With just $72.3 million in assets under management (AUM), the Spear Alpha ETF (NASDAQ:SPRX) is tiny and unknown, but with a total return of nearly 90% last year, it’s worthy of more attention. I’m bullish on this new, under-the-radar ETF based on its eye-catching performance last year and its concentrated, compelling collection of growth stocks, which ties together an interesting collection of promising themes.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

What Is the SPRX ETF’s Strategy?

The Spear Alpha ETF is an actively-managed ETF from Spear Funds that “invests in companies benefiting from breakthrough trends in industrial technology.”

SPRX’s aim is to find and invest in “underappreciated opportunities across different value chains that are beneficiaries of…” secular themes such as artificial intelligence (AI), automation and robotics, enterprise digitalization, environmental focus and decarbonization, photonics and additive manufacturing, and space exploration. SPRX looks for long-term capital growth.

Eclectic Group of Holdings

SPRX holds just 27 stocks, and its top 10 holdings account for 75% of assets, so this is not a diversified ETF. However, SPRX seeks to be an actively-managed, concentrated fund, so diversification isn’t really the goal. If the fund’s top picks do well, the fund is going to do very well, and if they don’t, it is going to perform poorly.

Below is an overview of SPRX’s top 10 holdings using TipRanks’ holdings tool.

As you can see, SPRX hits the theme of investing in generative AI through its top two holdings, Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD). Nvidia makes up 11.9% of the fund’s assets, while Advanced Micro Devices accounts for 9.9%. These large positions paid off, as Nvidia is up 235.5% over the past year, while Advanced Micro Devices is up 124.1%. Within this theme, the fund also has a top 10 position in Marvell Technology (NASDAQ:MRVL), which is up 53.2% over the past year.

Beyond generative AI, the fund’s managers also clearly have a favorable view toward cybersecurity stocks, as Crowdstrike (NASDAQ:CRWD), Zscaler (NASDAQ:ZS), and SentinelOne (NYSE:S) are all top 10 positions.

SPRX is also invested in a handful of software stocks, including Snowflake (NYSE:SNOW), Confluent (NASDAQ:CFLT), and Hubspot (NYSE:HUBS). Electric vehicles appear to be another area of interest as the fund is invested in both Tesla (NASDAQ:TSLA) and Rivian (NASDAQ:RIVN).

While the fund clearly skews towards technology stocks, interestingly, SPRX isn’t the type of fund that simply invests in the household name tech stocks and calls it a day. The fund notably has investments in several basic materials and metals and mining stocks, including Freeport McMoran (NYSE:FCX), Rio Tinto (NYSE:RIO), and Albemarle (NYSE:ALB).

This is a smart area for a fund focused on electrification and decarbonization to invest in. SPRX’s managers clearly recognize that if the world is going to electrify more of its vehicle fleet and power grid, then copper from companies like Freeport McMoran and lithium from companies like Albemarle are going to be more in demand.

I actually prefer investments in stocks like these to the likes of Rivian and other EV stocks because, unlike Rivian, they are making profits right now, they trade for inexpensive valuations, and many of them are also dividend stocks.

All in all, SPRX has an interesting portfolio and takes an omnivorous approach toward investing in what it sees as the major growth themes that it believes will drive the market, going forward.

Eye-Catching Performance

SPRX only launched in 2021, so it doesn’t yet have a long track record of performance to evaluate it. The fund had a difficult 2022, losing 45.0% for the year as the market punished tech and growth stocks.

However, it bounced back in resounding fashion in 2023, with a spectacular gain of 88.0%.

While technology and growth stocks were up generally, SPRX’s gain of 88% still stands out, as its returns easily surpassed those of popular tech and growth-themed index ETFs. For example, the Invesco QQQ Trust (NASDAQ:QQQ) returned 54.9% for the year, and the Technology Select Sector SPDR Fund (NYSEARCA:XLK) returned 56.0%. To be clear, these are fantastic returns that any investor would be happy with, but SPRX still managed to beat them for the year.

SPRX also outperformed perhaps the most popular actively-managed technology ETF in the market, the ARK Innovation ETF (NYSEARCA:ARKK), which returned a stellar 67.6% in 2023.

While it would be unreasonable to expect SPRX, or any ETF, to continue to put up these types of results, the fund looks promising based on what it has achieved thus far.

What Is SPRX’s Expense Ratio?

One downside of SPRX is that its expense ratio of 0.75% is on the high side. This 0.75% expense ratio means that an investor in the fund will pay $75 in fees on a $10,000 investment annually.

That being said, this is a smaller, actively managed ETF, so it is unsurprising that its fees are high. It’s also worth noting that these fees aren’t out of line with other popular actively managed technology ETFs. For example, the aforementioned ARK Innovation ETF also charges 0.75%.

If the fund is performing well like it did last year, many investors won’t mind paying this expense ratio, but if its performance suffers a downturn, this fee could end up being a bitter pill for investors to swallow.

Is SPRX Stock a Buy, According to Analysts?

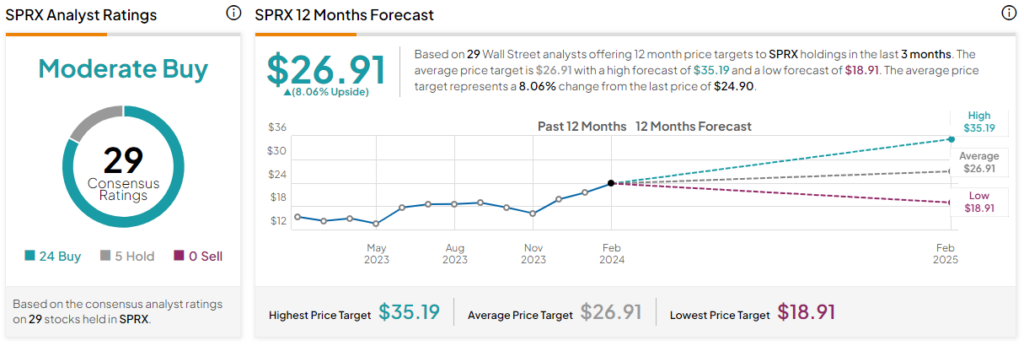

Turning to Wall Street, SPRX earns a Strong Buy consensus rating based on 24 Buys, five Holds, and zero Sell ratings assigned in the past three months. The average SPRX stock price target of $26.91 implies 8.1% upside potential.

Looking Ahead

SPRX is a small, under-the-radar, actively managed technology ETF that burst onto the scene with a return of nearly 90% last year, outperforming popular technology and growth index ETFs as well as popular actively-managed tech ETFs. The fund clearly warrants further attention from investors.

While it would be unreasonable to expect it to continue to put up results at these levels, its track record so far is impressive, and it looks like it is continuing this momentum with a return of 9.9% thus far in 2024.

I’m bullish on this ETF based on its supercharged performance and its intriguing portfolio, which brings in a variety of growth themes ranging from AI to the materials needed for vehicle electrification. SPRX brings a unique and omnivorous approach to growth investing that you don’t find in all tech funds, many of which buy large-cap tech companies and call it a day.

It’s important to note that as a small, actively-managed fund, SPRX is a pricey investment option with an expense ratio of 0.75%. If the fund continues to soundly outperform the market from here, this expense ratio will be water under the bridge, but these high fees could start to sting if the fund underperforms.

Given its short track record, high fees, and concentrated portfolio, SPRX is likely best suited for risk-tolerant investors.