It seems that the August market swoon bottomed out two weeks ago, and since then, stocks have recovered most of this month’s losses. This shift has given a renewed boost to investors’ positive sentiment, which has run high throughout the year and fueled a strong rally.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, there are still headwinds in the wings. Writing from Raymond James, CIO Larry Adam points out that while inflation has decreased, its uncertainty remains, and fiscal dynamics are likely to increase pressure on the general economy. Specifically, Adam notes that ‘structural shifts,’ such as disruptions in supply chains, rising labor strife, and the energy transition, make it harder to predict future inflationary trends. He also mentions that an expanding Federal deficit – the Treasury announced nearly $2 trillion in new borrowing for 2H23 – feeds into fears of further Federal credit downgrades or government shutdowns.

In short, while there’s reason for optimism, there are clouds on the horizon. The question is whether these clouds will coalesce into a dangerous storm front.

Against this backdrop, Raymond James’ 5-star analysts are taking the logical stance in the face of an uncertain investing environment and tagging high-yield dividend stocks as potential winners going forward. These are Buy-rated equities with dividends that can reach as high as 10%. Let’s take a closer look and find out what else has attracted the attention of the Raymond James analysts.

Golub Capital BDC (GBDC)

We’ll start with Golub Capital, a business development company that provides capital, credit, and financial services to small- and mid-sized businesses in the mid-market sector. These are the small enterprises that have traditionally driven US economic growth, and companies like Golub play a crucial role in offering them the banking services necessary for their survival and growth.

The majority of Golub’s portfolio consists of first lien one-stop loans, making up 85% of the total. The remaining 9% of the portfolio comprises first lien traditional senior notes, and 5% is invested in equity. In terms of sectors, Golub exhibits a preference for software companies, accounting for 27% of the portfolio. Healthcare providers and service companies constitute 8%, while several other sectors, including insurance, IT services, and specialty retail, each contribute 5%.

In its most recent financial report for Q3 of the fiscal year 2023, Golub’s top line, which represents total investment income, reached $154.72 million. This marked an increase of over 5% from the previous quarter and exceeded estimates by more than $5 million. On the bottom line, Golub reported a net investment income per share of 43 cents, a favorable comparison to the 41 cents from the same quarter the previous year and beating the forecast by a penny.

Golub’s earnings fully covered the company’s dividend payment, which was raised in the latest declaration by over 12%, resulting in a new base of 37 cents per share. The upcoming dividend is scheduled for payment on September 29. With an annualized rate of $1.48, this offers a forward yield of 10.3%. Additionally, the dividend receives a boost from a 4-cent supplemental payment.

For Raymond James’ 5-star analyst, Robert Dodd, the high dividend is one of the important attractive features of Golub’s shares. He writes of the stock, “The company announced two material initiatives which will benefit shareholders: a lower base management fee (moving back to the forefront of the group), as well as a high base dividend and new supplemental distribution program. In addition, credit metrics improved on all major metrics, positioning the BDC to outperform on a go forward basis. We see an improved forward return profile, and attractive risk/return.”

