In this piece, I evaluated two social media stocks, Snap (NYSE:SNAP) and Pinterest (NYSE:PINS), using TipRanks’ comparison tool to determine which is better. A closer look suggests a bearish view for Snap and a neutral view for Pinterest.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Snap is a social media company best known as the parent company of the well-known messaging app Snapchat, while Pinterest is a visual discovery engine that enables users to find ideas like recipes, inspirations for the home and style, and more.

Shares of Snap have skyrocketed 92.3% over the last three months and are also up 92% over the past year. Meanwhile, Pinterest stock is up 40.3% over the last three months and up 47.7% over the last year.

With Snap up roughly twice as much as Pinterest over the last year, a closer look is needed to determine whether the market is right to favor Snap.

Since neither company is profitable on an annual, non-adjusted basis, we’ll compare their price-to-sales (P/S) ratios to gauge their valuations against each other and against that of their industry. For comparison, the internet services and social media industry is currently trading at a P/S of 7.3, while Meta Platforms (NASDAQ:META), the poster child for social media, is trading at a P/S of 7.1.

Snap (NYSE:SNAP)

At a P/S of 6.2, Snap is trading at a discount to its industry’s valuation despite doubling over the last 12 months. However, the company’s weak earnings trends, its lack of profitability, and the fact that it’s trading around its 52-week high all suggest a bearish view might be appropriate.

Snap’s current 52-week high is right around $18 a share, and it’s been marching steadily higher over the last 12 months. In fact, company insiders have sold $3.8 million worth of shares in Informative Sell transactions over the last three months.

However, the reality is that the company’s earnings trends just aren’t good — despite receiving several analyst upgrades and target-price increases recently. Snap has a track record of missing revenue estimates in almost every quarter over the last two years, except for the two most recent quarters and the fourth quarter of 2021. It has done better on the earnings front, usually reporting better-than-expected adjusted losses.

However, Snap has never been profitable in its 10-year history, even on an adjusted basis, according to generally accepted accounting principles (GAAP). It did eke out a GAAP profit in the fourth quarter of 2021, but that hasn’t translated into any positive earnings trends.

In fact, Snap’s net income margins worsened from -12% in 2021 to -31% in 2022, stabilizing (at least temporarily) at -30% over the last 12 months. What’s worse is that it may be several years before the company becomes reliably profitable, with one analyst warning a year ago that Snap may not generate a profit until the lead-up to the 2028 presidential election.

What is the Price Target for SNAP Stock?

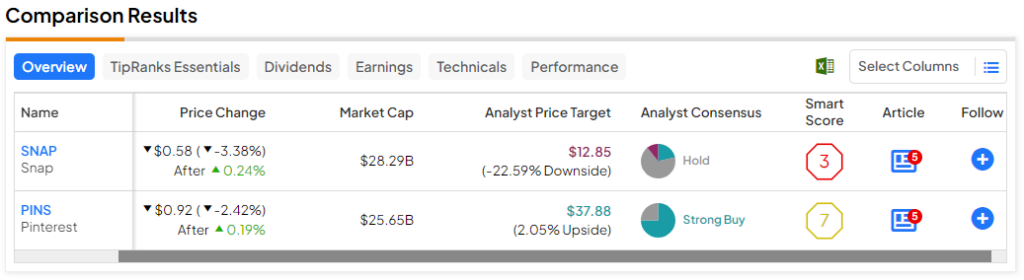

Snap has a Hold consensus rating based on six Buys, 19 Holds, and three Sell ratings assigned over the last three months. At $12.54, the average Snap stock price target implies downside potential of 24.46%.

Pinterest (NYSE:PINS)

Meanwhile, at a P/S of 8.7, Pinterest is trading at a steep premium to its industry but more importantly, to the much larger and profitable Meta Platforms. While its earnings trends are far better than Snap’s, the fact that Pinterest is trading around its 52-week high, which has triggered a large number of Auto Sell transactions among insiders, suggests a neutral view might be appropriate, pending a better entry price and more reliable financial metrics.

Pinterest’s current 52-week high is around $38 a share. While it has had a bumpier ride than Snap over the last year, Pinterest has been trending upward since late October.

As of December 20, there have been no Informative Sell (or Buy) transactions among Pinterest insiders, meaning those that don’t occur on the open market. However, there’s been a growing number of Auto Sell transactions. Most insiders establish pre-set trading plans with prices at which to automatically sell shares of their company.

Thus, a large number of Auto Sell transactions suggests that Pinterest stock is repeatedly brushing up against the high prices set by insiders. In other words, they don’t expect the stock to go much higher anytime soon, so these auto-sell transactions represent profit-taking among insiders.

However, the good news is that Pinterest is reliably profitable on a non-GAAP, adjusted basis. Of course, a company doesn’t really prove anything until they are steadily profitable on a GAAP basis, but Pinterest appears much closer to profitability than Snap.

In fact, Pinterest was profitable in 2021, with a net income margin of 12%. Unfortunately, the company lost money in 2022, as evidenced by its net income margin of -3%, and its margin fell further to -7% over the last 12 months.

Pinterest certainly isn’t out of the woods yet, as its monthly active users and average revenue per user have been bumpy. However, it did grow both metrics in the most recent quarter, so the company is worth monitoring.

What is the Price Target for PINS Stock?

Pinterest has a Strong Buy consensus rating based on 23 Buys, seven Holds, and zero Sell ratings assigned over the last three months. At $37.39, the average Pinterest stock price target implies downside potential of 1.71%.

Conclusion: Bearish on SNAP, Neutral on PINS

Based on the complete pictures of both companies, Pinterest is the clear winner, but it has gotten too expensive this year and is trading at a too-high P/S multiple. Thus, the company and its stock are worth monitoring for steadier user growth, an improvement in GAAP profitability, and a better entry price.

On the other hand, Snap is also extremely expensive after this year’s run-up, but its financial picture isn’t as clear as Pinterest’s, calling for a bearish view instead.