Walt Disney’s (DIS) Q2 FY2025 results revealed a pleasant surprise last week. The entertainment conglomerate’s stock jumped 10% after it announced that its Disney+ subscriber count jumped 1.1% to 126 million, beating estimates of around 123.3 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, despite macroeconomic pressures, Disney’s entertainment segment saw revenues climb 9%, thanks to a strong domestic performance. The sparkling quarter comes just a couple of years after its CEO, Bob Iger, oversaw a strategic restructuring that organized the company into “three core, collaborative business segments.”

The combination of better-than-anticipated subscriber growth in Disney’s direct-to-consumer streaming segment and resilient performance in its Experiences division signals a turnaround for Disney, which makes me bullish on the stock despite ominous macroeconomic headwinds.

Disney+ Subscriber Growth Fuels 10% Stock Rally

More so than anything else, Disney’s quarterly results are thanks to its streaming segment. Recall that the company previously anticipated a potential decline in Disney+ subscribers during the quarter. Disney+ and Hulu, combined, ended the quarter with a combined total of 180.7 million subscribers. This surprising growth wasn’t easy going amid competition from the likes of Netflix (NFLX) and Amazon (AMZN), among others.

The company recently integrated its Hulu content with the Disney+ experience and added sports content. This led to increased engagement and significantly reduced “churn,” a term that describes consumers dumping a service after a short while. Disney has had theatrical successes with Moana 2 and Mufasa: The Lion King. These films can cause a “multiplier effect” because they drive both theater and Disney+ revenue.

Meanwhile, Disney series like Paradise and The Fall of Ruby Franke, are popular among streamers, too. So, Disney’s focus on strategic pricing and Hulu integration seems to be paying off. Disney’s stock has always been sensitive to Disney+ numbers because it is a critical segment for its business. Streaming generates high-margin and recurring revenue, not to mention free advertising.

Domestic Parks Growth Offsets China’s Weakness

Disney also saw momentum in its domestic Experiences segment, including theme parks, resorts, cruise lines, and consumer products. This was also a surprise, given that consumer confidence is at its lowest level since the COVID-19 pandemic. While Domestic Parks & Experiences grew 13% year-over-year, things were not as rosy overseas. International park revenue dipped 5%, with a significant 23% decline in operating income. The company attributed this to “softness” in China.

Disney recently unveiled a plan for a new theme park in Abu Dhabi. This would be the seventh Disney theme park resort globally and its first in the Middle East. While Disney oversees the project and provides intellectual property, it will not have an ownership stake or make direct capital contributions. In this vein, this development is a bit different from previous ventures. Instead, it will receive ongoing royalties. So, this is a low-risk, high-upside model. Should Disney’s brand suffer in the Middle East or travel be restricted, it has little to lose. However, this project is still a few years off, so nothing will quell Disney’s stagnant international performance in the near term.

Disney is making significant investments in its domestic business, as evidenced by capital expenditures increasing to $4.3 billion in Q2 FY2025 compared to $2.6 billion in the previous year. Furthermore, Disney is expanding its cruise lines and improving its U.S. resort parks. The idea is that Disney cannot just sit on its hands and depend on its brand. Staying relevant requires substantial and ongoing investments, and it is doing just that.

Is Disney Stock a Buy, Sell, or Hold?

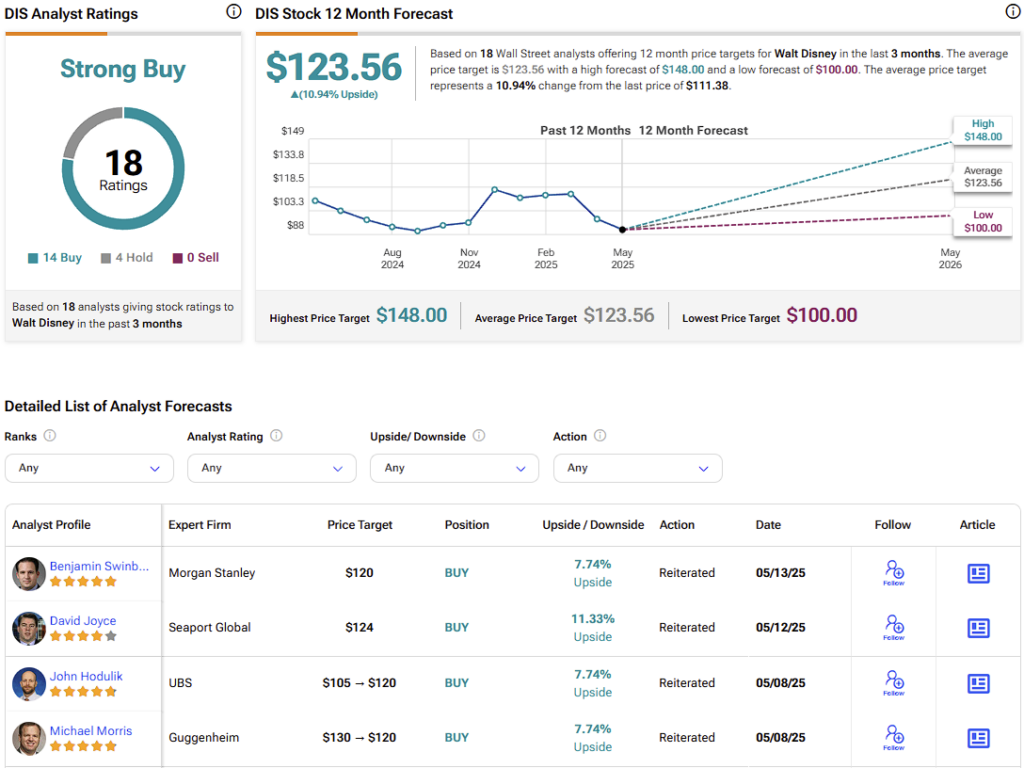

According to Wall Street, DIS carries a Strong Buy rating based on 14 Buy, four Hold, and zero Sell recommendations in the past three months. Walt Disney’s average price target of $123.56 implies an 11% upside potential in the next twelve months.

Last week, analyst Benjamin Swinburne from Morgan Stanley maintained a Buy rating on DIS and increased his price target to $120. The analyst highlighted Disney’s “robust revenue and margin performance” in its second quarter amid existing macroeconomic risks. He also attributed Disney’s increased EPS guidance to strong performance in its domestic parks and resorts segment.

Disney Surpasses Expectations but Struggles to Mitigate Risk

Disney’s streaming platforms and Experiences segment are currently exceeding expectations, even amid ongoing macroeconomic challenges. If economic conditions improve, the company could experience meaningful upside. Disney remains a well-positioned and resilient brand with a diverse portfolio that includes Disney+, ESPN, Hulu, and a globally recognized Experiences division.

However, there are risks worth noting. While Disney continues to enjoy strong brand recognition domestically, its performance may vary across international markets, as seen in recent reports of declining theme park attendance in China. Additionally, the company remains sensitive to broader economic shifts. During periods of financial strain, consumers often reduce discretionary spending, and streaming subscriptions are frequently among the first to be reconsidered.

Overall, Disney stands to benefit from a recovering entertainment industry and the continued evolution of the streaming landscape, making it a potentially valuable component in a well-balanced investment portfolio.