As 2022 enters the final stretch, one thing is certain; the stock market is not lacking for names trading at depressed levels. For those keen on bargain hunting, there are plenty of stocks whose valuations have contracted by huge amounts this year. Take Coinbase (COIN), for instance.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

You can now buy shares of the leading crypto exchange at a 74% discount compared to what they were going for at the start of the year. But more importantly, should you?

Absolutely not, is the message relayed by Wells Fargo’s Jeff Cantwell.

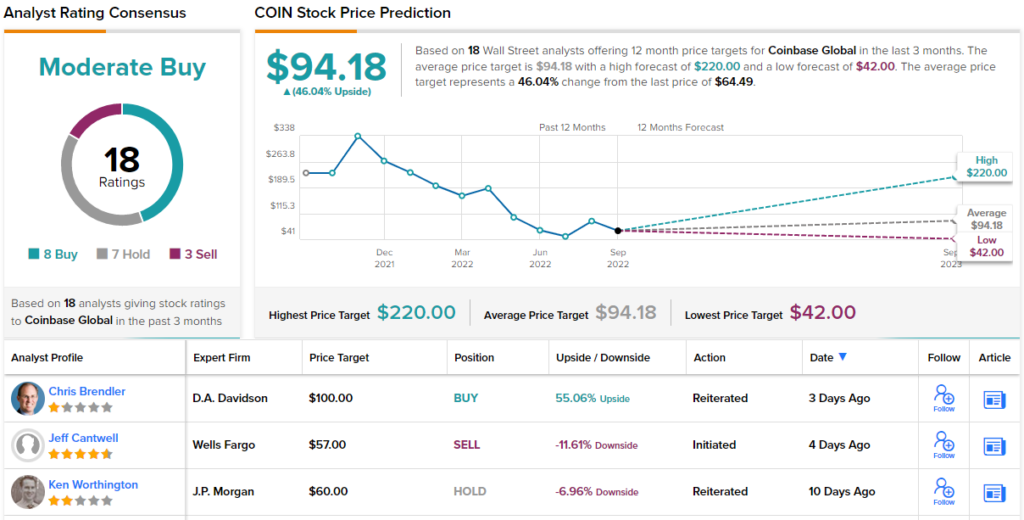

“Though we believe in the value of COIN’s platform, we see its early-mover advantages gradually being eroded away as the competition increasingly mimics the COIN ecosystem,” the analyst said and initiated coverage of the stock with an Underweight (i.e., Sell) rating and $57 price target. That means Cantwell thinks the shares have further downside of 12% from current levels. (To watch Cantwell’s track record, click here)

The stock’s 2022 horror show is a reflection of the leading crypto exchange’s real-world problems, which included a Q2 performance which showed big drops on most metrics. But according to Cantwell, don’t expect a turnaround from Q3 onwards.

The analyst expects Q3’s retail transaction revenue to drop by 56% year-over-year to $451 million, which is below consensus estiamtes. Furthermore, with a weak macro climate and a “tougher regulatory environment constraining COIN’s volumes/revenue,” playing their part too, Cantwell’s expectations for 2023 are also lower than the Street’s. Going forward, the analyst sees “several headwinds.” Of these, the regulatory environment is particularly relevant, and will be a “challenge,” with Cantwell noting the SEC’s recent comments about many cryptos having the characteristics of securities adding another potential problem.

There’s more. With the “crypto winter” showing no signs of an imminent thaw and competition increasing from other exchanges such as Binance and FTX, the path forward looks increasingly uncertain.

So, bad news for COINers, according to Wells Fargo, but what does the rest of the Street thinks lies in store for the company? Two other analysts join Cantwell in the bear camp but with an additional 8 Buys and 7 Holds, the stock claims a Moderate Buy consensus rating. Additionally, the average target is an upbeat one; at $94.18, the figure makes room for 12-month gains of 46%. (See Coinbase stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.