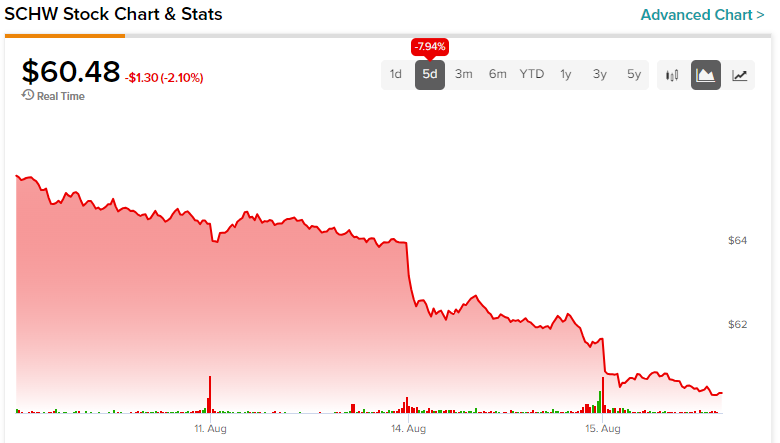

As Charles Schwab (NYSE:SCHW) stock falls today, investors might wonder whether the company’s integration of TD Ameritrade will pose an ongoing problem for Schwab. Nevertheless, I am bullish on SCHW stock because the company’s growing pains should be temporary and not a deal-breaker in the long run.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Charles Schwab has been around for a long time as a provider of brokerage and financial advisory services. It’s one of the most highly-respected firms in the U.S. banking sector.

TD Ameritrade, meanwhile, provides a popular trading platform for stocks and options. Though Schwab officially acquired TD Ameritrade in 2019, transitioning TD Ameritrade’s users onto Schwab’s platform won’t be an easy process. Today, SCHW stock traders are unforgiving as Schwab experiences some hiccups amid this transition, but this may be a prime buying opportunity for folks who can look beyond the short-term headlines.

Schwab Survives the Regional Banking Crisis

Lest we forget, Schwab did a terrific job of navigating the regional banking crisis of March 2023. While Silicon Valley Bank and First Republic Bank failed and were eventually taken over, Schwab stayed the course and survived despite the Federal Reserve’s interest rate hikes.

Indeed, it could be argued that Schwab is in excellent financial shape today. For July of this year, Schwab reported $8.24 trillion worth of total client assets, up 13% year-over-year and up 3% month-over-month. Thus, there’s no need to worry about Schwab’s clients pulling all of their money out now.

Besides, Schwab has a decent quarterly earnings track record and garnered at least two analyst price target hikes recently. Specifically, Piper Sandler analysts raised their price target on SCHW stock from $77 to $86, while Morgan Stanley (NYSE:MS) analysts lifted their price target on Schwab shares from $68 to $71.

A Temporary Issue with Schwab’s TD Ameritrade Acquisition

SCHW stock is down today, as investors mulled an issue with Schwab’s acquisition of TD Ameritrade. Charles Schwab Chief Financial Officer Peter Crawford explained, “As we continue to progress through the Ameritrade client conversion, we are observing initial evidence of the deal-related attrition we allowed for within the transaction math outlined at the announcement back in November 2019.”

In other words, Schwab predicted in 2019 that there would be some attrition of TD Ameritrade’s clients and advisors during the transition. Moreover, the rate of attrition appears to be roughly in line with expectations — “approximately 4% of Ameritrade revenue prior to the deal or around 1% of combined total client assets as of Dec. 31, 2022,” according to a statement from Schwab. In addition, starting in 2024, the attrition resulting from the TD Ameritrade integration should no longer be an issue for Schwab.

In other words, this is really just a speed bump along Schwab’s path to expansion and, potentially, a larger presence in the brokerage space. Concerning the movement of TD Ameritrade’s users to Schwab’s platform, this should be finalized in early September if all goes according to plan. Then, Schwab’s clients can get access to some of TD Ameritrade’s robust trading platform tools and functionalities, something that Schwab’s self-directed investment clients should definitely appreciate.

Is SCHW Stock a Buy, According to Analysts?

On TipRanks, SCHW comes in as a Moderate Buy based on 12 Buys, two Holds, and one Sell rating assigned by analysts in the past three months. The average Charles Schwab stock price target is $73.87, implying 22.2% upside potential.

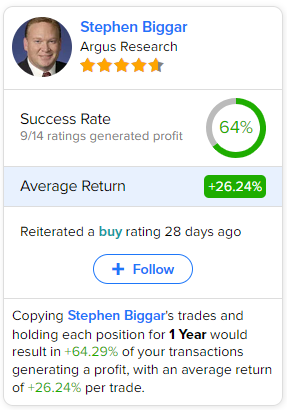

If you’re wondering which analyst you should follow if you want to buy and sell SCHW stock, the most profitable analyst covering the stock (on a one-year timeframe) is Stephen Biggar of Argus Research, with an average return of 26.24% per rating and a 64% success rate. Click on the image below to learn more.

Conclusion: Should You Consider SCHW Stock?

Charles Schwab will get bigger and, perhaps, better when the TD Ameritrade changeover is complete. However, today’s stock traders just aren’t willing to wait for this to happen. They’re expressing their frustration with temporary issues by selling Schwab stock, it seems.

Their haste could be an opportunity. Schwab made it through the regional banking crisis and appears to be in solid financial condition. As far as the TD Ameritrade news is concerned, it shouldn’t be a deal-breaker for forward-thinking investors. All in all, I believe people ought to consider SCHW stock and take advantage of the market’s temporary negative response.