The marriage of finance and digital technology, or fintech, has brought a sea-change to the way we spend and use money. From simply accessing our bank accounts online, to the explosive expansion of e-commerce, to the rise of digital payment processing and other consumer financial services – fintech touches all our lives in multiple ways.

Of course, this has generated money, too, in the form of profits and investor opportunities. According to the analysts at Mordor Intelligence, the fintech market will exceed $355 billion by 2028, and per Statista, transactions conducted within the fintech sector will reach $9.2 trillion by 2027. When numbers like that get bandied about, there’s sure to be an opening for investors.

Analyst Kevin Barker, from Piper Sandler, has his finger on fintech’s pulse, and he’s looking at three stocks in particular that investors should consider. SoFi, PayPal, Block – each has its own spin on the fintech business, and each offers investors its own combination of risk and reward. Barker, who is rated by TipRanks in the top 3% of Wall Street’s analysts, notes the benefits and drawbacks of these stocks, and doesn’t hold back from pointing out the best one to buy.

SoFi Technologies (SOFI)

First up on the list is SoFi Technologies, a fintech company based in San Francisco, where so much of the fintech world got its start. The company’s name is derived from ‘Social Finance,’ reflecting its basic orientation – SoFi brings the forms of online social media interaction to bear on fintech, creating a thoroughly modern take on banking. The company boasted 5.22 million customers at the end of last year, a number that was topping 6.9 million less than one year later at the end of this year’s third quarter.

SoFi offers its customers a full range of banking services, including investment banking, access to home and personal loans, credit cards, credit scoring, and even refinancing options for existing student loans, car loans, and the like. The company boasts that, since its founding in 2011, its services have helped members pay off more than $34 billion in debt and earn back some $35 million in rewards. SoFi has, in that time, funded over $73 billion in new loans.

Personal finance has been good business for SoFi over the years. The company has seen steadily rising revenue for some time, and the most recent financial results, from 3Q23, gave a top line of $537.2 million. This was up almost 27% year-over-year and beat the forecast by $21.6 million. The company’s bottom line came to a net loss of $0.03 per share, but this was a solid improvement from the 9-cent loss reported in the prior-year quarter – and it was 6 cents per share better than had been expected.

These results were generated by strong increases in the company’s business. SoFi reported a net gain of 717,000 new members during Q3, for a y/y increase of 47%. And, the company saw total customer deposits reach $15.7 billion during the quarter; this was a 23% y/y gain, or $2.9 billion in absolute terms.

Turning to Piper Sandler’s Barker, we find this top analyst taking a cautious approach, upbeat on SoFi’s overall strong business model but careful regarding the severity of approaching headwinds. Barker writes, “We expect SOFI to see a sizable increase in spread income due to a much larger asset base than FY23, but these tailwinds to be offset by a $400M headwind from higher NCOs and premium amortization on the personal loan portfolio. Meanwhile, the Technology and Financial Services segments should see sizable operating margin expansion from continued topline growth coupled with a greater focus on controlling expenses. The headwinds developing from premium amortization and slowing loan growth should cause SOFI to focus on operating margins via expense control in 2024.”

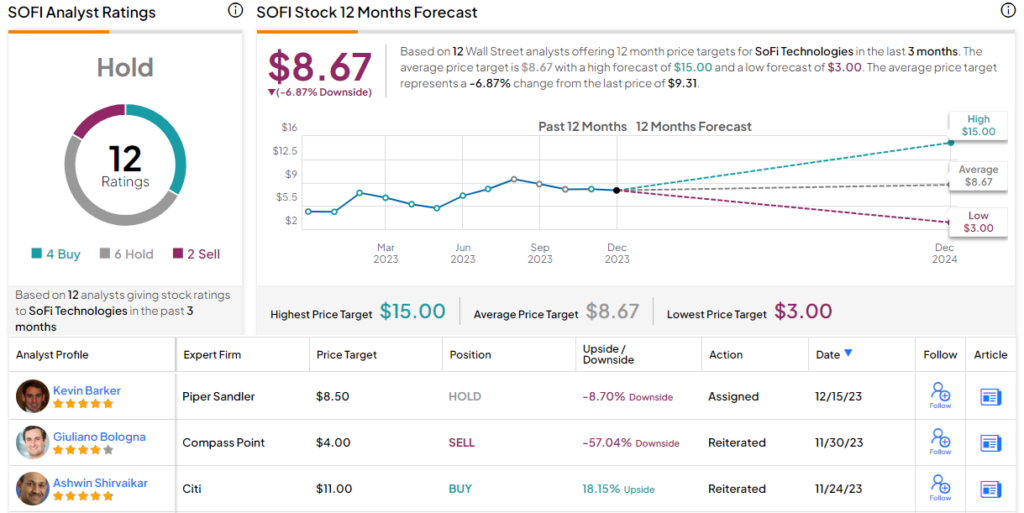

Quantifying his stance, Barker gives SOFI shares a Neutral rating, with an $8.50 price target that points toward a downside of 9% in the next 12 months. (To watch Barker’s track record, click here)

