In this piece, I evaluated two coffee chain stocks: Starbucks (SBUX) and Dutch Bros. (BROS). A closer look suggests a neutral view of Starbucks and a cautious bullish view of Dutch Bros.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With over 38,000 stores in more than 80 markets, Starbucks is the dominant coffee chain of the two. Dutch Bros. is an up-and-comer in the space that operates domestically in the U.S. through its company-operated chain of coffee shops, the main driver of its sales. BROS’ Franchising and Other division includes bean and product sales to franchisees, franchise fees, royalties, and other revenue.

Dutch Bros. stock is down 2% year-to-date and up 1% over the last year. Meanwhile, shares of Starbucks are nearly flat year-to-date, down about 1% on both a year-to-date and 12-month basis.

Despite such similar share-price performances, there is a significant gap in the two chains’ valuations. We compare their price-to-earnings (P/E) ratios to gauge their valuations against each other and that of their industry. The restaurant industry is trading at a P/E of 45.3x, versus its three-year average of 49.3x.

Importantly, Dutch Bros. is priced like a growth stock, while Starbucks’ valuation is that of a legacy firm.

Starbucks

At a P/E of 25.9x, Starbucks is being punished severely for concerns about higher costs of living, which have resulted in declining same-store sales as consumers choose cheaper coffee options, often at home or work. Unfortunately, falling same-store sales and a warning about its outlook suggest things may not turn around anytime soon. However, I’m calling for a neutral rating due to valuation until things start to improve.

The latest quarter marked Starbucks’ second straight quarter of declining same-store sales, which fell 3% year-over-year on the back of a 5% drop in transactions. Same-store sales in China plummeted 14% year-over-year, a massive problem for the coffee giant, although they improved sequentially.

Meanwhile, Starbucks management pointed to a few green shoots, such as improvements to mobile ordering and strong sales of new products. Nevertheless, they reiterated their call for revenue growth in the low single digits, with earnings-per-share growth ranging from flat to the low single digits.

Finally, the involvement of activist investor Elliott Management could turn things around faster than expected at Starbucks — a key reason for the neutral view. Starbucks CEO Laxman Narasimhan said so far, discussions have been “constructive.” Narasimhan also mentioned in the company’s latest earnings report that they are exploring partnerships to accelerate growth in China.

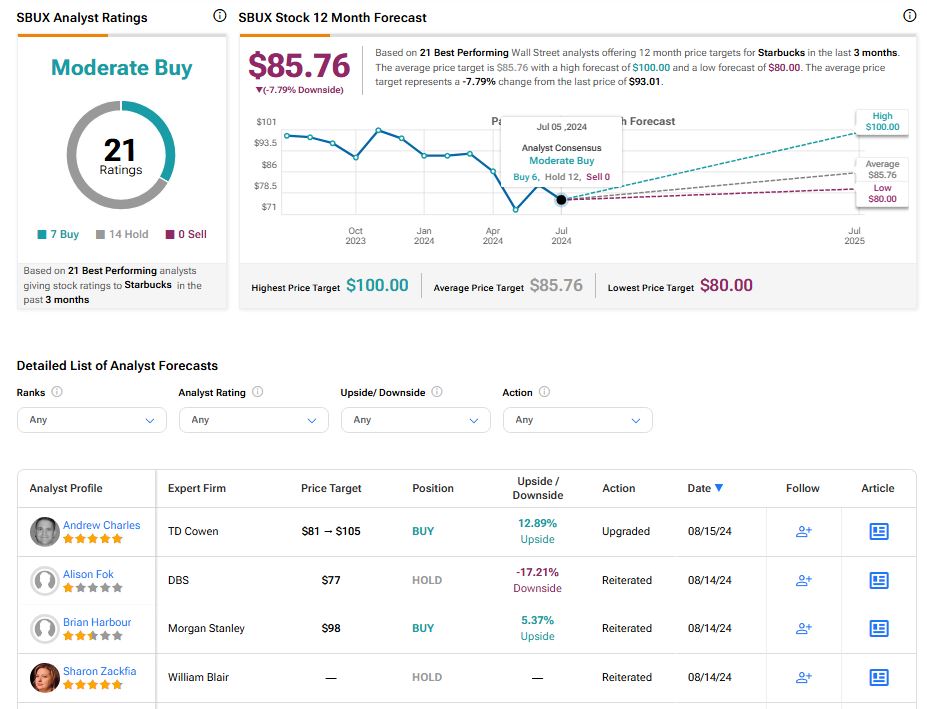

What Is the Price Target for SBUX stock?

Starbucks has a Moderate Buy consensus rating based on seven Buys, 14 Holds, and zero Sell ratings assigned over the last three months. At $85.76, the average Starbucks stock price target implies a downside potential of 7.79%.

Dutch Bros.

At a P/E of 124.8x, Dutch Bros. is priced like a growth stock, but is the company putting up the growth to warrant such a categorization? It does seem to deserve a premium multiple for growth, especially considering the forward P/E. This suggests a cautious bullish rating might be appropriate.

Dutch Bros’ forward P/E stands at 73.6x, suggesting the company’s valuation is on the way towards normalization. If that valuation continues to trend in the same direction, I would become less cautious about the shares.

Dutch Bros’ rapid growth earned it the title of the fourth-largest snack restaurant by QSR magazine earlier this year. The company is now positioned behind Starbucks, Dunkin’, and Dairy Queen, and its rapid growth justifies its status as a growth stock.

Systemwide sales approached $1 billion in 2023 and then surpassed that mark over the last 12 months, reaching $1.1 billion. Same-store sales are also growing rapidly, rising 4.1% in the latest quarter. Company-operated same-store sales grew 5.2% year over year, while company-operated shop gross profit rose from $51.1 million in the year-ago quarter to $70 million in the latest quarter. Revenues rose 30% year over year to $324.9 million in the latest quarter.

Finally, Dutch Bros’ drive-thru-only model positions it ahead of Starbucks during tough economic times, as its long-term costs should be lower due to the absence of in-shop dining expenses.

However, caution is still warranted with BROS, as it remains a speculative stock with no guarantee that its rapid growth will persist.

What Is the Price Target for BROS stock?

Dutch Bros. has a Moderate Buy consensus rating based on eight Buys, three Holds, and zero Sell ratings assigned over the last three months. At $40.64, the average Dutch Bros. stock price target implies upside potential of 32.12%.

Conclusion: Neutral on SBUX, Bullish on BROS

While Starbucks certainly won’t be going anywhere anytime soon, there’s no denying that it faces challenges in this difficult economic climate. With numerous financial gurus suggesting that people cut back on expensive take-out coffees to save money, Starbucks is directly in their crosshairs.

On the other hand, Dutch Bros. seems to be doing better in the current climate as it continues to put up the growth required to achieve a premium versus its industry. However, as stated, caution is advised with the shares if any warning signs start to appear.