Shares of Sonoco Products (NYSE:SON) have declined more than 6% so far this year. However, due to the price decline, the stock is now reasonably valued, according to Seaport Global analyst Mark Weintraub. Vernon is bullish on SON stock and upgraded his rating to Buy from Hold. Further, his price target of $65 implies an upside potential of 14.7%.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Sonoco manufactures industrial and consumer packaging products and provides packaging services.

The analyst is of the opinion that with the price stabilization of uncoated recycled paperboard, the outlook for industrial products has become more positive.

It is worth mentioning that Sonoco recently raised its first-quarter 2023 bottom-line expectations. The company now expects adjusted earnings to be in the range of $1.30 to $1.40 per share, versus the previous guidance of $1.15 to $1.25 per share.

The bottom-line growth is expected to be driven by a decline in input costs, improved productivity, and elevated demand in certain products and end markets.

Is Sonoco Stock a Good Buy?

Sonoco has consistently paid dividends over the past several years. It currently has a dividend yield of 3.5% which compares favorably with the sector’s average of 1.9%.

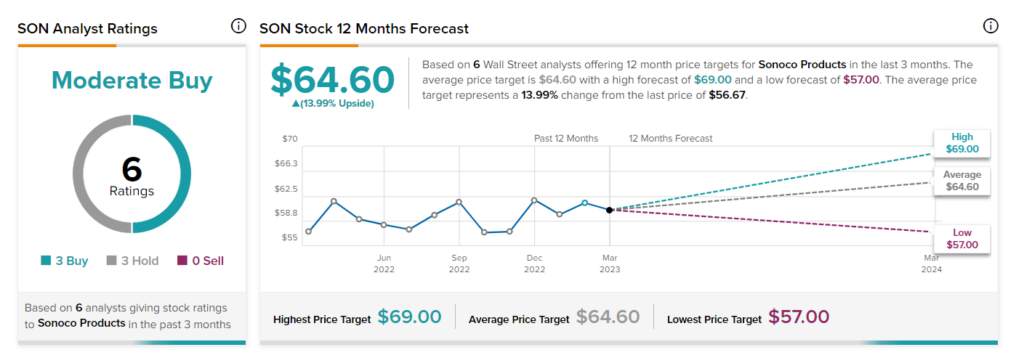

Overall, analysts are cautiously optimistic about Sonoco. The stock has a Moderate Buy consensus rating based on three Buys and three Holds. The average SON stock price target of $64.60 implies an upside potential of 14% from the current level.