Amid fears of a global recession, investors are looking for a safe haven for their investments. Real estate prices have remained somewhat resilient despite coming off their peaks. Investing in real estate investment trusts (REITs), therefore, makes a lot of sense. We think that Realty Income (NYSE: O) presents a good investment opportunity, especially thanks to its stellar dividend growth.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With a current market capitalization of $37 billion, Realty Income Corporation is one of the largest U.S.-based real estate investment trusts with over 11,400 commercial properties across the United States, Spain, and the United Kingdom.

The company has a best-in-class property portfolio. The company continues to bolster its position through meaningful acquisitions. Realty Income invested an impressive $3.2 billion in acquiring high-quality real estate properties in the first half of FY2022.

The company is scheduled to release its Q3 results on November 2. Let’s take a closer look at O stock, which stands out for its outstanding dividend growth history.

Impressive & Consistently Growing Dividends

The company has an impressive track record of growing its dividends for 27 years at a 4.4% CAGR since 1994. Further, it has achieved a milestone of 100 consecutive quarterly dividend increases and, in total, has increased its dividends 117 times to date. No wonder then, it has a steady place in the S&P Dividend Aristocrats index.

Based on the current share price and monthly dividend payments of $0.25 per share, Realty Income’s TTM dividend yield is 5%.

Besides Realty Income, see which other stocks have an ex-dividend date in October 2022. Investors can also take advantage of TipRanks’ Dividend Yield Calculator.

Is Realty Income a Long-Term Buy?

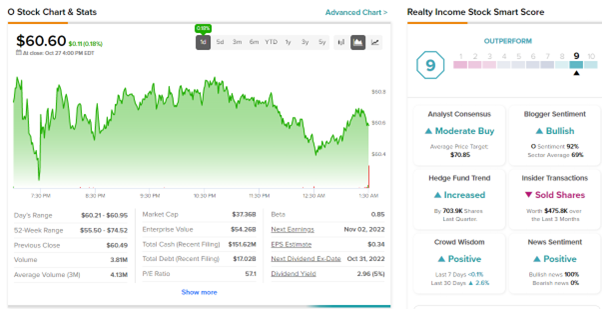

As per TipRanks, analysts are both cautious and optimistic about the stock and have a Moderate Buy consensus rating, which is based on seven Buys and three Holds. Realty Income stocks’ average price forecast of $70.85 implies 16.91% upside potential.

Notably, O stock boasts a score of 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Concluding Thoughts

The Realty Income stock has provided a compounded annual total return of 15.1% to its shareholders since its IPO in 1994. It is considered one of the leading REITs in the U.S. with a huge $12 trillion global net lease addressable market.

Given a strong balance sheet and a conservative and low debt profile, the stock can be considered a safe haven investment with a regular dividend income stream.

Read full Disclosure