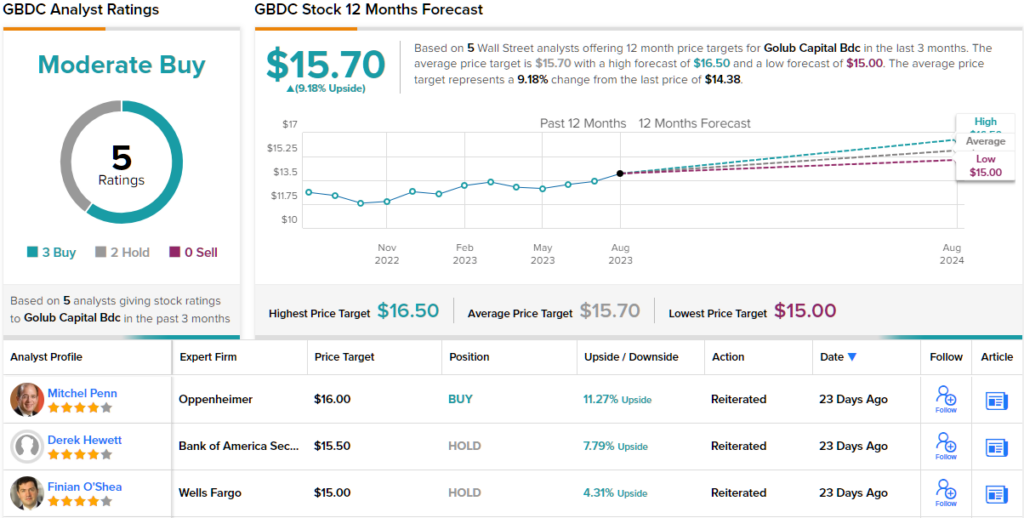

Looking ahead, Dodd goes on to give GBDC an Outperform (i.e. Buy) rating, and a target price of $15.50 to imply ~8% upside from current levels. Based on the current dividend yield and the expected price appreciation, the stock has ~18% potential total return profile. (To watch Dodd’s track record, click here)

Overall, this stock holds a Moderate Buy consensus rating from the Street’s analysts, based on 5 recent reviews that include 3 Buys and 2 Holds. (See GBDC stock forecast)

Flushing Financial Corporation (FFIC)

Raymond James’s next high dividend-yield pick is a bank holding company, Flushing Financial Corporation. This corporation serves as the parent company for Flushing Bank, a New York-based bank with offices in various locations around New York City, including Manhattan, Queens, Brooklyn, and Long Island. Established in 1929, the bank is a long-standing institution, and Flushing Financial Corporation (FFIC) currently boasts a market capitalization of $408 million.

Operating at the B2C level, Flushing Financial Corporation, through its banking subsidiary, offers a comprehensive range of personal and business banking services, along with loan services such as checking and savings accounts, CDs, and cash management. Secure mobile apps provide access to online banking, tailored to meet the needs of business banking.

In July of this year, Flushing Financial made an interesting announcement – it had acquired the commercial real estate lending team from the now-defunct Signature Bank. Signature was one of the small regional banks that collapsed in March of this year, an event that sparked fears of a spreading bank contagion. The March bank crisis was short-lived, and Flushing Financial has gained a definite benefit in the form of an experienced commercial real estate team to help expand the CRE loan business.

In 2Q23, the most recent reported quarter, the company’s bottom line, at 26 cents per share according to non-GAAP measures, grew by 160% quarter-over-quarter. This marked a significant difference from the 63% year-over-year decrease and was taken as a sign that the bank’s earnings have turned the corner.

The improvement in the EPS fully covered the Q2 dividend of 22 cents per share. The next payment, also of 22 cents per common share, is scheduled for September 29. Its annualized rate of 88 cents gives a yield of 6.23%.

In his coverage of Flushing Financial, Raymond James’ 5-star analyst, Steve Moss, sees the company’s ‘earnings challenges’ as linked to the Fed’s interest rate cycle, and adds that the dividend appears to be affordable for the bank. He writes in his recent note, “FFIC is positioning themselves for the future as recent swap transactions should moderate earnings headwinds and buy time for the bank’s short (~3-year) duration loan portfolio to reprice and support higher profitability over time. FFIC’s earnings challenges are interest rate driven, and earnings should improve when the Fed’s current tightening cycle ends or interest rates are cut.

“With the stock at 62% of TBV, what we believe is a sustainable dividend given the bank’s strong capital position and credit quality, the risk-reward is attractive especially for those seeking to benefit from a change in policy by the Federal Reserve,” Moss summed up.

For the analyst, this view supports an Outperform (i.e. Buy) rating on the stock, while his $17 price target shows his confidence in a 20% one-year upside potential. (To watch Moss’s track record, click here)

The 3 most recent analyst reviews here are a Buy and 2 Holds, for a Moderate Buy consensus on the stock. (See FFIC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.