If you bought Snap (NYSE:SNAP) stock at the beginning of this year, you are probably sitting on hefty losses. Shares of this camera and social media company have plunged over 83% year-to-date. Meanwhile, it is down about 27% in after-hours of trading following the Q3 earnings result on October 20. While the massive decline in Snap stock presents a buying opportunity, the ongoing headwinds could continue to stall the recovery.

Snap’s revenue growth is decelerating (down from 38% registered in Q1 to 6% growth in Q3). Meanwhile, the macroeconomic slowdown and declining marketing budgets suggest that SNAP stock could remain pressured in the short term.

In a letter to shareholders, Snap said that its advertising partners are reducing spending on marketing amid a tough operating environment and input cost pressure. Further, policy changes related to ad measurement and increased competition are likely to weigh on Snap’s financial performance and restrict the recovery of its stock.

Citing uncertainties, Snap’s management didn’t provide guidance for revenue and EBITDA for the fourth quarter. Following the earnings, Piper Sandler analyst Thomas Champion cut his price target to $9 from $12. He expects further deterioration in ad demand, implying challenges for SNAP stock.

Is Snap a Buy or Hold?

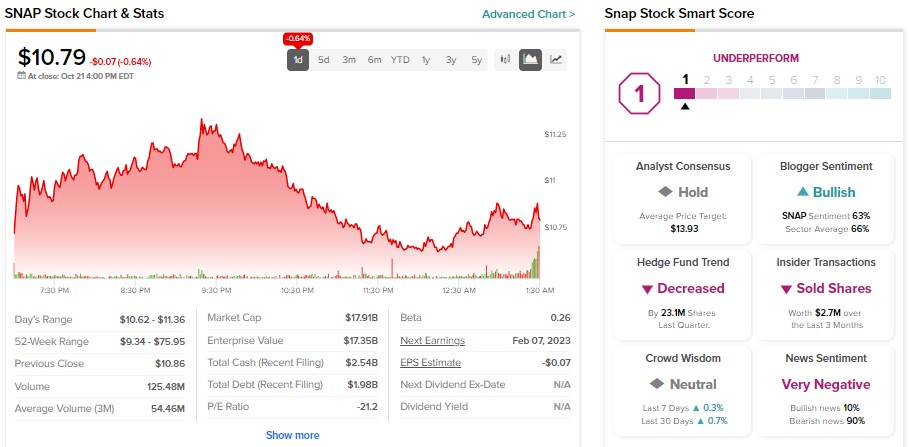

On TipRanks, Snap stock has a Hold consensus rating based on nine Buy, 22 Hold, and two Sell recommendations. Further, its average price target of $13.93 implies 29.1% upside potential.

SNAP stock has negative indicators from hedge funds and insiders. Hedge funds sold 23.1M SNAP stock last quarter. Meanwhile, insiders sold SNAP stock worth $2.7M.

Overall, SNAP stock has the lowest Smart Score of one out of 10 on TipRanks, implying it is likely to underperform the broader market averages.