Down about 94% year-to-date, Redfin (NASDAQ:RDFN) stock looks inexpensive on the valuation front. For instance, shares of this tech-based real estate brokerage platform are trading at a price-to-sales multiple of 0.22, which is incredibly cheap. Redfin, a penny stock now, may take time to recover if the economy continues to deteriorate sharply.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Redfin’s problems are mounting. The tech-based real estate company announced a 13% reduction in its workforce. Moreover, it closed its house flipping business, RedfinNow. Since April, Redfin has reduced its employee count by 27%. It’s worth noting that the earlier layoffs were due to slowing home sales. Meanwhile, the recent one assumes a downturn in the housing market, said Glenn Kelman, Redfin’s CEO.

Redfin is not profitable (Learn more about RDFN’s financials here). Moreover, its Q3 results show that its losses widened amid rising mortgage rates. It lost $90 million in Q3 compared to its earlier forecast of $87 million to $79 million. Further, it compares unfavorably with the prior year’s net loss of $18.9 million. Redfin also posted an adjusted EBITDA loss of $51 million.

The company blamed its RedfinNow business for the widening of the losses. Notably, the segment that buys houses for cash and sells them later has been selling its homes at lower-than-expected prices amid softening demand.

Redfin expects its total revenue to decline by 29-33% in Q4. Further, its net loss is expected to widen in Q4. For Q4, it projects a net loss in the range of $134 million to $118 million, compared to a net loss of $27 million in the prior year.

Will Redfin Ever Be Profitable?

While Redfin’s losses are mounting, the company stood by its earlier profit guidance. During the Q3 conference call, Kelman said, “We still plan to generate our first annual net income in 2024.” However, whether the company can turn profitable amid a challenging housing market remains a wait-and-watch story.

Bottom Line

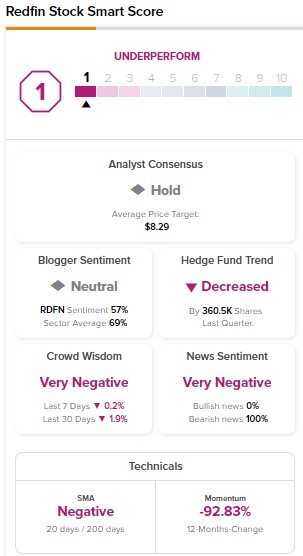

Higher mortgage rates, slowing demand, and economic uncertainty continue to pose challenges for Redfin. It has a Hold consensus rating on TipRanks based on eight Holds and one Sell recommendation. Due to the massive decline, analysts’ average price target of $8.29 implies 153.3% upside potential. However, it scores one out of 10 on TipRanks’ Smart Score system, indicating weak prospects ahead.

While investors should be cautious about RDFN stock, they can find top penny stocks using TipRanks’ Penny Stocks Screener.