Overall, the Street agrees with Barker’s caution on this one. The stock has 12 recent reviews that break down to 4 Buys, 6 Holds, and 2 Sells – for a Hold consensus rating. The shares are selling for $9.31 currently, and the $8.67 average target price suggests a modest 7% depreciation in the coming year. (See SoFi stock forecast)

PayPal Holdings (PYPL)

Next on the list is PayPal, an old-timer in the fintech world – having been founded back in 1998 and survived the dot.com bubble. PayPal has since become a leader in its field, with a market cap of almost $68 billion and processing more than $387 billion worth of transactions in its last reported quarter.

PayPal offers customers the advantages of a digital wallet and online payments capability with a global footprint – and options to both send and receive payments, to send invoices, to operate in multiple currencies, and to work with a wide range of online vendors, including auction sites.

On the positive side, PayPal’s high transaction volume in 3Q23, up 15% y/y, generated $7.4 billion in net quarterly revenue for the company, for an 8% y/y increase that beat the forecast by $20 million. At the bottom line, PayPal realized a non-GAAP operating income of $1.6 billion in the quarter, a figure that was also up 8% y/y. Per share, the non-GAAP earnings came to $1.30, 7 cents per share above the forecast. The company’s quarterly free cash flow was reported at $1.1 billion.

These results came from the collective activity of 428 million active users, conducting a total of 6.3 billion payment transactions. This was an 11% increase in total transactions year-over-year.

On the negative side, we should note that PayPal’s active user accounts total was down from 3Q22, by 4 million accounts – or a shade under 1%. The company’s revenues, while trending upward, are rising slowly. And, earlier this month, Amazon.com, the world’s largest e-commerce site, announced that as of this coming January it will no longer accept PayPal’s Venmo digital wallet as a payment option.

All of that would naturally cause some caution among investors. In addition, the company has also experienced an upper level management transition this year, as former Intuit exec Alex Chriss took over as CEO this past September. Shares in PayPal are down approximately 17% this year, as investors are taking a cautionary stance. In short, some on the Street see PayPal, for all of its success, as something of a ‘show me’ story, and want to see sustained growth before going all-in.

That background helps us make sense of Barker’s comments on PYPL – and his Neutral rating on the stock. Barker writes, “We were encouraged to see Alex Chriss (new CEO) lay out his vision during 3Q which included: a focus on ‘aligning resources to the highest growth areas,’ committing to greater transparency, and acknowledging the organization is ‘spread too thin’ due to several acquisitions. CEO Chriss also specifically cited a need to generate greater small business adoption of PayPal Complete Payments, in the U.S. and globally. We expect management to roll out much more detail during 4Q earnings.”

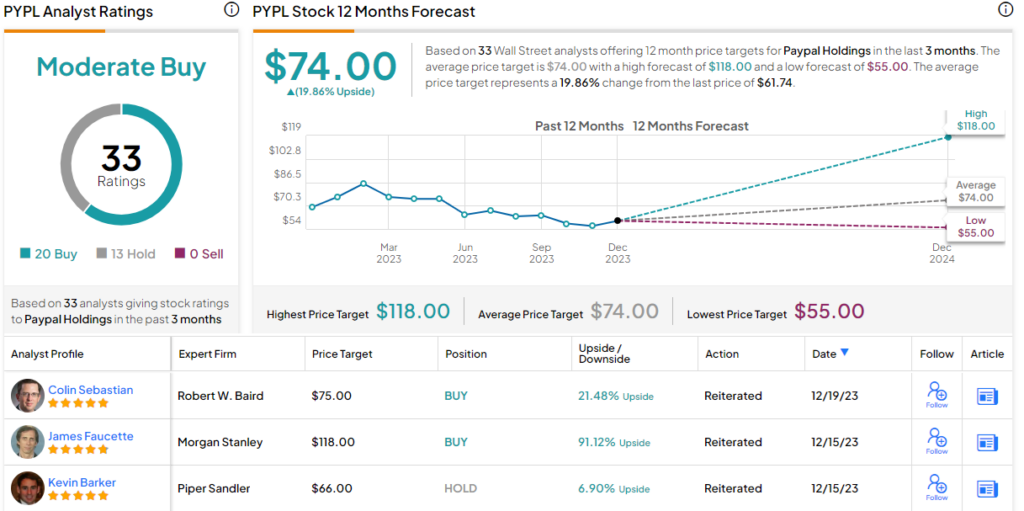

As noted, Barker rates PYPL as Neutral and his his price target, of $66, implies a 7% one-year upside potential.

