverage will support its financials and payouts. Also, the company’s commitment to maintaining its Dividend Aristocrat status suggests that it will continue increasing its dividends in the coming years.

What is the Price Target for Sysco Stock?

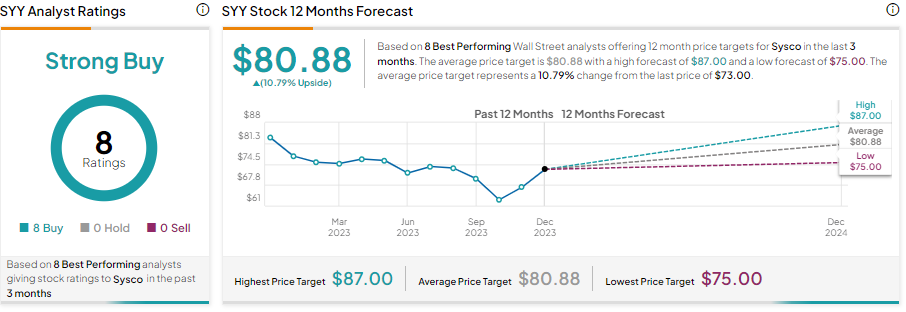

The stock has received Buy ratings from all eight top analysts who have recently rated it. Collectively, their 12-month average price target of $80.88 implies 10.79% upside potential from current levels.

Overall, the stock has 11 Buys and two Holds for a Strong Buy consensus rating. Moreover, these analysts’ average price target of $79.69 implies 9.16% upside potential.

Bottom Line

Sysco is a reliable stock for investors seeking regular income. Its solid dividend growth history and commitment to return more cash to its shareholders support its bull case. Meanwhile, top analysts covering the stock also maintain a favorable outlook on the stock.