Facebook’s rebranding into Meta Platforms (NASDAQ:META) to reflect its growing focus on bringing the “metaverse to life” generated a lot of interest in the futuristic idea. Metaverse is an emerging digital concept based on virtual reality, augmented reality, and other advanced technologies. While macro pressures have forced some companies to postpone their metaverse projects, the long-term potential of the concept continues to be exciting. We used TipRanks Stock Comparison Tool to place Roblox (NYSE:RBLX), Nvidia (NASDAQ:NVDA), and Meta Platforms against each other to find Wall Street’s top metaverse pick.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Roblox (NYSE:RBLX)

Roblox is an online gaming company that allows users to create and play games as well as interact with other players. The gaming-oriented metaverse company’s Q1 revenue grew 22% to $655.3 million, with average daily active users rising also rising 22% to 66.1 million. However, the loss per share worsened to $0.44 compared to $0.27 in the prior-year quarter.

The company assured investors that it anticipates its bookings growth to surpass its compensation expense growth in Q1 2024. Roblox is expanding its user base by making continued improvements to its platform.

Is Roblox a Buy or Sell?

On Tuesday, Canaccord analyst Jason Tilchen initiated coverage of RBLX stock with a Buy rating and a price target of $48. The analyst highlighted that while Roblox commenced its journey as a gaming hub for young kids, it has evolved to become “one of the leading destinations for immersive gaming and social interactions in persistent virtual worlds.”

Tilchen added that the company’s investments to create more realistic “avatars” and communication features have helped it attract older users and venture into new international markets. Overall, the analyst believes that Roblox has a long-term opportunity to enter new verticals as technological advancements drive the mainstream adoption of the metaverse.

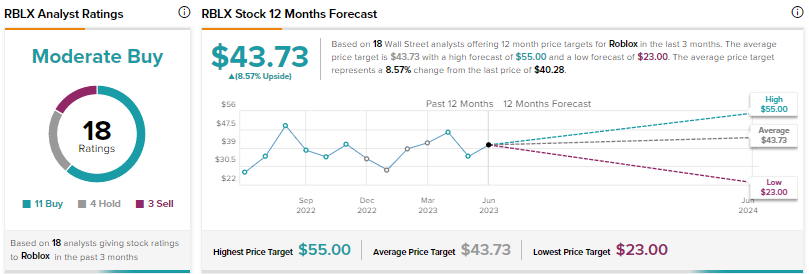

Wall Street is cautiously optimistic on Roblox, with a Moderate Buy consensus rating based on 11 Buys, four Holds, and three Sells. The average price target of $43.73 implies about 9% upside. Shares have rallied nearly 42% year-to-date.

Nvidia (NASDAQ:NVDA)

The metaverse will need immensely high computing power and chip giant Nvidia is well-positioned to address this requirement. The company is already seeing high demand for its advanced chips, as several tech companies are aggressively investing in generative artificial intelligence (AI).

In 2021, Nvidia unveiled its Omniverse Enterprise offering that enables companies to create AI models, robotic simulations, and build digital twins of factories. In March, the company announced a collaboration with Microsoft (NASDAQ:MSFT), under which Microsoft Azure will host a new cloud offering from Nvidia called Nvidia Omniverse Cloud. This service will enable enterprise users to design, develop, deploy, and manage industrial metaverse applications.

Additionally, at the GTC event held in March, Nvidia announced six new NVIDIA RTX Ada Lovelace architecture graphic processing units (GPUs) for laptops and desktops, which will help in meeting the demands of AI and the metaverse.

What is the Prediction for Nvidia Stock?

On May 30, CFRA analyst Angelo Zino reiterated a Buy rating on Nvidia after CEO Jensen Huang held a live keynote at the COMPUTEX conference in Taipei, where he announced a slew of new accelerated computing products. Zino believes that NVIDIA’s accelerated computing GPUs stand out to be the biggest beneficiary of the AI wave.

