SoFi Technologies (NASDAQ:SOFI) might represent the future of banking, but prospective investors should think twice. Downgrades from prominent strategists indicate that SoFi Technologies could have a bumpy road ahead, and I am neutral on SOFI stock for the foreseeable future.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

SoFi Technologies is both a personal finance app and a legitimate, chartered bank in the U.S. While it’s available to a wide variety of demographics, SoFi Technologies mainly appeals to younger bankers, including Zoomers and Millennials.

There’s a potentially positive catalyst for SoFi Technologies contained within the bipartisan debt-ceiling agreement. Plus, SOFI stock has rallied significantly recently. Be careful, though, as a number of analysts are currently cautious about SoFi Technologies.

Student Loan Overhang is Lifted for SoFi Technologies

Earlier this year, some folks were worried about SoFi Technologies because of the regional bank fiasco that involved Silicon Valley Bank, as well as the cryptocurrency scandal involving FTX. However, SoFi Technologies seems to have survived those financial sector crises. Now, investors can turn their attention to another issue that has been problematic for SoFi Technologies – the pause on required federal student loan repayments.

Certainly, it’s not a coincidence that SOFI ran higher while practically the entire stock market rallied during the past month. As the old saying goes, a rising tide lifts all boats. Yet, there’s also been another catalyst at work. SoFi Technologies generates some of its revenue from refinancing student loans. Therefore, it’s positive news for SoFi Technologies that the recent debt-ceiling agreement indicates a potential ending of the student loan repayment pause after August 30.

At least one analyst took note of this, as BTIG analyst Lance Jessurun initiated his coverage of SOFI with a Buy rating, citing “potential further upside coming from the end to the student loan payment moratorium.” Jessurun also feels that “it’s difficult to see valuation remaining this low with GAAP profitability by the end of FY23.” However, I’d respond to that by saying there’s no guarantee that SoFi Technologies will achieve profitability within that timeframe.

Analysts Point to Valuation Concerns with SoFi Technologies

One thing to remember is that the financial markets are highly efficient. Everything I just stated about the likely end to the student loan repayment pause is already known and has likely already been priced into SOFI stock. Furthermore, it’s worth considering whether the SoFi Technologies share price might be too high and due for a pullback or at least a period of consolidation.

After all, when a stock goes from $4.75 to $8.50 in less than a month, that’s not normal or natural, even if the student loan repayment pause is set to end soon. As Bank of America (NYSE:BAC) Global Research analyst Mihir Bhatia put it, “While we agree the payment moratorium expiry is a positive, we now see the positive fundamental aspects of the story as largely priced in.” Notably, Bank of America analysts reduced their rating on SoFi Technologies stock from Buy to Neutral.

In a similar vein, Oppenheimer analyst Dominick Gabriele downgraded SOFI stock from Outperform (similar to Buy) to Perform (similar to Hold). Gabriele cited the stock’s “epic” year-to-date rally and reported that “SoFi’s stock is trading at the top end of our high range.”

Moreover, Piper Sandler analyst Kevin Barker lowered his rating on SoFi Technologies shares from Overweight (similar to Buy) to Neutral, with the explanation that “The change in our rating is primarily due to valuation.” With that in mind, Piper Sandler analysts downgraded SoFi Technologies stock from Overweight to Neutral.

What is the Price Target for SOFI Stock?

Turning to Wall Street, SOFI stock comes in as a Moderate Buy based on seven Buys, eight Holds, and one Sell rating. The average SoFi Technologies stock price target is $8.86, implying 2.9% upside potential.

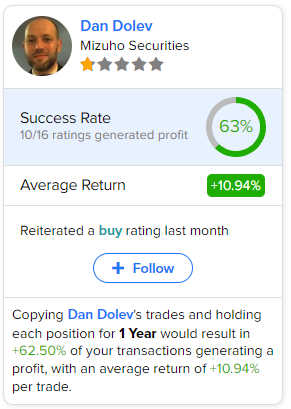

If you’re wondering which analyst you should follow if you want to buy and sell SOFI stock, the most accurate analyst covering the stock (on a one-year timeframe) is Dan Dolev of Mizuho Securities, with an average return of 10.94% per rating and a 63% success rate. Click on the image below to learn more.

Conclusion: Should You Consider SOFI Stock?

With multiple experts on Wall Street pointing to SoFi Technologies’ possible overvaluation, it may be time for the perma-bulls to pause and reflect. Sure, it’s positive news for SoFi Technologies that the government plans to end the student loan repayment pause, but that’s already a known and priced-in factor.

This doesn’t mean SoFi Technologies is a failing business by any means. Perhaps SOFI stock will be a worthy Buy if it comes down by 10%. Unless and until that happens, though, I’m only prepared to assign a neutral assessment to SoFi Technologies.