Investors are always looking for high returns, and right now the signs are lining up in favor of the high-yield dividend segment. Dividend payments ensure a regular income stream, regardless of market conditions, while high yields offer the potential for solid returns on investment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The dividend stocks are also favorites of defensive investors, tending to be less volatile during market ups and downs. That’s an important point right now – even though the consensus wisdom is suggesting that we’ll see an economic soft landing, there is still a chance of an economic downturn.

This background has informed a recent note from Desh Peramunetilleke, head of Microstrategy at investment bank Jefferies, who points toward high-yield dividend stocks as sound choices given today’s conditions.

“After a challenging 2023,” the Jefferies team says, “the outlook for dividend strategies has improved. Fed is increasingly leaning towards June being the first cut, indicating that growth will become a bigger challenge than inflation. However, given that a hard-landing is unlikely, ultra-defensive bond-proxies could continue to struggle. Instead, we find high-quality yield as best-placed to capture the cycle.”

Jefferies’ Omar Nokta, a 5-star analyst rated in the top 4% of the Street’s stock pros, has followed this line of thought with several specific picks – tagging 2 high-yielding dividend stocks as buys, choices that should return up to 8% dividend yield. We’ve used the TipRanks database to get the broader view of these stocks, and found that they’ve earned Strong Buy consensus ratings. Here are the details

DHT Holdings (DHT)

We’ll start with a tanker company, DHT Holdings. This firm is one of the independent operators in the global oceanic transport sector, specializing in the carriage of crude oil. DHT’s name is the acronym for ‘double hull tankers,’ a modern mode of tanker construction designed to promote safety and prevent leaks. The company is a pure-play operator of VLCC’s, or ‘very large crude carriers,’ massive tankers with rated in the range of 299,000 to 320,000 dry weight tonnage (DWT). These are the largest of the crude tankers plying the oceans today.

DHT’s fleet of 28 VLCCs is wholly owned by the company and operated primarily on a charter basis. The prevalence of long-term charter contracts in the company’s operations model gives DHT a high level of reliable fixed income.

Fleet quality is a vital factor for oceanic tanker companies, and DHT has a relatively young fleet. All but 4 of its vessels were built in 2011 or later, with the 5 youngest vessels afloat having been built in 2018. The company’s fleet comprises a total of 28 VLCCs, including 4 tankers for which the company has recently entered into building agreements. These 4 vessels are to be built at South Korean shipyards and will gross 320,000 DWT each. Each ship has an average price of $128,500,000 and will be delivered in 2026.

In its last quarterly financial results, from 4Q23, DHT reported a total of $94.5 million in adjusted net revenues, a total that was down 19% year-over-year but was $1 million better than had been expected. The company’s EPS, by GAAP measures, came to 22 cents per share. This was 1 cent above the forecast – and it fully covered the company’s most recent dividend declaration.

The dividend, amounting to 22 cents per common share, was declared along with the Q4 results. This dividend payment represented a 15.7% increase from the previous payment and was sent out to common shareholders on February 28. The annualized payment of $0.88 per common share yields an 8% return.

Jefferies analyst Omar Nokta is impressed by the quality of DHT’s ships and operations, writing: “DHT is a pure-play VLCC shipowner with exposure to the spot market, with its eco-design and scrubber-equipped vessels positioned for outsized earnings potential. We see stronger dynamics ahead for tankers, especially with growing non-OPEC production volumes and the potential for additional OPEC+ exports. We expect shareholders to benefit from its dividend payout ratio of 100% of quarterly earnings.”

Taking this forward, Nokta gives DHT a rating of Buy, an upgrade from Hold, and a price target of $14 that points toward a one-year upside potential of ~26%. (To watch Nokta’s track record, click here)

Overall, this stock’s Strong Buy consensus rating is based on 4 recent analyst reviews, that break down to 3 Buys and 1 Hold. The shares are trading for $11.15, and the $13.43 average target price implies the shares will gain ~20% in the next 12 months. (See DHT stock forecast)

Frontline (FRO)

The next stock on Jefferies’ list is Frontline, one of the world’s largest tanker companies. Frontline carries both crude oil and refined products and operates one of the industry’s largest and most modern fleets. The company has 86 vessels afloat, with the oldest built in 2009 and 20 built in 2020 or later. The fleet is composed of 43 VLCCs, the largest category of ocean-going tanker, and also includes 25 Suezmax vessels, rated at 157,000 DWT and the largest that can transit the Suez canal, as well as 18 LR2/Aframax tankers, rated at 110,000 DWT.