Zooming out, we find the Street’s analysts giving PYPL a Moderate Buy consensus rating, based on 33 recent reviews that include 20 Buys to 13 Holds. The shares are currently trading for $61.74 and their $74 average target price points toward a one-year gain of 20%. (See PayPal stock forecast)

Block, Inc. (SQ)

Last on our list is Block, a holding company that owns two important names in fintech – Square and Cash App. These give the company one hand on the vendor side and one hand on the consumer side of digital transactions, and make Block a highly flexible fintech. The company’s two leading apps, together, make mobile payments easy, make it possible to conduct business anytime, anywhere, and allow buyers to make their own electronic payments as simple as using cash.

To start with, Square includes both hardware and software – and vendor users can apply Square to turn their own devices, smartphones and tablets, into card readers and cash registers. This is particularly useful for small vendors following a traveling kiosk model – imagine having the cash register in your back pocket. From the customer side, the Cash App boasts of universal accessibility. Together, these applications have made Block a go-to place for streamlined financial transactions.

Drilling down, we find that Block is fine-tuning its apps to improve their applicability to specialized situations. Square, for example, can be optimized by users to fit better with particular businesses, such as food service or package delivery, and offers features that allow small businesspeople to both diversify revenue and manage cash flow. Cash App brings some of the same flexibility to its users’ bank accounts, with options to move funds to savings, to access debit and credit functions, and even to conduct stock investments.

Shares in Block have been climbing since early November, buoyed by the general market gains – but they also got a boost from a solid Q3 report. The company’s quarterly revenue came to $5.6 billion, $190 million over the forecast and up 24% from 3Q22, while the non-GAAP net income of 55 cents per diluted share was 9 cents better than analysts had anticipated. The company achieved these results despite weaker results from Square; the seller-side app saw profits go up 15% y/y, while Cash App recorded a 27% increase.

For Kevin Barker, there is reason to believe that Block is going places – good places. The analyst says of the company, “Management cited a combination of weakening macro conditions during 3Q and company-specific issues for the weaker Square revenue growth. In addition to the series of efficiency initiatives in motion, management stated one of the key initiatives to drive more growth within seller will be providing banking products. The change in tone during last Q’s earnings was a step in the right direction for SQ, as the company established a specific timeframe of 2026 to achieve the ‘Rule of 40’ (gross margin + GP growth = 40%).”’

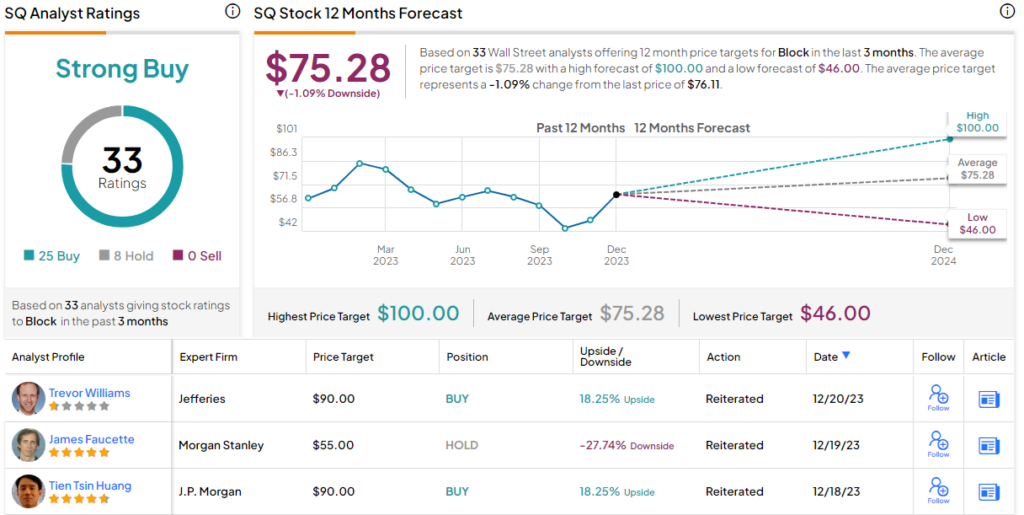

Barker goes on to rate SQ shares as Overweight (Buy), with an $86 price target indicating room for 13% share appreciation by this time next year. (To watch Barker’s track record, click here)

Overall, Wall Street clearly likes Block, too. The stock has a Strong Buy rating from the analyst consensus, based on 33 ratings with a breakdown of 25 Buys to 8 Holds. The stock has a selling price of $76.11 and an average target price of $75.28; that target implies the shares will stay rangebound for the time being, possibly showing that the analysts’ price targets have not kept pace with the stock’s recent spike. (See Block stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.