As the Q3 earnings season has mostly drawn to a close, investors are looking to year-end trends like the holiday shopping season to determine which stocks are worthy of their cash. Meanwhile, macro forces like inflation and supply constraints continue to loom over financial markets. Additionally, energy and gas prices have climbed considerably over the last few months, straining already cash-strapped businesses.

While the difficulty in finding a healthy and growing company in this over-extended environment can be a time-consuming task for most investors, some have extra information that they use to their advantage.

Insiders, as they are defined, are individuals who either hold a 10% or more stake in a public company, work in a senior officer role, or have a position on a board of directors. While there are some restrictions on their capacities to trade stock in their own companies, for the most part it is legal.

Within two days after a transaction, the insiders are required by the Securities and Exchange Commission (SEC) to submit a Form 4 for regulatory approval. After processed, the SEC publicly publishes the report for anyone interested enough to read through it. These reports can be convoluted, and hundreds may be published each week. Additionally, not all transactions are indicative of a possible future change in share price.

Those identified as an “Informative Buy” are the ones worth looking at. This particular transaction is one in which the insider purchased stock using their own capital. If one or several insiders of a single firm are buying stock on their own dime, it can be inferred that their level of confidence in the company has risen.

TipRanks unique insiders’ tools organize and collate the SEC data into digestible information. Insiders’ Hot Stocks and the Top 25 Corporate Insiders pages can be leveraged by everyday investors to trace which insiders and strategies are outperforming the market. Using the Daily Insider Transactions tool, users can follow filtered insider trades on a rolling basis.

Let’s take a look at two stocks that have recently been on insiders’ radars.

Krispy Kreme

Being rich in sugar and fat doesn’t always translate into being rich in valuation. Krispy Kreme, Inc. (DNUT) went public last July, and has yet to recapture its initial pricing level. The doughnut and coffee company has seen its share price steadily slump over the last few months, although a slight increase has occurred in recent weeks. While tech, energy, and the broader market have risen since the summer, DNUT has underperformed.

However, the firm has begun to turn its business around. It recently reported Q3 revenues above Wall Street consensus estimates, and its raised doughnut prices appear to have been digested properly by consumers. Moreover, the company plans to hike prices more in the current quarter, and that might provide it with enough cash flow to offset the larger market forces weighing down its peers, like rising inflation and labor costs.

While the general outlook on the stock appears sweet, the situation becomes far more savory when insider purchases are incorporated. Over the last eight days, two insiders and Krispy Kreme’s holding company made Informative Buy purchases of company stock. The insiders included both CEO Michael Tattersfield and board member Olivier Goudet. Goudet put down $693,000 of his own capital, raising his total holding value to $29,292,734 and further cementing his confidence in the company.

On TipRanks, this particular insider has a four-star rating, and has returned an average of 16.4% on his trades over the last year.

Analysts are no less bullish on the stock, with David Palmer of Evercore ISI declaring that “while inflation and labor continue to be near-term concerns, we continue to see more positive long-term data points.” The analyst went on to argue that the company has been expanding both internationally and domestically, and that the stock is currently trading at a discount in regard to its peers.

Palmer rated the stock a Buy, and added a price target of $20.

DraftKings

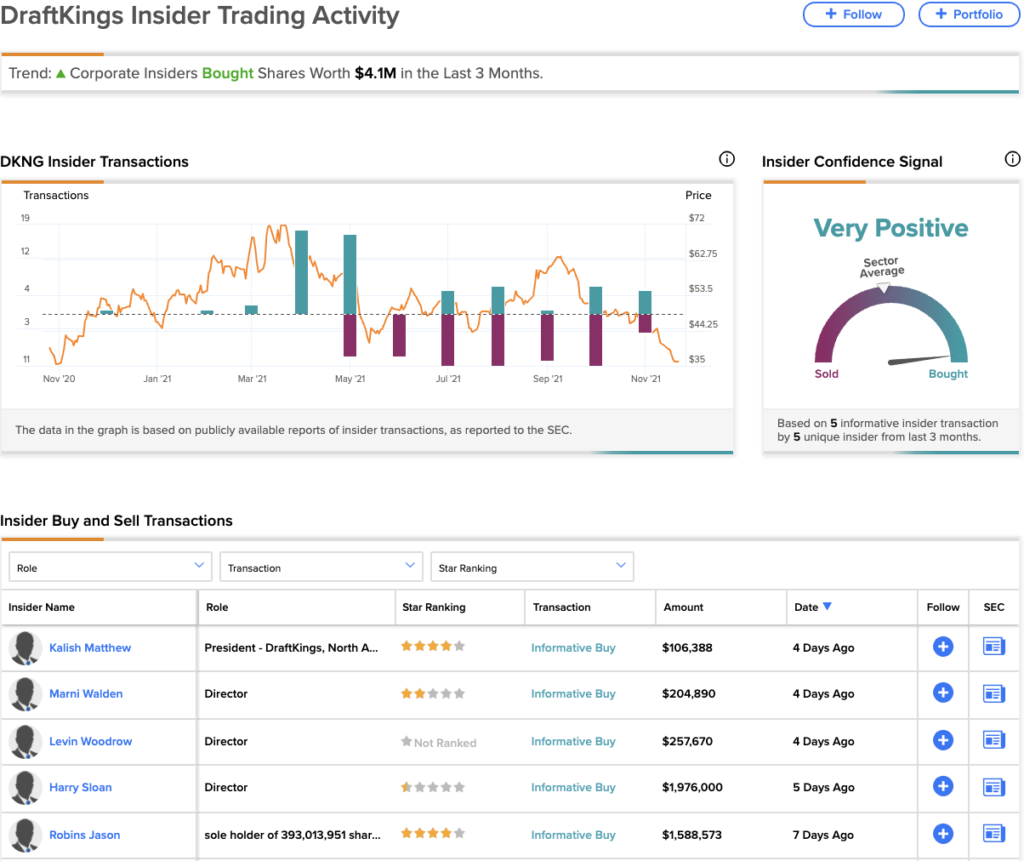

The COVID-19 pandemic accelerated many consumer trends, one of which was online sports gambling. With individuals stuck at home and armed with stimulus checks and time, many turned to DraftKings Inc. (DKNG) for entertainment. The digital sports book company went public via reverse SPAC merger in April 2020, and soon thereafter saw its valuation reach a peak of about three times its original price by March 2021.

However, the stock has struggled since, and most recently fell about 40% while the majority of the market gained. It appears that after weeks of losses, the insiders are eyeing buying opportunities.

Over the last seven days, five individuals have purchased about $4 million in company stock. The most recent purchase was made by Matthew Kalish, President and Co-Founder, who increased his holding value by $106,388. His current position in DKNG now stands at $75,876,581.

On TipRanks, Kalish is rated as a four-star insider, and his transactions over the past year have netted him an average of 36.8%. Considering that no Informative Buys had been executed in the past six months, and that five high-ranking company insiders have bought stock in the past week, it appears they believe that the stock has found its bottom.

After checking in with the financial analysts, we came across a similar hypothesis. Bernie McTernan of Needham & Co. asserted that “the legislative environment is overall supportive of greater market access as it’s a win-win for customers and states.” The bullish analyst also noted that the company is showing higher levels of engagement, with “new users betting nearly 20% more on average” in this year’s NFL season in comparison to last year.

McTernan rated the stock a Buy, and assigned a price target of $73.

Disclosure: At the time of publication, Brock Ladenheim did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.