Roblox (RBLX) is a video game platform that enables players to build games in a virtual world. After building a user base of gamers and developers throughout the pandemic, the company has gained a lot of interest from investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based on the current cash flows and market sentiment, I am bearish on Roblox in the near term, and feel the company is overvalued. (See Analysts’ Top Stocks on TipRanks)

Future Outlook

As of the third quarter of 2021, gaming company Roblox Corporation had over 47.3 million daily active users of Roblox games worldwide. This figure is up from 13.7 million from Q4 2018, or a 345% increase in daily active users in almost three years. With 3.24 billion gamers worldwide, Roblox has plenty of room to gain market share.

Roblox daily active users spend an average of 156 minutes, or 2.6 hours per day, on the platform. These facts sound great until investors look further into the data where they will see 67% of the users are under the age of 16 and only 14% of users are 25 or older.

This likely explains the higher average daily usage of the platform, and presents difficulties for monetizing the platform. Roblox has to find a way to reach into the pockets of the majority of its users as a way to monetize the platform.

Parents are not as likely to spend money on the platform on a regular basis, which presents difficulties in creating revenue from the platform. While Roblox has the momentum to continue growing, its user base’s age will continue to present difficulties that the company’s leadership must find ways to creatively maneuver around.

Company Financials

Roblox is still not profitable, but is free cash flow positive. Its balance sheet is very healthy, with its short-term assets covering its short-term and long-term liabilities, and the company has no debt.

Currently, the company generates just shy of $600 million in free cash flow. Cash flows are projected to decline to around $500 million by 2023, and then grow back to $650 million by the end of 2023. All the while, the company is projected to remain unprofitable.

Valuation

In order for a discounted cash flow analysis to justify the current price, Roblox will have to grow its current free cash flows by 50.2% annually.

This calculation assumes starting at $600 million in free cash flow and discounting at a rate of 7% annually. Cash flows must grow by 50.2% consecutively for 10 years to account for the current stock price.

As a comparison, Amazon (AMZN) increased its cash flows by an average of 31% from 2005 to the end of 2020. If investors believe that Roblox is truly the next Amazon, then the current stock price already factors in 50.2% free cash flow growth for the next 10 years.

If investors don’t believe it can sustain that level of growth, then the stock is likely overvalued.

Wall Street’s Take

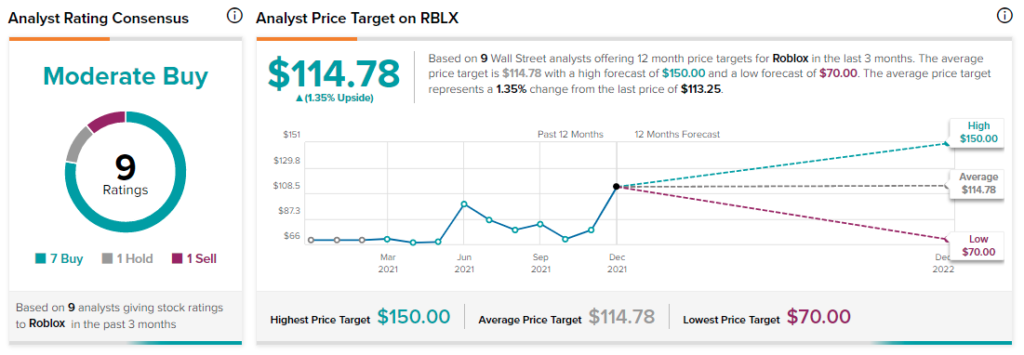

Turning to Wall Street, Roblox has a Moderate Buy consensus rating, based on seven Buys, one Hold, and one Sell assigned in the last three months. At $114.78, the average Roblox price target implies 1.4% upside potential.

Final Thoughts

While Roblox is an excellent company with solid financials, the current stock price does not align with the company’s intrinsic value.

The company will likely thrive in the future, but the sheer growth necessary to justify the current price is astronomical.

Disclosure: At the time of publication, Aaron Stine did have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >