Qualcomm (QCOM) is the world’s leading manufacturer of mobile semiconductors. The company supplies chips to major corporations such as Apple (AAPL) and Microsoft (MSFT), among others.

Despite persistent issues in the global supply chain, yesterday the firm reported better-than-expected first-quarter results and issued optimistic Q2 forecasts.

The chipmaker reported sales of roughly $10.7 billion, which was higher than the Street’s expectation of $10.41 billion, thanks to strong growth in the Android business and sustained demand from China’s mobile makers. Also, earnings of $3.23 per share came in above consensus expectations of $3.01. Qualcomm paid $1.9 billion to shareholders, including roughly $1.2 billion in dividend payments, thanks to its ability to produce robust cash flows.

The company’s strong competitive position in the mobile category, along with a steady increase in demand for digital products, will assure steady growth in the foreseeable future.

What’s Ahead?

QCOM is in an excellent position to benefit from the growing adoption of 5G technology. Diversifying outside of the mobile sector into RF Front-End, Automotive, and the Internet of Things (IoT) appears to be paying off for the firm.

The corporation gave a positive outlook for the second quarter. The chipmaker predicts sales of $10.2-$11 billion, which is higher than the Street projection of $9.61 billion. Furthermore, earnings of at least $2.80 per share are predicted, significantly ahead of the consensus projection of $2.49.

The business should be able to meet its goal thanks to robust demand for Android devices, 5G momentum, and healthy acceptance of the company’s Snapdragon solutions by original equipment manufacturers (OEMs).

Analyst Weighs In

In response to Qualcomm’s Q2 guidance, Kevin Cassidy of Rosenblatt Securities stated, “We believe Qualcomm is well-positioned for another strong year of over 25% revenue growth and over 30% earnings growth.”

The analyst is optimistic about the company’s prospects in 2022. He believes that “increasing content per 5G handset and increasing 5G handset shipments” will drive revenue and profitability growth.

Further, he believes that QCOM’s diversification plan will serve as a positive catalyst in the long run. He writes, “We see management’s strategy for moving into adjacent IoT and Automotive markets with its Snapdragon platform as setting up longer-term growth well beyond the handset market.”

As a result, Cassidy reiterated his Buy rating on QCOM stock and raised his target price to $225 from $220.

Wall Street’s Take

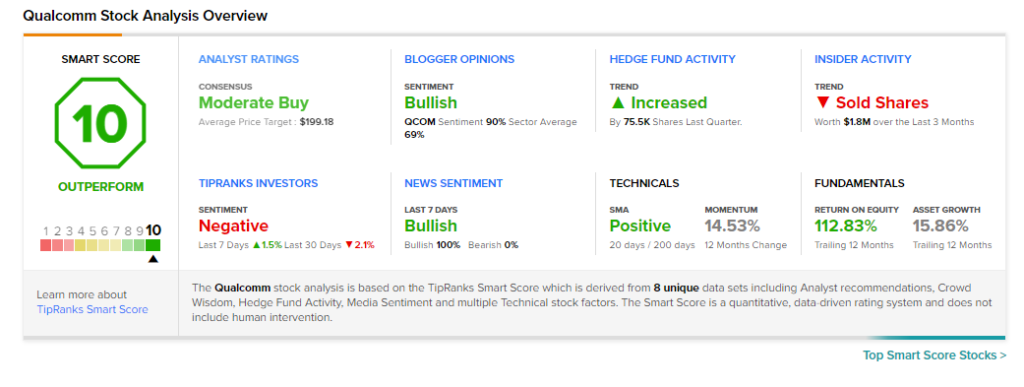

However, Qualcomm does not impress all experts. On TipRanks, Qualcomm has a Moderate Buy average rating, based on 11 Buys and 8 Holds. On a positive note, four of those Buy ratings were given after yesterday’s QCOM earnings release.

As for the price target, the average QCOM price target of $198.29 implies 5.8% upside potential to current levels.

Additionally, Qualcomm scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.