Frontline has been in operation since 1985 and has seen solid successes in recent quarters. Revenues were up last year compared to the prior year, rising 27% from $1.44 billion in 2022 to $1.83 billion in 2023. The company’s stock also saw strong gains, more than 60% in the last 12 months and nearly 17% for the year-to-date.

With the fourth quarter of 2023 behind us, we can look at Frontline’s revenue for that quarter. The company had $415 million at the top line, down 21% year-over-year and more than $5 million below the forecast. On a better note, the company’s adjusted profit for the quarter, at $102.2 million, came to 46 cents per share.

This was more than enough to cover the regular share dividend, which was declared on February 28 for a payment on March 27, at a rate of 37 cents per share. This declaration represents a 23% increase from the previous quarter, and the annualized dividend, of $1.48, gives a yield of 6.4%. Frontline has a history of adjusting its dividend payment to keep it in line with current earnings.

In his coverage for Jefferies, analyst Nokta is impressed by the company’s ability to consistently maintain a high dividend payout ratio. He says of the stock, “Frontline is one of the largest crude tanker operators in the world with a young fleet and high scrubber exposure. We see stronger dynamics ahead for tankers, especially with growing non-OPEC production volumes and the potential for additional OPEC+ exports. We expect dividends to remain a central part of the Frontline story and expect shareholders to benefit from its unofficial dividend payout ratio of 80% of quarterly earnings.”

Looking ahead, Nokta gives this stock, like DHT above, an upgraded rating, from Hold to Buy. His price target here, set at $30, suggests a potential one-year upside of 30%.

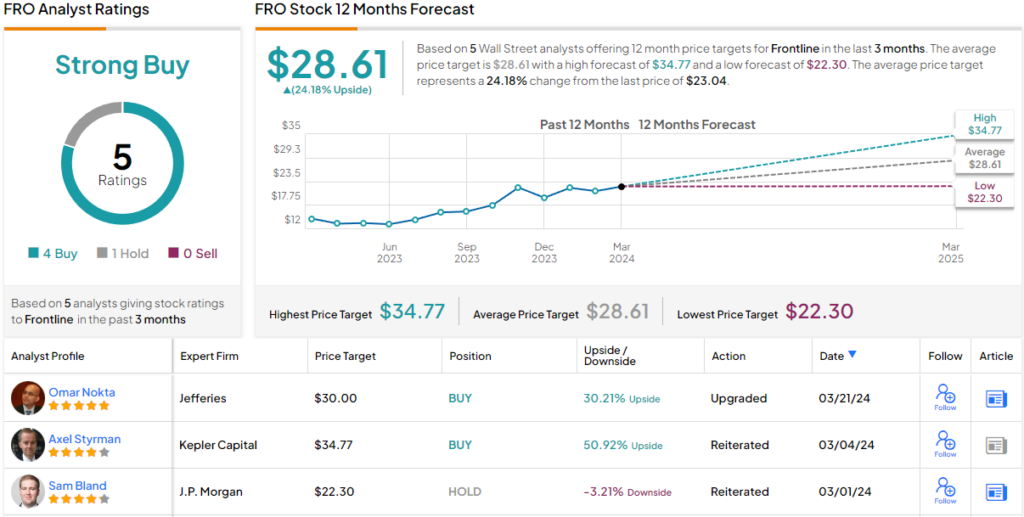

All in all, Frontline has 5 recent analyst reviews, including 4 Buys to 1 Hold, for a Strong Buy consensus rating from the Street’s analysts. The stock’s average target price of $28.61 and its current trading price of $23.04 together imply a one-year gain of 24%. (See FRO stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.