STAG Industrial (NYSE:STAG) stock has outperformed the rest of the real estate sector by a wide margin lately. This industrial REIT is known among investors for its monthly dividend. Over the past year, its shares have surged by 24%, while Vanguard’s Real Estate Index Fund (NYSEARCA:VNQ), the largest in the sector, saw a 1% decline. In my view, STAG’s solid characteristics are likely to persist, suggesting that the REIT remains attractive. Thus, I’m bullish on the stock.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

How Has STAG Industrial Stock Managed to Outperform?

In my view, STAG’s outperformance over the past year can be credited to the exceptional quality of its portfolio. The company’s strong asset base empowers STAG to consistently deliver resilient results and uphold a robust credit profile. This resilience, in turn, highlights STAG’s strong track record and provides a degree of insulation against the backdrop of interest rate hikes that have transpired in the past year. Let’s dive deeper into this.

STAG’s Property Portfolio

To set the scene, STAG Industrial boasts an exceptional portfolio comprising 558 industrial properties across 41 states, totaling approximately 111.1 million rentable square feet. Remarkably, this portfolio has exhibited unwavering resilience since STAG’s IPO in 2011, a time when the company’s holdings numbered a mere 93 properties. But what exactly makes STAG’s portfolio stand out so much to cause investors to stick with the stock even during such harsh environments for REITs?

To begin with, industrial properties, specifically warehouse and distribution buildings, typically entail lower capital expenditures compared to other types of commercial real estate. In the case of STAG, which primarily focuses on single-tenant properties, the associated costs for leasing, operations, and capital are also notably lower per property than those incurred with multi-tenant properties.

Moreover, STAG’s expansive portfolio spans more than 60 markets, strategically ensuring that no single market represents more than 7% of the company’s annualized base rent (ABR). Furthermore, the tenant base operates in a diverse array of 45+ industries, and no single tenant contributes more than 3% to its ABR.

Such a diversification strategy serves to mitigate the potential adverse impact of any industry-specific challenges on the overall performance of the portfolio. To add to that, STAG’s tenant roster consists of high-quality entities, including multinational giants boasting robust financials. For context, Amazon (NASDAQ:AMZN) is STAG’s largest tenant, accounting for 2.8% of its ABR.

Strong Track Record

The notable qualities of STAG’s property portfolio are evident in the company’s strong track record. As I mentioned, STAG’s portfolio has expanded significantly since the company’s IPO. More importantly, however, management has consistently ensured that each of the numerous acquisitions executed during this period has contributed positively on a per-share basis—an essential factor for any REIT investor to consider.

In particular, STAG’s funds from operations per share (FFO/share) have demonstrated solid growth, rising from $1.44 in 2013 to $2.21 last year, indicating a commendable compound annual growth rate of 7.5% over the past decade. That’s a strong result to achieve, especially given the company’s commitment to a monthly dividend policy. Notably, STAG has hiked its dividend for 12 consecutive years, a feat that reflects not only top-notch capital allocation agility but also a forward-thinking and reliable planning approach.

Assertive Results Despite Rising Rates

Despite the challenges posed by rising interest rates, STAG has maintained an impressive performance in Q2 2023, with a 4.8% increase in net operating income and a stable core FFO/share at $0.56. While many REITs experienced declines in these metrics, STAG’s strong operational performance and relatively low leverage successfully offset the 27.7% rise in interest expenses the company faced.

Looking ahead, STAG’s resilience is expected to persist throughout the second half of the year, as indicated by the company’s comprehensive full-year outlook. Management anticipates core FFO/share for FY2023 to fall within the range of $2.23 to $2.27. Notably, the midpoint of this forecast implies year-over-year growth of 1.8%, underlining STAG’s capacity for sustained success in the face of dynamic market conditions.

Is STAG Stock a Buy, According to Analysts?

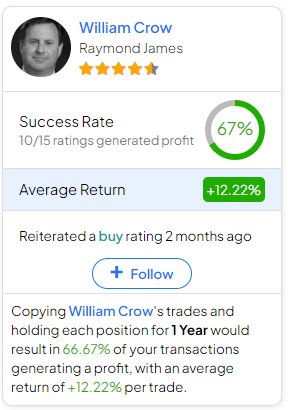

Turning to Wall Street, STAG Industrial has a Moderate Buy consensus rating based on four Buys, two Holds, and one Sell assigned in the past three months. At $38.71, the average STAG Industrial stock forecast implies 15.3% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell STAG stock, the most profitable analyst covering the stock (on a one-year timeframe) is William Crow from Raymond James, with an average return of 12.22% per rating and a 67% success rate.

Conclusion

STAG Industrial stock’s wide outperformance against its real estate peers can be attributed to its resilient, high-quality portfolio. Simultaneously, management’s strong track record and STAG performing well despite rising interest rates further convince investors to flock toward STAG in this market environment. Moreover, its monthly dividend payments, a favored trait among investors, add an extra layer of appeal, solidifying the justification for STAG’s recent impressive share price performance.

With a positive outlook for the rest of the year, STAG Industrial is likely to remain a compelling pick among conservative investors, sustaining the stock’s sector-beating trajectory. Consequently, I am bullish on the stock.