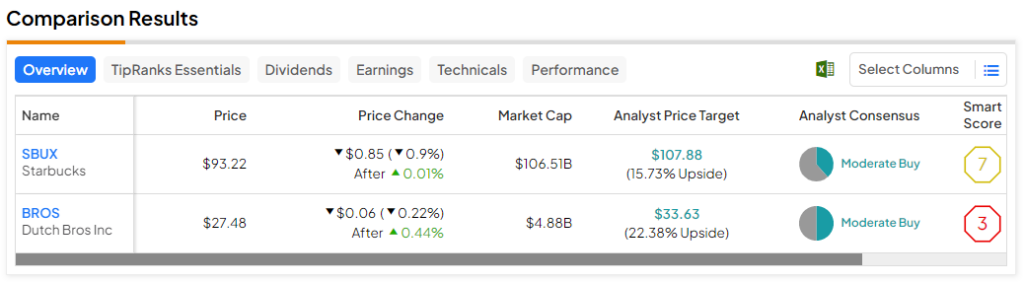

In this piece, I evaluated two coffee shop stocks, Starbucks (NASDAQ:SBUX) and Dutch Bros (NYSE:BROS), using TipRanks’ comparison tool to see which is better. A closer look suggests a long-term bullish view for Starbucks and a bearish view for Dutch Bros.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Starbucks is a roaster and retailer of specialty coffee, operating over 30,000 stores in 80 markets, while Dutch Bros has more than 800 coffee shops in 17 states. Starbucks stock is off 2% year-to-date and down 11% over the last three months. Meanwhile, Dutch Bros shares have fallen 14% year-to-date and are off 6% over the last three months.

Even though Dutch Bros has plummeted so much more than Starbucks year-to-date, its valuation can only be considered obscene at current levels. Both companies are profitable, so we’ll compare their price-to-earnings (P/E) ratios to gauge their valuations against each other.

Starbucks (NASDAQ:SBUX)

At a P/E of 25.1, Starbucks is trading on the low end of its more normalized P/E. That valuation, combined with the company’s long-term stock-price appreciation, suggests a long-term bullish view may be appropriate, especially with the dividend to sweeten the deal.

Between July 2020 and July 2021, Starbucks’ P/E spiked, rising to about 67 and then peaking at over 200. However, going back to April 2019, Starbucks’ P/E typically has ranged between roughly 19 and 37. Thus, at its current P/E, the coffee chain is trading closer to the low end of its typical valuation.

Unfortunately, Starbucks missed estimates in its latest earnings report, posting adjusted earnings of 90 cents per share on $9.4 billion in revenue versus the consensus figures of 93 cents per share in earnings and $9.6 billion in sales.

The company cited boycotts over the Israel-Hamas war and cautious Chinese consumers for those misses. Starbucks management also revised its full-year sales outlook lower to a projection of 7% to 10% growth, down from the previous estimate of revenue growth between 10% and 12%. However, management reiterated its full-year guidance for 15% to 20% growth in earnings per share.

While this latest earnings report wasn’t great, and there are some concerning trends, these issues are all temporary problems that have created a buy-the-dip opportunity in a long-term share-price gainer.

Although Starbucks shares are down 5% over the last three years, they have returned 47% over the last five years and 206% over the last 10. Thus, at its current valuation, Starbucks stock just looks too cheap to ignore, especially with its dividend serving as icing on the cake.

The coffee chain has been boosting its dividend annually for at least the last 14 years and currently pays a dividend of 2.3% with a payout ratio of 59.35%, which isn’t spectacular but is safe enough given the temporary nature of the issues.

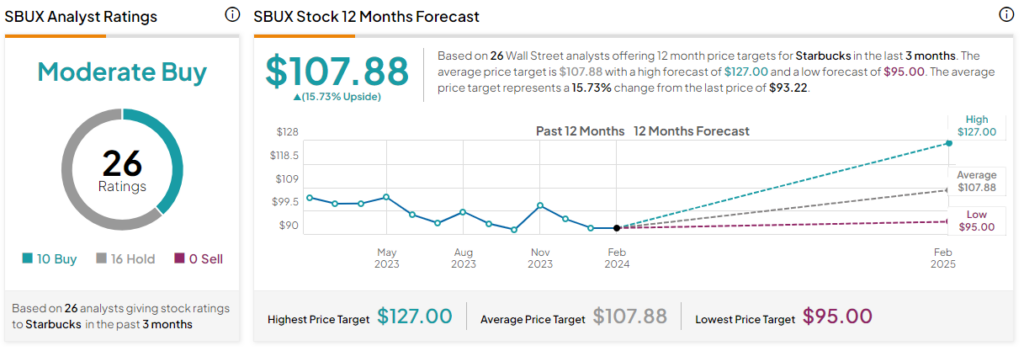

What Is the Price Target for SBUX Stock?

Starbucks has a Moderate Buy consensus rating based on 10 Buys, 16 Holds, and zero Sell ratings assigned over the last three months. At $107.88, the average Starbucks stock price target implies upside potential of 15.7%.

Dutch Bros (NYSE:BROS)

At a P/E of 702.8, Dutch Bros’ valuation is nothing short of obscene despite its recent share-price drop. While the coffee chain does get points for growth, the current valuation requires too much speculation about its future. Thus, a bearish view seems appropriate, at least for now.

While Dutch Bros is trading closer to its 52-week low of $22.67 than its 52-week high of $40.87, company insiders were automatically selling its shares one and two months ago in the neighborhood of $25 to $30 per share or so. A large number of Auto Sell transactions suggests insiders don’t see much more upside in the stock in the near term, and at Dutch Bros’ current valuation, it’s easy to see why.

However, at current levels, it’s clear that the coffee chain is priced like a growth stock, which it certainly is. The company smashed estimates in its latest earnings report, posting adjusted earnings of 14 cents per share on $264.5 million in revenue versus expectations of 6 cents per share on $258.3 million in sales.

Dutch Bros grew its quarterly revenue by 33% year-over-year in the third quarter, 34% in the second quarter, and 30% in the first, so it does deserve a premium for growth. In fact, on a forward basis, the coffee chain’s P/E is a more reasonable 78.3. However, the forward P/E is still rather high and based purely on speculation. As such, it will take quite some time for Dutch Bros to grow into its current valuation.

What Is the Price Target for BROS Stock?

Dutch Bros has a Moderate Buy consensus rating based on four Buys, four Holds, and zero Sell ratings assigned over the last three months. At $33.63, the average Dutch Bros stock price target implies upside potential of 22.4%.

Conclusion: Long-Term Bullish on SBUX, Bearish on BROS

Valuation makes all the difference when comparing the old stalwart Starbucks with the new, up-and-comer Dutch Bros. As such, the pullback in Starbucks stock has created a buy-the-dip opportunity in a company that makes an attractive buy-and-hold position for the long term, and investors get to collect a decent dividend as well.

On the other hand, Dutch Bros remains a show-me story with a valuation that’s gotten ahead of itself. The company could one day be a real competitor for Starbucks, but for now, it seems better to wait and see what happens.