Charles Schwab (NYSE:SCHW), commonly just known as Schwab, is generally favored by analysts, but investors are still awaiting a real recovery in the stock. I am bullish on SCHW stock and see it as a good value stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Headquartered in Texas, Charles Schwab is a bank and investment broker that also offers advisory services. The company is in the process of integrating the popular TD Ameritrade trading platform, which Schwab acquired in 2019.

Proper price discovery would mean that SCHW stock should reflect Schwab’s true intrinsic value. In time, I believe the stock will get back up to where it ought to be. Just be patient, as the stock market’s weighing machine needs some time to process recently disclosed data concerning Schwab.

Charles Schwab: A “Substantial” Rebound May be Coming

In March and April of last year, Charles Schwab and some other financial institutions experienced major outflows of capital from their brokerages into high-interest-bearing money-market accounts. This phenomenon, known as “cash sorting,” was a serious problem for Schwab, which generates substantial revenue from its brokerage business. However, the company started to rebound from this issue last year and could be on its way to a full recovery.

Schwab had an important financial event recently, but even before that happened, some analysts already saw an opportunity with SCHW stock. For example, Morgan Stanley (NYSE:MS) reiterated an Equal Weight rating on the stock and raised its price target on Charles Schwab shares from $64 to $68. Furthermore, for brokers and exchanges in general, which would include Schwab, Morgan Stanley declared that investors should “prepare to be nimble for idiosyncratic and attractive growth opportunities.”

A more optimistic assessment came from Raymond James analyst Patrick O’Shaughnessy. He lifted his price target on SCHW stock from $76 to $78 and maintained his Outperform rating on the shares.

Per TheFly, O’Shaughnessy addressed the cash-sorting issue, observing that recent data “continues to indicate that client cash sorting at Schwab is tapering.” Moreover, O’Shaughnessy feels that Schwab’s “near-term disruptions from the TD Ameritrade integration” appear to “largely be in the rear-view mirror” at the end of last year. All in all, Raymond James anticipates a “substantial” rebound in Schwab’s EPS in 2024 and 2025.

The Market Largely Ignored Charles Schwab’s EPS Beat

Speaking of Charles Schwab’s EPS, investors largely chose to sell SCHW stock, even though the company just posted an earnings beat. This is the type of situation that value-conscious stock traders should consider an opportunity rather than a problem.

Charles Schwab stock finished the day down modestly today after the company released its Q4-2023 financial results. I won’t claim that Schwab’s results were stellar, but investors should put the data points in context and consider the financial sector’s challenges in 2023.

After all, interest rates remained elevated, and Schwab still had to sort out its cash sorting problem. This helps to explain why Schwab’s revenue declined by 19% year-over-year to $4.459 billion, missing analysts’ consensus expectations by $30 million. Still, that’s not a huge miss percentage-wise and could almost be considered in line with what Wall Street had expected.

Turning to earnings, Schwab reported Q4-2023 adjusted EPS of $0.68, which beat the Street’s consensus estimates by $0.04 per share. This suggests that analysts were fully prepared for Schwab’s quarterly EPS to decline on a year-over-year basis. That’s what happened, since the company posted EPS of $1.07 in 2022’s fourth quarter.

Here’s my favorite part, though. In Fiscal Year 2023, Charles Schwab added 3.8 million new brokerage accounts, and the company’s total client assets expanded by $306 billion to $8.52 trillion. That’s a great sign for Schwab, and if interest-rate cuts come as expected in 2024, the company’s recovery could quickly pick up steam.

Is SCHW Stock a Buy, According to Analysts?

On TipRanks, SCHW comes in as a Moderate Buy based on 11 Buys, five Holds, and one Sell rating assigned by analysts in the past three months. The average Charles Schwab price target is $72.93, implying 14.9% upside potential.

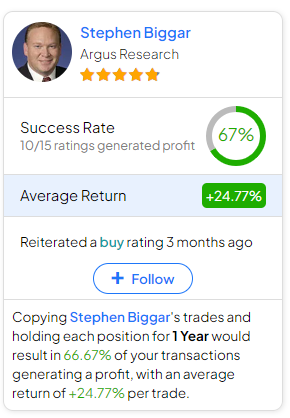

If you’re wondering which analyst you should follow if you want to buy and sell SCHW stock, the most profitable analyst covering the stock (on a one-year timeframe) is Stephen Biggar of Argus Research, with an average return of 24.77% per rating and a 67% success rate. Click on the image below to learn more.

Conclusion: Should You Consider SCHW Stock?

Judging from today’s share-price action, it looks like the market doesn’t want to wait for Charles Schwab to recover from 2023’s challenges. If you can be more patient than the market, then you might capture a great opportunity with Schwab stock.

So, when conducting your due diligence on Charles Schwab, put all data points into the context of a difficult year with high interest rates and cash sorting. In time, I expect true price discovery to kick in, and the market should soon appreciate what Schwab has achieved in the face of challenges. Therefore, I like the future of SCHW stock and am definitely considering it now.