Amid the raging debate regarding the viability of the global banking sector, investors may want to hedge their bets toward a surer wager. Indeed, the best bet to survive the carnage in the financial market may be to consider the Strong-Buy-rated Coca-Cola (NYSE:KO). Detached from the banking drama (at least from a direct angle), the beverage maker benefits from a boring but reliable narrative. Therefore, I am bullish on KO stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To set up the reason why Coca-Cola may rise above the muck, investors must realize that the financial sector remains a questionable environment. For instance, toward the end of last week, genuinely hopeful developments materialized regarding First Republic (NYSE:FRC). Specifically, a consortium of the biggest banks in the U.S. got together to give FRC a $30 billion capital injection.

Still, FRC stock is near lows, down 90% year-to-date. In other words, the initial fears over a banking sector contagion still uncomfortably remain on the table.

Further, the U.S. government cannot keep bailing out depositors. Arguably, it made the right decision to protect individuals and businesses suddenly impacted by the implosion of the two major financial institutions. However, should other banking failures materialize, at some point, the government must draw a line in the sand. Otherwise, inflation could get out of control.

What investors committed to staying in the market really need is a dependable investment that can weather storms. That’s where KO stock looks very attractive.

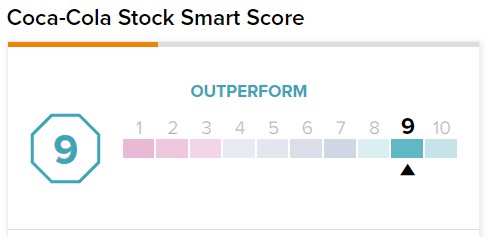

Aiding the bull case, on TipRanks, KO stock has a 9 out of 10 Smart Score rating. This indicates strong potential for the stock to outperform the broader market.

KO Stock May Benefit from the Chaos

Choosing an investment based merely on the fact that it’s not tied to a troubled sector doesn’t make for a convincing approach. Fortunately, the bullish narrative for KO stock involves more than just being a non-banking enterprise. On the contrary, Coca-Cola may benefit from the chaos.

Fundamentally, the beverage maker benefits from the trade-down effect. When faced with the shock of higher prices, consumers might not go cold turkey on their discretionary purchases. Rather, they may seek an increasingly cheaper alternative until they reach an equilibrium between cost outlays and received quality.

For instance, Starbucks (NASDAQ:SBUX) feeds the caffeine addiction of corporate America. However, as the price of everything rises dramatically, it’s becoming increasingly untenable for everyday folks to pay a premium price for a cup of coffee. Instead, consumers may eschew such premium treats for a trip to the grocery store, picking up Coca-Cola products as a significantly cheaper alternative.

Further, social normalization trends – particularly the return-to-office narrative – may offer a downwind benefit to KO stock. During the worst of the COVID-19 pandemic, white-collar workers operating remotely could essentially choose their schedule (within reason). Therefore, the need to drive over to the local coffee shop diminished considerably.

However, with companies recalling their employees, the standardization of schedules will become the norm. With the return of the drudgery associated with the nine-to-five – such as the morning commute and office politics – people need their caffeine fix. Still, with inflation pricing out previously popular options like Starbucks, Coca-Cola could become interesting. Therefore, investors should keep close tabs on KO stock.

Solid Financials Support Coca-Cola Investors

As you might expect from a consumer staples icon, Coca-Cola benefits from solid financials. Most notably, the company shines in terms of profitability. In particular, its operating margin (on a trailing-year basis) stands at 28%, while its net margin comes in at 22.19%. Both stats are elite for the industry. For instance, the sector median net margin comes in at 3.5%.

Not surprisingly, then, the company provides a solid trailing dividend yield of 2.92%. Per TipRanks, this stat ranks noticeably higher than the consumer goods sector’s average yield of 2.125%. And while its payout ratio of 71.65% is a bit on the elevated side, it’s also manageable based on the company’s overall fiscal profile.

To be fair, KO stock isn’t perfect. Regarding both trailing and forward earnings multiples, KO is above average for the sector, meaning the stock is relatively expensive. As well, it’s also priced at nearly 11 times book value, which is extremely high.

Still, people buy KO stock not necessarily to swing for the fences but to steadily move baserunners.

Is KO Stock a Buy, According to Analysts?

Turning to Wall Street, KO stock has a Strong Buy consensus rating based on 10 Buys, two Holds, and zero Sell ratings. The average KO price target is $68.18, implying 11.95% upside potential.

The Takeaway: KO Stock Keeps You in the Game

With the banking sector presenting not-unjustified anxieties, investors need to think about staying in the game rather than going for a knockout blow that would leave them exposed to significant volatility. Instead, KO stock provides a relatively safe investment. It’s not exciting by any stretch of the imagination. However, it should keep you in the game.