Shares in leading consumer health goods company Reckitt Benckiser (GB: RKT) are performing well, and are up by 24% in the last year.

The company’s biggest competitor, Unilever (GB:ULVR) stock was trading up by 1.3% during the same time.

Reckitt’s shares gained further momentum after the company raised its guidance number in its half-yearly results reported in July 2022.

What are Reckitt Benckiser products?

Reckitt Benckiser owns some of the best brands loved across the globe, ranging from health to hygiene to nutrition.

Some of the iconic brands include Dettol, Durex, Harpic, Gaviscon, Strepsils, Mortein, Enfamil, Vanish, Lysol, and many more.

On track for full-year results

After the company reported solid first-half results in July 2022, it remains optimistic about the full year’s results. The company has raised its guidance numbers, and is now expecting net revenue growth of 5-8% rather than the previously reported 1-4%.

The company’s first half revenue grew by 8.6% on a like-for-like basis. The revenues were well supported by all segments and geographies. The operating margins increased by 290 bps to 25.6% as a result of more products and improved productivity. The company also remains on track to achieve its medium-term goal of achieving adjusted operating margins in the mid-20s.

The company’s cash-generating ability is high and the FCF for the first half was £727 million, up from £520 million in 2021. Its dividend yield of 2.6% is above the sector average of 1.6%. But its dividends are fully covered by profits and are increased regularly, which makes the stock more attractive.

A solid pile of cash also allows the company to clear off its debt and fund more acquisitions that add value to the brand.

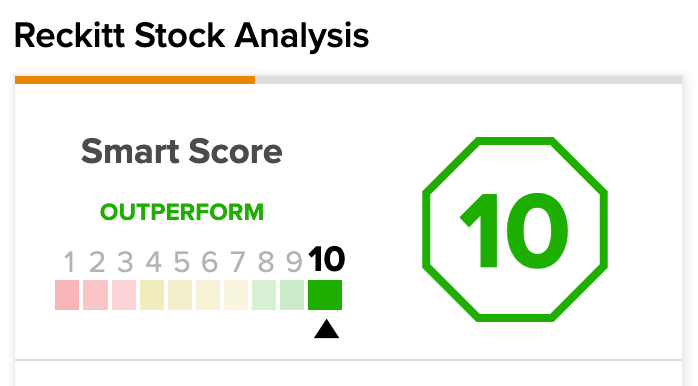

A perfect smart score

Reckitt’s stock scores a perfect 10 on the TipRanks Smart Score tool. This indicates that the company has the potential to outperform the market and generate higher returns for shareholders.

The Smart Score is derived after evaluating the stock on eight different parameters such as analyst ratings, news sentiment, fundamentals, technical analysis, insider transactions, etc.

Investors can use this tool to select stocks and maximise their returns.

Is Reckitt Benckiser a good investment?

According to TipRanks’ analyst rating consensus, Reckitt Benckiser stock has a Moderate Buy rating. The company has a total of 14 ratings, including 11 Buy, two Hold, and one sell recommendation.

The RKT target price is 7,639.3p, with a high and a low forecast of 9,500p and 6,100p, respectively. The price target implies around 15% of the upside potential.

Analyst comments

Matt Britzman, an analyst from Hargreaves Lansdown, commented, “Reckitt’s resilient performance so far this year continues to impress. Price hikes were all but guaranteed given the double-digit inflation in certain costs the group was seeing, but impressively, volumes are still growing. That’s testament to the defensive nature of Reckitt’s portfolio; cleaning and hygiene products are hardly going to be the first things left off shopping lists when wallets are stretched.”

Conclusion

Without a doubt, the rising cost of inflation at this level is a source of concern for the company. But with premium brands, pricing power comes naturally to these companies, which helps in an inflationary economy.

Overall, the sentiment is bullish for Reckitt’s shares based on its stable brand portfolio that is driving profits for the company.