Zino contended that while bears will point to Nvidia’s “daunting” P/E valuation multiple, he thinks that investors need to be more forward-looking for a high-growth company like NVDA. He argued that a low 40s P/E based on the calendar year 2024 earnings is within NVDA’s five-year historical forward P/E range and justified given his expectation that the company’s EPS can grow at a five-year CAGR of more than 25%.

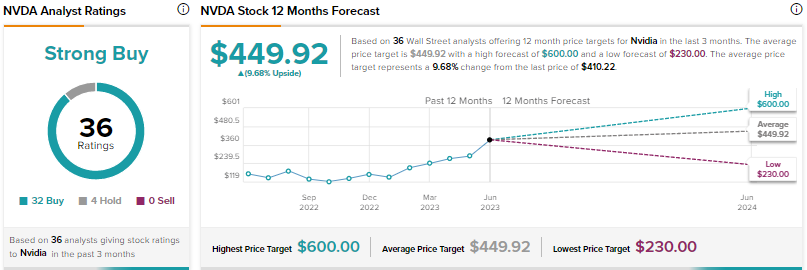

With 32 Buys and four Holds, Wall Street has a Strong Buy consensus rating on Nvidia stock. The average price target of $449.92 implies nearly 10% upside. Shares have skyrocketed over 180% so far in 2023.

Meta Platforms (NASDAQ:META)

Meta’s rebranding in 2021 to emphasize its focus on evolving into a metaverse company sparked a lot of interest in investors about its growth potential. However, the mounting losses of the company’s Reality Labs division, which houses its metaverse projects like developing virtual and augmented reality devices and other foundational technologies for the metaverse, has been concerning.

In Q1 2023, Meta’s Reality Labs division recorded an operating loss of nearly $4.0 billion. Last year, the division recorded an operating loss of $13.72 billion on revenue of $2.16 billion. While CEO Mark Zuckerberg continues to invest in the metaverse, he is focused on bringing down the company’s overall costs in this “year of efficiency.”

During the Q1 earnings call, Zuckerberg said that the narrative about the company shifting away from its focus on the metaverse vision is not accurate. He said that the company has been focusing on both and AI and metaverse for years now and will continue to do so.

Is META Stock Worth Holding?

On Wednesday, Wolfe Research analyst Deepak Mathivanan increased the price target for Meta stock to $330 from $300 and reiterated a Buy rating. Meta is a top pick at Wolfe Research. Mathivanan believes that few companies have all the building blocks required to create and deploy generative AI experiences that can significantly boost revenue and free cash flow growth, and Meta is one among them.

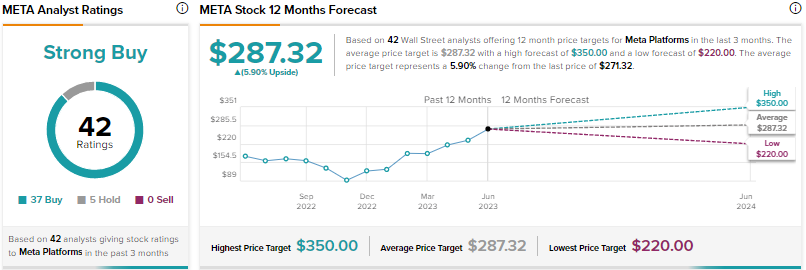

Wall Street’s Strong Buy consensus rating on Meta is based on 37 Buys and five Holds. The average price target of $287.32 implies about 6% upside. Shares have jumped about 126% so far this year.

Conclusion

Metaverse is an emerging concept that could gain immense traction in the years ahead. Currently, Wall Street seems more optimistic about larger players like Meta Platforms and Nvidia compared to Roblox. While Nvidia has outperformed the other two stocks year-to-date, Wall Street sees comparable upside in the three stocks from current levels.

As per TipRanks’ Smart Score System, Nvidia scores a “Perfect 10,” implying the stock could outperform the broader market.