Oil major Shell (LSE:SHEL) recently announced that it would take an impairment charge of $4 to $5 billion in Q1 on account of its decision to exit the Russian market. This follows the company’s earlier announcement of its intention to sever ties with Russian hydrocarbons in a phased manner.

It stated that it would stop buying Russian crude and shut down service stations and other operations. Further, it announced its exit from joint ventures with Gazprom and ended its involvement in the Nord Stream 2 pipeline project.

Now What?

Despite the significant impairment charges, Shell stock remained fairly resilient and fell slightly on Thursday. Further, it is up over 2% in early trade this morning. Notably, higher oil prices and increased trading volumes are keeping investors upbeat.

In response to the supply disruption and high oil prices, Deutsche Bank analyst James Hubbard raised his oil price assumptions for 2022 and named Shell as his top pick. Hubbard raised his price target on SHEL shares by 25% to 2,551p.

He stated, “Shell continues to be placed at the efficient frontier on our value vs. fundamentals cross-plot.” Moreover, the analyst is upbeat about Shell’s gas and LNG business and its efforts to decarbonize its products.

On the valuation front, “Shell trades on a 2023e PE of 7.3x (i.e. at $81.5/bbl Brent), in-line with the sector average and a significant discount to EU oil sector 4-year average of 11.3x,” noted Hubbard.

Bottom Line

Shell’s strong cash-generating capabilities, a focus on enhancing shareholder value, and the decarbonization of its products are positive. Further, higher volumes and pricing could support its financial performance. It’s worth noting that Shell has significantly reduced its debt and generated strong free cash flows.

Its net debt declined to $52.6 billion in Q4 2021 from $75.4 billion in the prior-year period. Moreover, its free cash flows came in at $10.7 billion from $0.7 billion in Q4 2020.

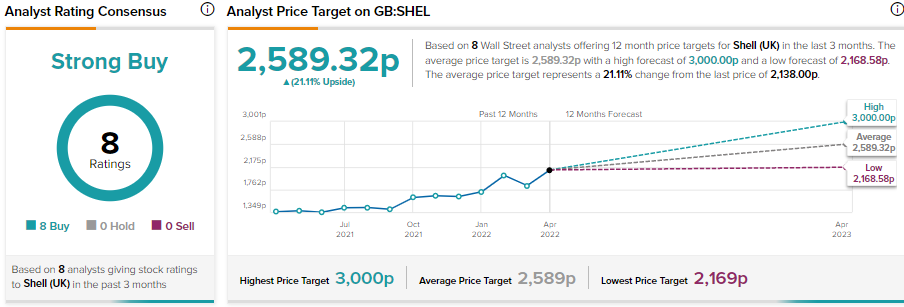

Overall, analysts are bullish on SHEL stock. It has received eight unanimous Buy recommendations for a Strong Buy analyst consensus rating. Further, the average Shell price target of 2,589.32p implies 21.1% upside potential to current levels.

Moreover, SHEL stock has a maximum Smart Score rating of 10 out of 10 according to TipRanks’ data-driven stock ranking system.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure