Salesforce (CRM) has been trending modestly higher of late, following the release of its second-quarter results. It was a stellar beat and raise for Marc Benioff‘s cloud giant, with EPS coming in at $1.48 per share, beating the Street consensus of $0.92 per share. Revenue came in at $6.34 billion, up 23% year-over-year.

The company also raised the bar on its full-year guidance, inspiring many analysts on the Street to upgrade their price targets. It was another solid quarter for Salesforce, one that’s still being slightly discounted by investors.

Moving ahead, Q3 could propel Salesforce stock to new all-time highs for the first time since late August of last year, the last time Salesforce delivered a jaw-dropping result.

As such, I remain bullish on Salesforce stock, with its Slack acquisition now officially complete. (See CRM stock charts on TipRanks)

Salesforce’s Investments Could Bring Separation

Things are looking up for organic growth these days, but it was continued gains from investments that should not go ignored. There’s no question that Benioff and his team are some of the most brilliant minds in Silicon Valley.

The man has made some pretty bold bets in late-stage tech innovators, and they’ve paid off big-time. Whether we’re talking about Snowflake (SNOW) or nCino (NCNO), it’s clear that Benioff’s team is quickly gaining a reputation for generating some very promising alpha.

You can’t help but notice the striking similarities to Warren Buffett‘s Berkshire Hathaway (BRK.A) when it comes to Salesforce’s investment portfolio, and ability to add to the bottom line.

Whether the company can keep up the incredible returns with its strategic investments remains to be seen. Regardless, it appears that Salesforce is well worth the hefty premium currently commanded, due to its knack for spotting opportunities in its corner of the tech industry.

Whether we’re talking late-stage tech investments or acquisitions, investors should give Benioff and company the benefit of the doubt, given their impeccable track record thus far.

Investors Should Cut Salesforce some Slack

Looking back, investors seemed to have hated the Slack acquisition, which acted as an overhang on Salesforce in late-2020 and early-2021. Despite Salesforce’s track record of success with its investments, you can expect future acquisitions to also be met with great distaste, especially as valuations across the broader tech scene continue to climb.

Pending another blockbuster acquisition (I don’t think this is likely after the big Slack deal), Salesforce stock looks to be in great shape to make up for lost time, as it looks to catch up to its high-tech cloud peers, many of which have been hot of late.

Wall Street’s Take

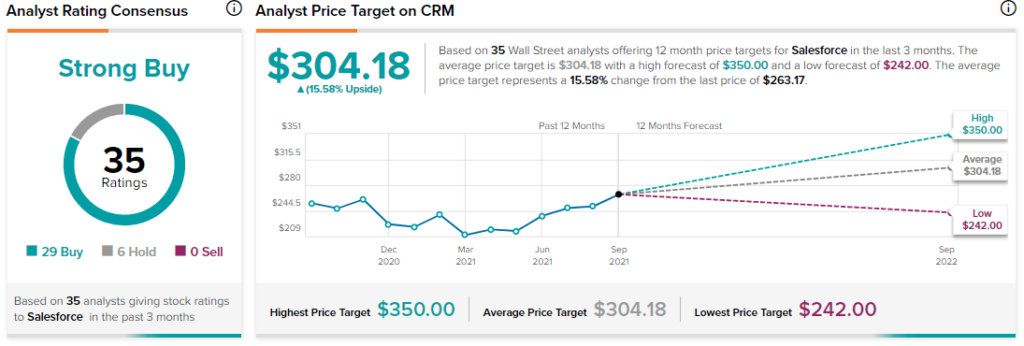

According to TipRanks’ analyst rating consensus, CRM stock comes in as a Strong Buy. Out of 35 analyst ratings, there are 29 Buy recommendations, and six Hold recommendations.

The average CRM price target is $304.18. Analyst price targets range from a low of $242 per share, to a high of $350 per share.

Bottom Line

With another remarkable quarter in the books, Salesforce stock looks to be a top catch-up trade for growth-hungry investors. The management team looks poised to continue to execute, not just with organic growth, but with strategic, disciplined investments.

Right now, it’s quite a stretch to call Salesforce the Berkshire of tech. Give it a few years though, and that may no longer be the case.

Disclosure: Joey Frenette owned shares of Salesforce and Berkshire Hathaway at the time of publication.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.