Nvidia (NASDAQ:NVDA) shares jumped nearly 25% in Wednesday’s extended trading session as investors cheered the company’s market-crushing revenue guidance of $11 billion (plus or minus 2%) for the fiscal second quarter, backed by solid demand for its artificial intelligence (AI) chips. The chip giant delivered upbeat fiscal first-quarter earnings despite a 13% decline in the top line due to a slump in the gaming division.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AI Drives Solid Demand for Nvidia

Nvidia’s CEO Jensen Huang said that the computer industry is undergoing two simultaneous transitions – accelerated computing and generative AI. “A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process,” said Huang.

The CEO added that the company is “significantly” ramping up the supply of its data center family of products, like H100, Grace CPU, Grace Hopper Superchip, NVLink, Quantum 400 InfiniBand, and BlueField-3 DPU, to meet the booming demand.

The demand for Nvidia’s graphics processing units (GPUs) in cloud computing and generative AI applications like OpenAI’s ChatGPT drove a 14% year-over-year growth in its data center segment revenue to $4.28 billion. Generative AI is fueling “exponential” growth in compute requirements and a rapid transition to the company’s accelerated computing offerings, which Nvidia believes are the “most versatile, most energy-efficient, and the lowest TCO [total cost of ownership] approach to train and deploy AI.”

Nvidia is seeing robust demand across its three major customer categories – cloud service providers or CSPs, consumer internet companies, and enterprises. During the Q1 earnings call, CFO Colette Kress highlighted that CSPs around the world are keen to deploy the company’s flagship Hopper and Ampere architecture GPUs to meet the growing interest for AI applications for training and inference. She noted that multiple cloud giants, including Microsoft (MSFT) Azure, Google (GOOGL) (GOOG) Cloud, and Amazon (AMZN) Web Services (AWS), have made H100 available on their platforms.

Further, consumer internet companies are also driving demand for Nvidia’s AI chips. For instance, Meta has deployed an H100-powered Grand Teton AI supercomputer for its AI production and research teams. Likewise, the momentum for Nvidia’s AI chips is strong in the case of enterprise customers, especially in verticals like automotive, healthcare, financial services, and telecom.

Overall, the company said that the demand for its chips in generative AI and large language models has extended its “data center visibility out a few quarters” and the company has procured significantly higher supply for the second half of the year.

Is Nvidia a Buy, Hold, or Sell?

Following the Q1 print, Citigroup analyst Atif Malik increased the price target for Nvidia stock to $363 from $305 and reiterated a Buy rating based on the accelerating generative AI adoption.

Malik boosted the price target after assessing the opportunity for the company in the mobile AI space. He estimates that the potential integration of Nvidia’s GPUs into next-generation mobile processor makers, like MediaTek (MDTKF), to co-design mobile handset platforms and AI-powered Windows on Arm may bring in over $2 billion in estimated cumulative licensing and royalty sales by 2025.

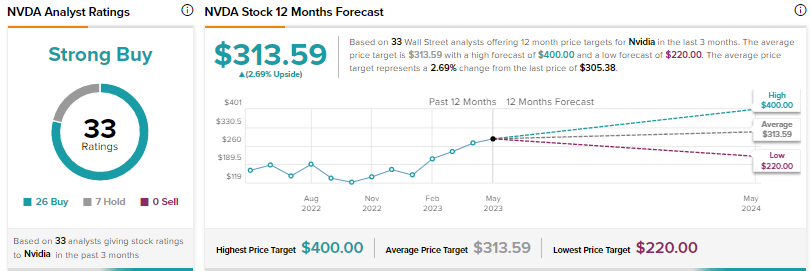

Wall Street’s Strong Buy consensus rating on Nvidia is backed by 26 Buys and seven Holds. The average price target of $313.59 suggests nearly 3% upside.