Thanks to the recent rally in tech stocks, the Invesco QQQ Trust (QQQ) ETF (Exchange-Traded fund) has gained about 20% year-to-date, outperforming the S&P 500 Index (SPX). While this tech-focused ETF has appreciated, technical indicators suggest a Buy on QQQ at current levels, implying further upside.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

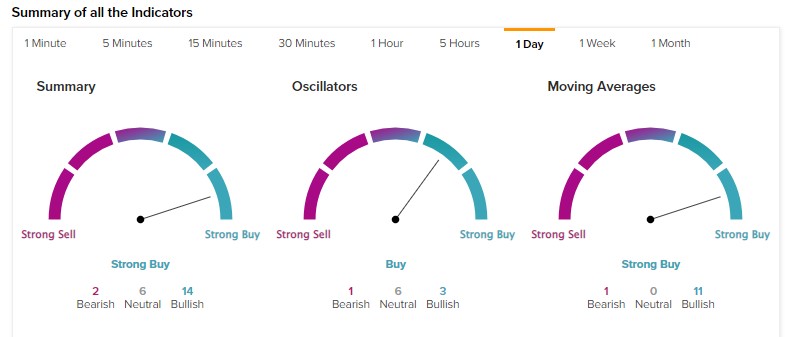

According to TipRanks’ technical analysis tool, the Invesco QQQ Trust ETF’s 50-Day EMA (exponential moving average) is 302.49, while its price is $315.83, making it a Buy. Further, QQQ’s shorter duration EMA (20-day) also signals a bullish trend.

While QQQ’s price has appreciated year-to-date, its RSI (Relative Strength Index) of 62.68 still doesn’t signal an overbought condition. Based on Pivot Points, the QQQ has the next resistance near $333 (see the graph below).

What’s the Prediction for QQQ?

Overall, QQQ is a Buy based on TipRanks’ easy-to-understand summary signals (which combine the moving averages and the technical indicators into a single, summarized signal).

While technical indicators signal an uptrend, the QQQ ETF has further upside potential based on the consensus view of over 2K analysts. Per the recommendations of 1,752 analysts, the 12-month average Invesco QQQ Trust ETF price target of $355.90 implies 12.69% upside potential.

The QQQ ETF has a Moderate Buy consensus rating on TipRanks. Among the 1,752 analysts providing ratings on 102 holdings of QQQ, 66.58% have given a Buy rating, 29.79% have assigned a Hold rating, and 4.62% have given a Sell rating.

QQQ tracks the Nasdaq-100 index (NDX), providing investors exposure to the largest tech stocks in one basket. It has outperformed SPX in nine of the last 10 years and has a low expense ratio of 0.20%, which makes it an attractive investment.

Overall, it has an Outperform Smart Score of eight on TipRanks.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue