Even the smartest traders make mistakes, which may be the overriding sentiment regarding discount apparel retailer Ross Stores (NASDAQ:ROST). While the smart money arguably had legitimate reasons to be bearish on Ross, the company’s solid earnings report forced a rethink, as evident in the bullish post-earnings options activity. However, this wishy-washy reactionary move may have been the wrong one. I am bearish on ROST stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

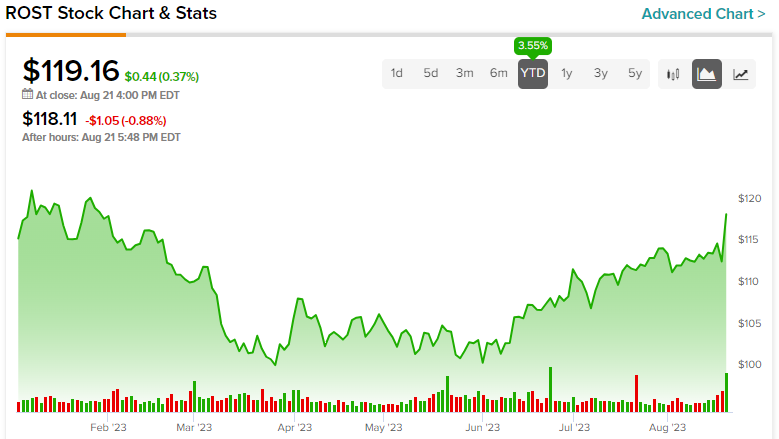

ROST Stock Jumps Unexpectedly

Prior to Ross revealing its Fiscal Q2-2023 earnings report, market participants reading the tea leaves had plenty of reasons to be skeptical of the off-price retailer. Primarily, core inflation – while moving in the right direction – remained stubbornly high. Further, consumers have started to feel the pain, exhibiting tell-tale behaviors such as delaying expensive purchases.

Combined with other headwinds, such as mass corporate layoffs, the discretionary retail space didn’t exactly engender confidence. As a result, ROST stock seemed a riskier-than-usual wager.

However, as TipRanks reporter Sheryl Sheth pointed out, the retailer surpassed Wall Street’s estimates on both the top and bottom lines. Specifically, the company posted diluted earnings per share of $1.32, handily beating analysts’ EPS target of $1.16. On the top line, Ross posted revenue of $4.93 billion, driving past the consensus target of $4.72 billion.

Even better, management increased its guidance for both Q3 and Q4. Per Sheth, “Comparable store sales for Q3 and Q4 are expected to grow by 2%-3% and 1%-2%, respectively.” Further, the reporter added that for Q3, “diluted earnings are expected in the range of $1.16 to $1.21 per share, while consensus is pegged at $1.18 per share.”

Not surprisingly, many analysts reiterated their bullish assessment of ROST stock, with some raising their price targets. However, that might not be the smart move here.

Options Traders Change Their Minds

Given the surprise optimism associated with the fiscal Q2 print, it wasn’t shocking to see rumblings in the derivatives market. However, the extent of the changed minds among the smart money seems odd.

For example, on TipRanks’ options chain for ROST stock, several high-volume trades were recorded. In particular, $120 strike price calls with an expiration date of August 25, 2023, saw volume hit 922 contracts, while the $122 calls (also with the same expiration) printed volume of 263 contracts.

To be fair, activity for put contracts was likewise robust. For instance, $118 puts (with the same August 25 expiration date) printed volume of 788 contracts, while $117 puts saw volume of 192 contracts.

However, a tell-tale sign of options traders pivoting away from their initial thesis centers on the change in open interest. For the aforementioned calls, the change in open interest came out to 173 contracts, which implies the initiation of new positions.

In sharp contrast, the change in open interest for the previously mentioned puts came out to only two contracts. Stated differently, this framework probably suggests the closing of existing bearish positions. Seemingly, that would be a smart tactical move, given that ROST stock jumped on a surprisingly positive earnings print.

Nevertheless, market share data suggests that the bears were likely early, not wrong.

Ross Stores May be More Precarious Than Advertised

While Ross may have delivered a positive earnings surprise, it’s important for investors to consider the bigger picture. Specifically, when the business undergirding ROST stock is stacked against the competition, the thesis isn’t quite as encouraging.

For Ross’ Fiscal Q4 2020, the company posted revenue of nearly $4.25 billion. This figure represented 21.33% of total retail sales in the clothing and clothing accessory stores sector, according to data from the U.S. Census Bureau. However, since that period, this metric has been generally declining. In Fiscal Q1 2023, the company’s market share slipped to 17.46%.

Here’s the problem: in Ross’ latest earnings disclosure, management stated that its operating margin was flat compared to last year at 11.3%. Further, its operating margin has been coming under pressure in recent years. So, Ross can’t attempt to take back market share without compounding its profitability challenges. That’s why investors need to be careful with ROST stock.

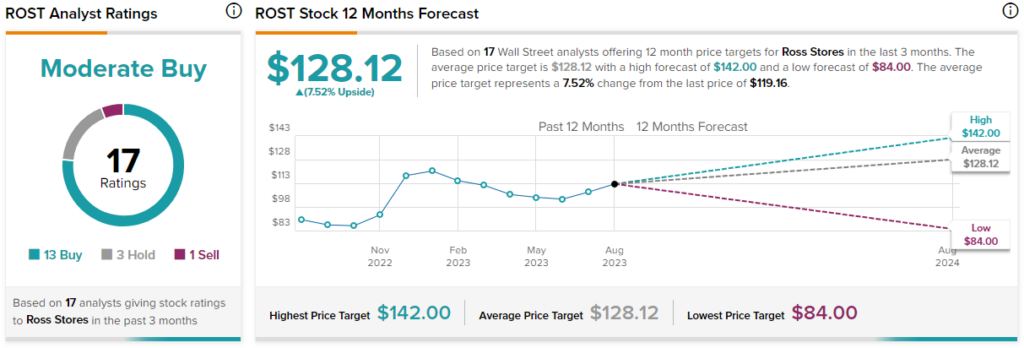

Is Ross Stores Stock a Buy, According to Analysts?

Turning to Wall Street, ROST stock has a Moderate Buy consensus rating based on 13 Buys, three Holds, and one Sell rating. The average ROST stock price target is $128.12, implying 7.52% upside potential.

The Takeaway: Traders of ROST Stock Should Have Stuck with Their Guts

Prior to Ross’ Q2 earnings disclosure, traders were largely skeptical about the company amid rising economic pressures. However, when the retailer posted surprisingly strong figures, they changed their minds. In my opinion, they should have stuck with their guns because the financial profile of ROST stock is more precarious than many realize.