Suncor Energy (TSE:SU), a Canada-based integrated energy company, has been plagued with numerous challenges in the past few years, including safety and health-related issues at various oil sites, causing cost increases and multiple downtimes. Nevertheless, SU has long-term prospects that cannot be overlooked.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company is wasting no time on enhancing its core business and reducing its debt. In 2021, Suncor deleveraged its balance sheet by almost C$4 billion. Its strategy is to maintain a disciplined capital approach to support cash flows and repay further debt this year.

The importance of energy security is growing as many countries are turning their attention to Canadian production. Incidentally, Suncor is the largest oil sand producer in Canada, which positions it to efficiently meet the growing demand for Canadian oil production over the years.

Consistent dividend-generating capabilities are also among Suncor’s positives. In Q3, the company returned C$638 million to shareholders in dividends. Last week, the company hiked its dividend by 11%, reaching C$0.52 per share, after its earnings increased by around 150% in the third quarter.

The company’s dividend yield is 4.3% currently, meaning 4.3% of share prices are paid to shareholders as dividends, which is impressive, especially during uncertain times when capital gains are hard to achieve.

Is Suncor Energy Stock a Good Investment?

The company has clearly benefited this year from burgeoning oil prices. Despite the recent lull in the oil sector, SU stock has gained 47% so far this year. Moreover, the current price is around 5.1x its forward 12-month earnings estimates, lower than the sector median forward P/E of 7.9x. This makes it reasonably priced currently.

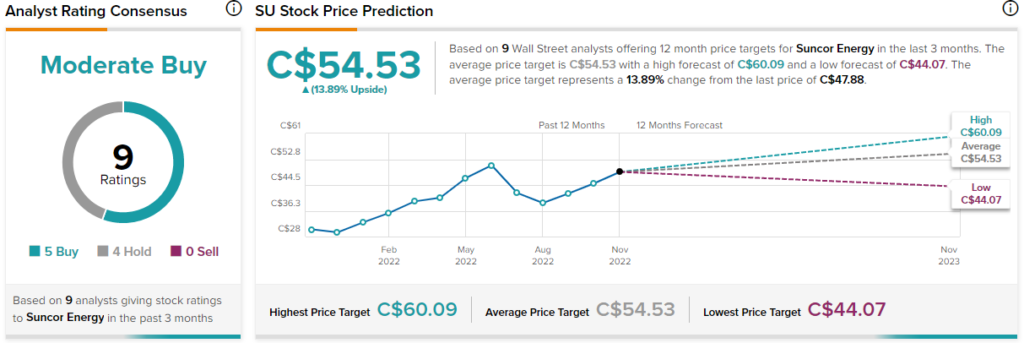

Wall Street is cautiously optimistic about the company’s prospects, with a Moderate Buy consensus rating based on five Buys and four Holds. The average SU price target of C$54.53 indicates that Suncor stock has the potential to increase by about 13.9% over the next 12 months.

Also, hedge fund activity on SU stock looks encouraging. Hedge funds increased holdings by 2.1 million shares last quarter, indicating a very positive confidence signal. Hedge funds are run by industry experts, and an increased purchase activity by them may indicate a positive outlook.

Takeaway: Don’t Overlook Suncor Stock

Reducing debt, a strong capital usage roadmap, secular demand for oil and energy, and a relatively inexpensive valuation make SU stock an attractive stock to consider.