Starbucks stock (NASDAQ:SBUX) has essentially recorded no gains for investors for over four years. Shares are trading at the same levels they did all the way back in September of 2019. In fact, the stock has declined by about 2% since, despite the S&P 500 (SPX) gaining roughly 44%. While there are grounds justifying the stock’s steep underperformance, Starbucks continues to grow rapidly. Along with a margin expansion, the company features strong earnings growth potential. Thus, I’m bullish on SBUX stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Why Has Starbucks Stock Struggled in Recent Years?

Unlike the majority of stocks within the S&P 500, which experienced robust gains in the post-pandemic era, Starbucks stock has faced challenges in keeping pace. In my view, this can primarily be attributed to the upswing in interest rates. These rates have not only compressed Starbucks’ net profit margins but have also led to a concerning reduction in valuation.

For context, Starbucks’ revenue and operating income have grown from $26.5 billion and $3.9 billion in 2019 to $35.0 billion and $5.1 billion over the past 12 months. This progress is noteworthy, as it occurred during a turbulent macroeconomic landscape, which likely suppressed consumer spending on premium items like Starbucks’ expensive beverages. However, the issue lies in Starbucks’ inability to match its top-line progress with profitability.

Specifically, Starbucks’ net income has only inched up from $3.6 billion to a modest $3.8 billion during this period. Also, note that net income in Fiscal 2022 dipped to a mere $3.3 billion. What’s impeding profit growth? Nothing other than a surge in net interest expenses, which ballooned from $199.7 million in 2019 to a substantial $460.6 million over the past 12 months.

Simultaneously, the rising interest rate environment has translated into an elevated cost of equity. While this holds true for all equities, Starbucks’ muted net income growth has further deterred investors from being willing to pay a premium price for the stock.

Consequently, shares have transitioned from trading at a forward P/E ratio of about 30 in September 2019 to a current forward P/E ratio of just 23.8 (on a next-12-month basis). The combined effect of sluggish earnings and a sharp reduction in valuation, both driven by rising interest rates, clearly explain the stock’s underperformance.

Steadfast Revenue Growth Paving the Way for Earnings Rebound

While Starbucks has faced some challenges in recent years, there is a promising silver lining: Starbucks’ robust revenue growth is poised to catalyze a resurgence in earnings. Particularly noteworthy is the company’s recent re-acceleration in revenue growth. Given the unlikelihood of experiencing another abrupt interest rate increase akin to recent hikes, the company’s strong revenue growth should pave the way for promising earnings growth potential.

In Starbucks’ Q3 results, revenues reached a record $9.2 billion, up 12.5% from the prior year period. This implies an acceleration compared to last year’s revenue growth of 8.7%. The result was driven by the strength of Starbucks’ brand, the loyalty of its customers, and innovative products.

These catalysts fueled double-digit comparable store sales growth of 10%. In addition to this, revenues also benefited from 7% net-new company-operated store growth globally year-over-year, as well as continued momentum in the company’s global licensed market.

Importantly, powered by sales leverage, pricing, and productivity improvement from increased efficiency in its U.S. stores, Starbucks’ Q3 operating margin expanded 50 basis points from the prior year to 17.4%. The blend of higher revenues and the operating margin expansion resulted in a 22.3% rise in operating income.

Thus, even though interest expenses grew by 14.5% to $140.9 million, Starbucks’ net income still grew by 25.1% to $1.14 billion. With buybacks lowering the share count, EPS rose by a slightly larger 25.3% to $0.99.

Based on Starbucks’ results during the first nine months of its fiscal year, Wall Street expects that its EPS will grow by 17.7% for the full year to reach $3.45. Vigorous earnings growth of 16.5% to 18.5% is also expected to persist between Fiscal 2024 and Fiscal 2026. This illustrates the market’s expectations of fairly stable interest expenses moving forward against growing revenues and further operating margin expansion. Consequently, Starbucks, after a period of stagnation, is poised for a notable resurgence in earnings growth.

Is SBUX Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, Starbucks has a Moderate Buy consensus rating based on seven Buys and 12 Holds assigned in the past three months. At $114.31, the average Starbucks stock price target implies 25.4% upside potential.

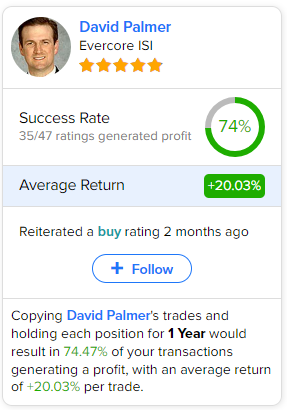

If you’re wondering which analyst you should follow if you want to buy and sell SBUX stock, the most accurate analyst covering the stock (on a one-year timeframe) is David Palmer from Evercore ISI, with an average return of 20.03% per rating and a 74% success rate.

The Takeaway

Overall, Starbucks stock may have experienced a prolonged period of stagnation, but recent progress suggests a potential turnaround. The challenges posed by rising interest rates have impacted the company’s profitability and valuation, contributing to its underperformance. However, Starbucks’ steadfast revenue growth, driven by brand strength, customer loyalty, and more store openings, presents a promising path toward an earnings rebound.

With expectations of stable interest expenses and continued margin expansion, the stock appears poised for a robust resurgence in earnings growth, and SBUX stock is likely to attract growing investor interest, moving forward. Thus, I am now bullish on the stock.