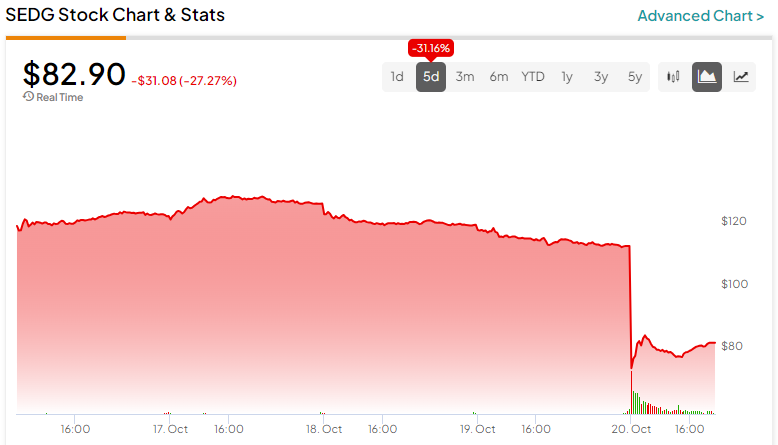

SolarEdge Technologies (NASDAQ:SEDG) stock is one of the worst performers today, both inside and outside of the solar sector. Before making any buying decisions, it’s wise for prospective investors to let the market absorb SolarEdge’s recent announcements. It will take some time for the bad news surrounding SolarEdge Technologies to sink in, so I am neutral on SEDG stock and am staying out of the way for a while.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based in Israel, SolarEdge Technologies sells inverter systems for solar photovoltaic (PV) installations. Some investors may be optimistic about SolarEdge’s prospects as a global competitor in the solar equipment space.

It’s fine to be bullish about the solar industry and even about SolarEdge Technologies in particular. However, you’ll definitely want to get the lowdown on SolarEdge Technologies’ latest update before considering SEDG stock. Then, you’ll probably decide to wait on the sidelines until the market calms down.

SolarEdge Technologies Gets Multiple Price Target Cuts

Even before SEDG stock collapsed on October 20, a number of experts on Wall Street signaled caution about SolarEdge Technologies. Did they sense that a share-price rout was about to take place?

I don’t know the answer to that question, but I can say with confidence that some analysts had mixed feelings about SolarEdge. For example, Piper Sandler analyst Kashy Harrison lowered his price target on SolarEdge stock from $325 to $210. Harrison observed (the following citations are courtesy of TheFly) that the “demand dichotomy” between utility and consumer end markets has persisted into third-quarter earnings for the renewable and alternative energy space.

Similarly, Citigroup (NYSE:C) lowered its price target on SEDG stock from $330 to $248. The Citigroup analyst expects “another rough quarter” for residential solar companies, though they also contend that utility-scale stocks should fare better.

Meanwhile, JPMorgan Chase (NYSE:JPM) analyst Mark Strouse lowered his price target on SolarEdge stock from $299 to $275. Strouse noted a “very volatile” last few months for alternative energy stocks, though he predicted that the sector’s third-quarter results should be an “important catalyst, helping to buoy better positioned stocks that have been dragged down with the overall space.” As we’ll discover in a moment, Strouse’s optimistic expectations might not pan out as anticipated.

In addition, Scotiabank (NYSE:BNS) drastically reduced its SolarEdge Technologies stock price target from $345 to $170. Scotiabank expects the third-quarter reporting season to be “very early to see major signs of inflection or improvement in the operating environment for residential solar.” Just to give you a preview, investors probably shouldn’t be overly confident that there will be “major signs” of “improvement.”

SolarEdge Technologies’ Pre-Earnings Disaster

Those analysts were right to be cautious and to lower their price targets for SEDG stock. SolarEdge Technologies won’t release its full Q3-2023 earnings results until November 6, but the company announced its preliminary quarterly financial figures yesterday. Suffice to say, the market didn’t respond favorably, as SolarEdge shares have plummeted.

Here’s what happened. SolarEdge Technologies CEO Zvi Lando admitted that the company “experienced substantial unexpected cancellations and pushouts of existing backlog” from European distributors, and this weighed on the company’s financials.

Consequently, SolarEdge’s management anticipates third-quarter “revenue, gross margin and operating income” to be “below the low end of the prior guidance range.” Not only that, but SolarEdge Technologies braced the market for “significantly lower revenues” in the fourth quarter.

Furthermore, SolarEdge Technologies lowered its third-quarter revenue guidance range to $720 million-$730 million from the previous range of $880 million-$920 million. So now, it’s easy to see why investors aren’t very happy about SolarEdge.

Is SEDG Stock a Buy, According to Analysts?

On TipRanks, SEDG comes in as a Moderate Buy based on 11 Buys and eight Hold ratings assigned by analysts in the past three months. The average SolarEdge Technologies stock price target is $206.11 (though this is likely to change soon), implying 148% upside potential.

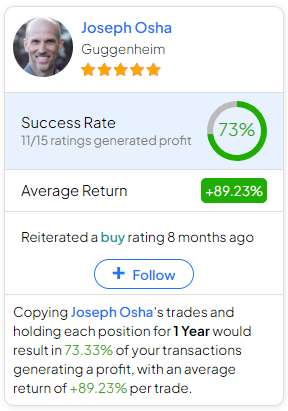

If you’re wondering which analyst you should follow if you want to buy and sell SEDG stock, the most profitable analyst covering the stock (on a one-year timeframe) is Joseph Osha of Guggenheim, with an average return of 89.23% per rating and a 73% success rate. Click on the image below to learn more.

Conclusion: Should You Consider SEDG Stock?

There actually might be a rally coming for SolarEdge Technologies stock since the market is now pricing in all of the unfavorable news. Maybe investors will relax a little bit after SolarEdge releases its full quarterly earnings results.

There’s no guarantee that this will happen, though. The market might take days, weeks, or longer to absorb the shock of SolarEdge Technologies’ preliminary quarterly announcements. Therefore, investors probably shouldn’t consider buying SEDG stock now, and I believe it would be wise to wait and see if the share price drops further before making any decisions.