Despite facing headwinds, Shopify (NYSE:SHOP) has managed to sustain high growth. However, the road ahead may not be entirely smooth sailing for the e-commerce giant. Investors are understandably cautious about profitability concerns in today’s market, and they’re prioritizing strong free cash flows and minimal dilution.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Unfortunately, Shopify seems to be facing issues in both of these areas, which could potentially become a hurdle for the stock as it attempts to recover from last year’s devastating decline. Unless the company manages to somehow achieve real GAAP profitability, the stock will likely remain very expensive, deterring investors from driving it higher. Accordingly, I am neutral on SHOP stock.

The Positive: Shopify’s Resilient Growth in a Tough Environment

Shopify’s resilience was well-demonstrated in Fiscal 2022. Despite operating in a tough economic environment as macroeconomic challenges affected consumers’ discretionary spending, Shopify managed to grow revenues at a rather strong pace.

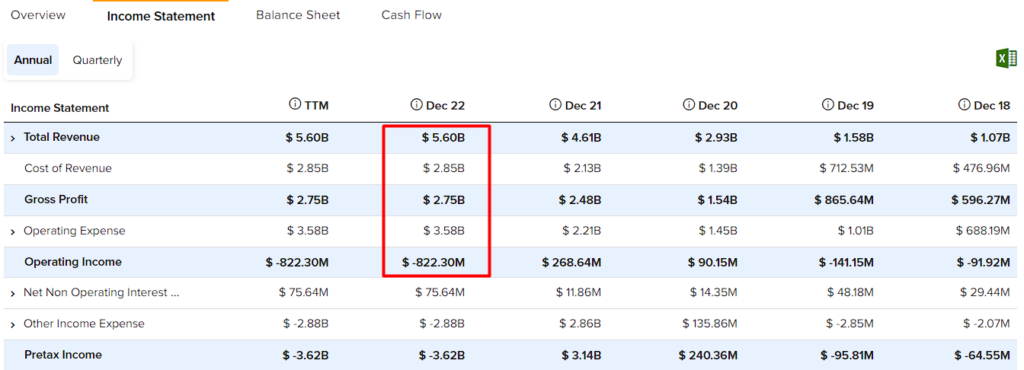

Total revenues for 2022 rose to $5.6 billion, a year-over-year increase of 21%. That’s a fairly tremendous increase, given that many had expected results to soften in comparison to last year’s record-breaking numbers.

It’s important to highlight this, as revenue growth in the previous year was largely driven by the pandemic-induced shift to e-commerce, which had propelled many consumers to shift to online shopping. So the growth rate Shopify posted in 2022 is especially significant when you see that this growth was on top of the incredible 57% growth the company posted in 2021 and the 85% growth experienced in 2020.

Shopify’s continuous ambition to innovate and offer new solutions in the e-commerce space has been a key driver of the company’s impressive growth. In 2022, the company rolled out a number of new products and features aimed at making life easier for merchants and customers alike. For example, Shopify Audiences, Tap to Pay, and integrated Twitter Shopping and YouTube channels are just a few of the initiatives that Shopify launched over the year.

Additionally, Shopify continued to build out its Shop app, providing merchants with an even more powerful tool for building relationships with their customers. The company also saw significant gains in gross merchandise value (GMV), thanks in part to loftier penetration of Shopify Payments and the additional contributions from Deliverr.

In fact, Shopify Payments, which is now available in 22 countries, processed a staggering $34.2 billion of GMV in Q4 alone, representing a 23% year-over-year increase. As more merchants opt for Shopify Payments, the company’s penetration rate has also continued to rise. In 2022, Shopify Payments accounted for 56% of GMV, up from 51% the previous year. This is a clear indication that Shopify’s frictionless, well-integrated payment processing is resonating with merchants around the world.

The trend of more merchants choosing Shopify Payments to easily process their transactions should be a great growth catalyst for Shopify, as the company’s take rate on this GMV is a hefty 1.5% in the U.S. and 2% in all other countries.

Shopify aims to scale several of its solutions, like Shop Pay and point-of-sale, more broadly in 2023, implying sustained growth momentum. Specifically, management expects revenue growth to remain in the high teens on a year-over-year basis in Q1-2023.

The Negative: Losses Keep Widening

Despite Shopify’s undeniable ability to grow, the company has a hard time controlling its spending spree, resulting in widening losses. After subtracting a massive $3.6 billion in operating expenses from a much smaller gross profit of $2.8 billion, Shopify’s operating loss came in at a startling $822.3 million in 2022. This is clearly a worrying trend, especially when you consider that Shopify has already achieved significant scale and has even implemented cost-cutting measures such as reducing its headcount in Q3.

It’s a concerning situation because if they can’t turn a profit now, during a period when investors essentially demand strong profits to feel comfortable investing in a stock, when will they?

Even though the management team has made significant operating developments, it appears they are not giving enough attention to the lack of profitability, which is a major issue. One clear indication of this is the surge in stock-based compensation from $330.7 million to $549.1 million year-over-year in 2022.

The last thing investors want to see after losses have eroded a company’s equity is dilution. This raises serious questions about management’s focus on preserving and growing shareholders’ wealth.

Is SHOP Stock a Buy or Sell, According to Analysts?

Turning to Wall Street, Shopify has a Hold consensus rating based on 10 Buys, 18 Holds, and three Sells assigned in the past three months. At $47.83, the average Shopify stock price target implies 18.4% upside potential.

The Takeaway

It’s hard to argue against Shopify’s ability to grow. Despite operating in a rather tough economic landscape and its results being compared to the pandemic-driven ripple, Shopify still managed to increase revenues at a strong pace. Its growth outlook for the first quarter of 2023 also appears quite optimistic.

Nevertheless, the company’s widening losses are hard to overlook. Overall, it remains to be seen whether Shopify can strike the right balance between managing growth and achieving profitability as it scales its operations in 2023. And, as investors speculate on that, I believe that Shopify shares will have a hard time recovering.