Sociedad Química y Minera de Chile S.A. (NYSE:SQM), which produces lithium, fertilizer, and chemical products (and also pays large dividends), has experienced highs and lows in the past few years. However, it’s unclear to me if the stock can bounce back. SQM recently signed an MoU (memorandum of understanding) concerning a deal proposed by the Chilean government that will see it become a minority partner (49%) in its existing operations from 2030, and demand for its lithium product is volatile.

The stock is currently down ~27% over the past 12 months, but it’s not giving me buy signals, and that’s why I’m neutral on SQM.

The Boom and Bust Cycle of Lithium

Lithium prices have reflected something of a rollercoaster over the past two years. Fueled by electric vehicle (EV) hype, prices of the silvery-white metal soared in 2022. However, SQM was part of the supply surge as miners around the world looked to respond to the electrification agenda.

Coupled with slower-than-expected EV adoption, we saw a dramatic price drop in 2023, with lithium reaching multi-year lows. It’s been something of a boom-bust cycle, highlighting the challenges of matching rapid demand growth with the relatively lengthy lead times needed to increase lithium production.

The falling price of lithium was evident in the company’s full-year results. Full-year revenues from the company’s lithium unit were approximately 36% lower when compared to 2022. Lower prices were partially offset by record-high sales volumes, which were almost 10% higher when compared to the previous year.

One major plus, however, is that SQM remained profitable despite the price of lithium collapsing over the past year. The company has access to excellent resources, which it is able to extract profitably, even at current prices.

Moving forward, the company’s management has remained hesitant to provide a clear outlook on the lithium segment. CFO Gerardo Illanes suggested demand would increase by 20% during the course of the year but highlighted that the timing of new supply coming online — noting that delays are common — may positively impact realized prices.

“We have seen stable prices in the last three months, and we do not have information today that allow us to foresee important changes in the coming three months,” the CFO stated. For me, the overriding message from the earnings call is uncertainty.

Given the volatility in lithium, it’s positive that SQM continued to invest in other areas, such as iodine and potassium. However, these remain a smaller part of the business. The company’s success remains highly intertwined with the realized price of lithium. It’s also worth highlighting that while lithium surged on EV hype, several battery makers have developed lithium-free batteries that are reportedly just as efficient. Looking further ahead, this adds another layer of uncertainty.

Clarity in Chile

One of the biggest threats facing SQM in recent years has been concerns about losing its production lease in Chile. Amid calls to nationalize the industry, and with SQM’s lease on the Salar de Atacama set to expire in 2030, investors were concerned that the company would lose its main lithium source.

As such, the aforementioned proposed deal with the Chilean government will avoid a lose-lose situation. SQM will retain a stake in the operation but only a minority interest (49% of the site). Codelco, the Chilean state-owned mining giant, will become the majority partner. If the deal is reached, it will certainly provide some clarity for investors and reduce the possible downside risks.

The agreement with the Chilean government — still at the MoU stage — suggests a shift in SQM’s focus. It seems likely that the company may now look to prioritize its lithium operations in Australia. The Santiago-headquartered firm recently inked an earn-in-agreement with Tambourah Metals (ASX:TMB) covering the Australian explorer’s Julimar North Project. This builds on an existing JVs at Mount Holland, also in Western Australia.

Analyzing SQM’s Valuation

SQM currently trades at 7x TTM earnings and 10x forward earnings. That’s not the movement we’d want to see, with analysts forecasting the year ahead to be less profitable than the one just past. In fact, analysts suggest that SQM’s earnings could fall by 14% annually over the medium term. Personally, I take these forecasts with a pinch of salt, as I’d be incredibly wary about forecasting the price of lithium in this volatile market.

Is SQM Stock a Buy, According to Analysts?

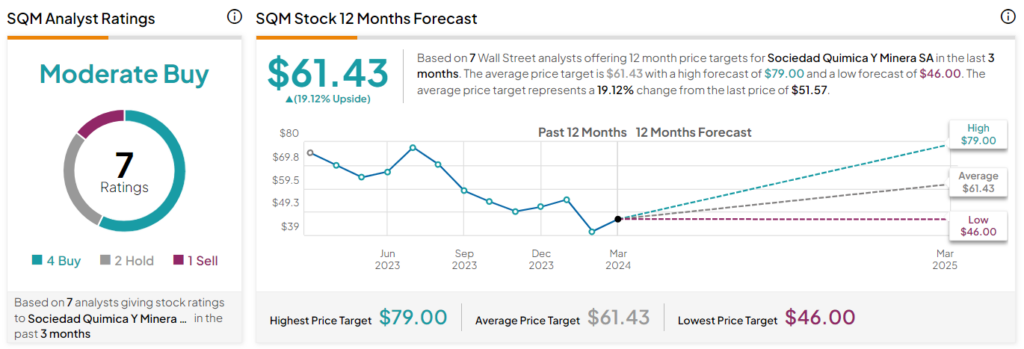

SQM stock currently has a Moderate Buy consensus rating on TipRanks based on four Buys, two Holds, and one Sell assigned in the past three months. The average Sociedad Quimica Y Minera S.A. stock price target is $61.43, implying 19.1% upside potential. The stock has a high forecast of $79.00 and a low forecast of $46.00.

The Bottom Line on SQM Stock

Few investment opportunities offer any kind of certainty. Companies in most sectors can be booming one moment and then suffering the next. However, in my view, very few investments offer the type of uncertainty that SQM offers right now.

A conclusion to negotiation over the lease in Chile will provide some clarity, which I’m sure will be welcomed with open arms by investors, but many uncertainties remain. Chief among these is the supply and demand dynamics for lithium. Nevertheless, I appreciate SQM’s low production costs and remain neutral despite the above concerns.