Salesforce (NYSE:CRM), the leading CRM solutions provider in the world, is proving to be a big winner in AI technology. The company’s growth is expected to accelerate, driven by the increased adoption of AI-enabled CRM solutions and revenue diversification efforts. Salesforce’s increasing focus on distributing excess cash to shareholders makes it even more attractive. However, Salesforce’s current valuation accounts for most of the expected growth. For this reason, I am neutral on Salesforce stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Decelerating Growth Masks the Bright Future

Salesforce has experienced a deceleration in growth since the second quarter of Fiscal 2022. From 21.77% in Q2 2022, the company’s revenue growth rate fell to 11.3% in Q3 2023, highlighting the impact of macroeconomic challenges the software industry is facing today. A deeper dive into the company’s recent performance, however, reveals several bright spots.

First, Salesforce’s focus on improving profitability is already yielding promising results. The company’s cost reduction strategy has played a key role since mid-2022 to improve the company’s profit margins. In the third quarter, sales and marketing costs as a percentage of revenue declined by 600 basis points year-over-year, boosting CRM’s GAAP operating margin to 17.2%. For context, in Q3 2022, its operating margin was a meager 6%.

Due to macroeconomic challenges such as surging inflation, interest rate hikes, and lingering fears of a recession, many businesses have curtailed spending on IT projects. This is one of the main reasons behind the decelerating revenue growth rates seen by Salesforce in recent quarters. In the next phase of the business cycle – which may begin as soon as 2024 – revenue growth trends are likely to reverse. Salesforce, as a company with a better cost structure, will see a notable improvement in profitability once this happens.

Second, Salesforce is successfully diversifying its revenue base, which ensures the long-term sustainability of growth. The company, which was incorporated in 1999 with the sole objective of sales force automation, has added new products and services in the last couple of decades to cater to the diverse requirements of customers.

Today, the company offers six clouds: Sales Cloud, Commerce Cloud, Experience Cloud, Marketing Cloud, Service Cloud, and Analytics Cloud. In addition to these, the company provides platform solutions while integrating its Tableau and Slack acquisitions.

The company is focused on offering packaged solutions involving a few of these clouds, which seems the right strategy to hook clients for the long term. In the third quarter, nine of the top 10 deals completed by the company included at least six clouds, which is a testament to the growing popularity of the additional services offered by Salesforce.

MuleSoft, which provides integration solutions for connecting applications, data, and devices, is proving to be a strong growth driver for the company. In Q3, MuleSoft was included in eight of the top 10 deals completed by Salesforce. By using MuleSoft, organizations can automate workflows, enhance efficiency, and improve the overall agility of their operations.

In an era where automation is taking center stage, MuleSoft will continue to be in high demand in the foreseeable future, further helping Salesforce’s revenue diversification efforts.

Third, Salesforce is integrating AI into many of its clouds, improving the user experience and the efficiency of its customers. AI investments are likely to pay off handsomely in the long run with the global business world embracing automated solutions.

Einstein Platform is the flagship AI product developed by Salesforce, which encompasses a suite of AI-powered features embedded across various Salesforce products. This platform provides unique solutions, such as AI-enabled business intelligence tools, AI-powered applications for image recognition and natural language processing, and AI-enabled marketing solutions, such as predictive lead scoring.

Salesforce enjoys first-mover advantages in many of these technologies, which paints a promising picture of what the future holds for the company. Technological superiority will help the company enjoy durable competitive advantages, which, in turn, will lead to economic profits.

Finally, Salesforce is beginning to reward shareholders through share buybacks as the company continues to generate free cash flows even while investing in AI aggressively. In the third quarter alone, the company repurchased $1.9 billion worth of shares, completing $10 billion worth of buybacks in the last five quarters. The company first started repurchasing shares in the third quarter of 2022.

During the third-quarter earnings call, Salesforce President and CFO Amy Weaver pledged that the company is planning to offset the dilutive effect of stock-based compensation through share repurchases. She went on to project the outstanding share count of the company to decline for the first time in the upcoming fiscal year.

Overall, Salesforce looks well-positioned to grow, aided by its recent AI investments and revenue diversification efforts. At the same time, its profitability potential looks promising, thanks to the success of its restructuring efforts.

Is Salesforce Stock a Buy, According to Analysts?

Salesforce stock is up by a staggering 85% this year. Even on the back of this stellar market performance, many analysts continue to view the company as attractively valued.

After digesting Q3 earnings, JPMorgan (NYSE:JPM) analyst Mark Murphy reiterated his Buy rating for the company and boosted the price target to $260 from $240, citing AI tailwinds. Bank of America (NYSE:BAC) analysts also boosted their price target for Salesforce from $280 to $300, noting the continued improvements in MuleSoft and Tableau offerings alongside core product sales growth.

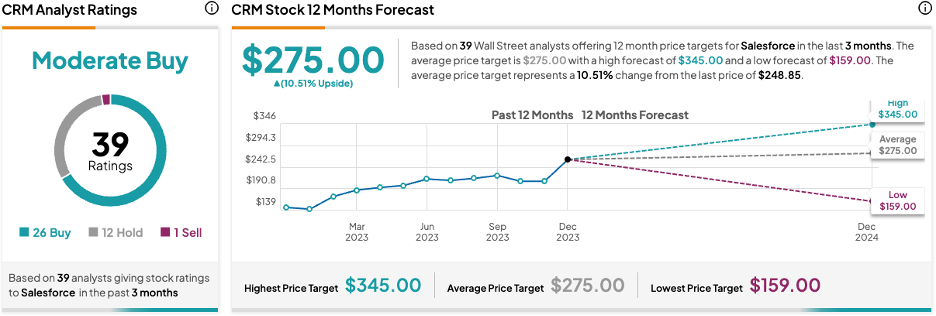

Based on the ratings of 39 Wall Street analysts, the average Salesforce stock price target is $275, which implies upside of 10.5% from the current market price.

Still, a closer look at the company’s valuation suggests much of the expected growth is already priced in today. Salesforce is valued at a price-to-sales multiple of 7.2 compared to the five-year average of 8.34. At a time when growth is decelerating, it makes sense for the company to trade at a discount to its historical valuation levels.

Although AI investments will continue to drive growth in the coming years, it will take time for the company to reach historical levels of revenue growth because of lingering macroeconomic challenges.

The Takeaway

Salesforce is executing its growth plans well, with the company expanding into new business verticals and markets while maintaining profitability. The company’s buyback program is also attractive. However, based on valuation concerns, investors may have to wait for a better opportunity to invest in the company.