Roku (ROKU) is a streaming software and hardware provider situated in the United States. The company and its subsidiaries provide various offerings including live TV, sports, music, news, and more. I am bearish on the stock.

The Implications of Roku’s Earnings Miss

Roku missed out on its revenue estimates by $28.47 million in its fourth-quarter report, as player sales dropped by 9%.

It seems as though the streaming space is heating up, with many market entrants having bigger budgets and better synergies that could potentially threaten Roku’s best-in-class TV streaming offering.

Rising competition comes at a bad time for Roku, as the U.S. economy is slowing down significantly. The average U.S. household financial obligations have increased by 9.44% during the past year, while disposable income has only increased by 3.96%. Many could be looking to offload non-necessities for the foreseeable future, and Roku could be one of the victims.

TipRanks provides a website click data graph that shows Roku’s declining traffic in recent times. Furthermore, Roku’s stock is closely correlated to its website clicks, and it seems as though it will continue to head in a downward trajectory based on artificial network predictions.

From a Market Perspective

The stock market is essentially a supply and demand function in which investors will continue investing for as long as their expected returns for given levels of risk are met. With Roku, we saw an absolute capitulation in stock price last year because the stock was overhyped during the “stay at home” phase.

Once the asset’s returns didn’t justify the risk, investors headed for the hills in masses and we could see much of the same moving forward. Growth stocks such as Roku are susceptible to volatility and based on the geopolitical tensions in Ukraine and the uncertainty in monetary policy, we’re likely to remain in a volatile market for quite some time to come.

Furthermore, a bearish stock market doesn’t play well into Roku’s stock because its overvalued. Roku is still trading at 6.7X sales and 82.82X its cash flow, suggesting that the market has to correct itself further before we can see a resurgence in Roku’s stock price.

Roku is trading below its 10-, 50-, 100-, and 200-day moving averages, meaning a downward momentum pattern is in full flow. Unfortunately, I can’t see anything changing the situation unless a catalyst presents itself out of the blue.

Wall Street’s Take

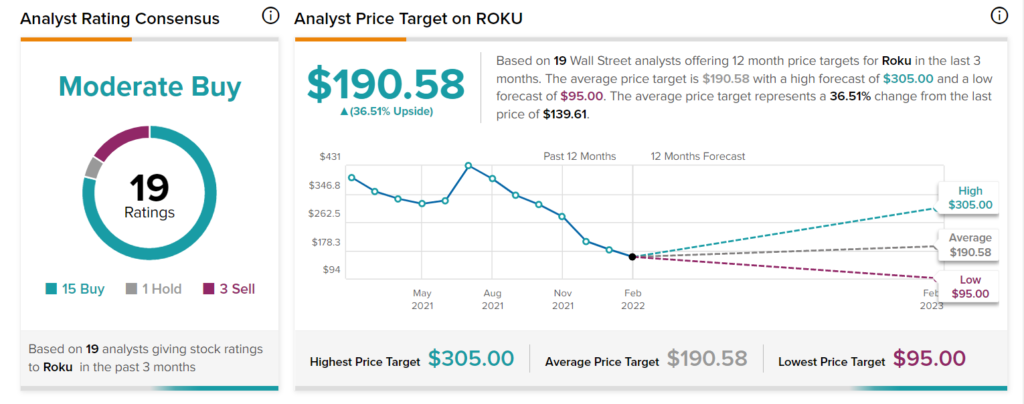

Turning to Wall Street, Roku has a Moderate Buy consensus rating, based on 15 Buys, one Hold and three Sells assigned in the past three months.

The average Roku price target of $190.58 implies 36.51% upside potential.

Concluding Thoughts

The competitive landscape has changed in the streaming world. Roku is being pushed hard by competitors with larger budgets and better synergies. Additionally, Roku isn’t the type of asset the stock market is currently accommodative of, and its valuation metrics suggest that a further drawdown is on the cards.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.