After a big run-up last year, electric vehicle stocks have been in a correction mode. This seems temporary because positive industry tailwinds are likely to sustain.

According to Deloitte, the global electric vehicle industry is likely to grow at a CAGR of 29% over the next decade. Considering the growth outlook, investors might consider exposure to electric vehicle stocks on intermediate corrections.

Earlier this year, Nio (NIO) stock touched a high of $66.90. Since that time, valuation concerns, coupled with a semiconductor shortage, have resulted in a steep correction.

However, it seems that the worst might be over for Nio stock. At current levels of $33.81, the stock might be worth considering. (See Nio stock analysis on TipRanks)

There are several potential catalysts for Nio in the coming quarters.

Expansion Triggers Potential Stock Upside

Over the next decade, China is likely to maintain a leadership position in the electric vehicle market. After China, Europe is expected to be the next largest growth market.

Therefore, it is not surprising that electric vehicle companies are focusing on European expansion. Tesla (TSLA) is already building a Gigafactory in Europe, which is likely to commence production in early FY2022. XPeng (XPEV), which is Nio’s competitor in China, has already commenced the delivery of electric vehicles in Norway. Not to be left out, Nio is planning an expansion into Europe in the second half of the year.

As of March 2021, Nio had a robust cash buffer of $7.3 billion. Strong financial flexibility is likely to help the company in planning an aggressive expansion in several European countries.

Initially, the company will be launching its vehicles in Norway. This does not come as a surprise, as more than 50% of cars sold in Norway last year were electric cars.

Nio also has plans for expansion in the U.S. That’s unlikely to begin this year, but the key point is that expansion into new markets will ensure that vehicle deliveries remain robust. The company is already building a new plant in the Xinqiao Industrial Park in Hefei. This will cater to the incremental demand from China as well as from international expansion.

Positive Indicators

From a financial perspective, Nio reported a vehicle margin of 21.2% for Q1 2021 as compared to a negative vehicle margin of 7.4% in Q1 2020. Even on a quarter-on-quarter basis, the company’s vehicle margin expanded. With increasing vehicle deliveries, vehicle margin will likely continue to improve.

It’s also worth noting that the company reported an operating level loss of RMB295.9 million in Q1 2021. In the same period last year, operating level losses were RMB1.6 billion. Clearly, there has been a significant improvement in operating margin.

With cost-cutting and operating leverage, Nio will likely achieve operating level profitability in the next one to two quarters. Once operating margins improve and Nio is able to report positive operating cash flows on a sustained basis, the stock is likely to trend higher.

From the perspective of sustained growth in vehicle deliveries, Nio’s Battery-as-a-Service is a key reason to be bullish. The biggest advantage of BaaS is that it significantly reduces upfront payments for buying an electric car. That price advantage gives Nio an edge over its peers. Further, with a monthly subscription fee, customers can avail themselves of battery swapping services or upgrades.

Additionally, Nio plans commercial delivery of its first sedan, ET7, in FY2022. Given the expansion plans, the sedan is likely to be available in China and Europe. This is another trigger for upside in vehicle deliveries.

Wall Street’s Take

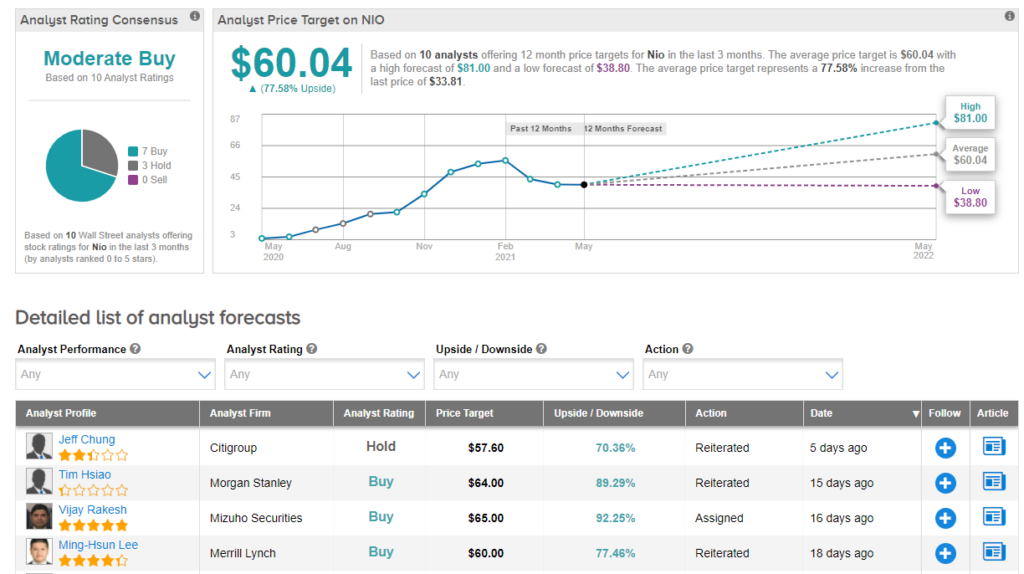

According to TipRanks’ analyst rating consensus, NIO stock comes in as a Moderate Buy, with 7 Buys and 3 Holds assigned in the last three months.

As for price targets, the average analyst price target is $60.04 per share, implying around 77.58% upside potential from current levels.

Concluding Views

Overall, with a strong financial profile, positive cash flows, investment in manufacturing expansion, and an international presence, Nio stock looks attractive for long-term investors. Taken together, its positive catalysts paint a hopeful picture for the auto maker’s future.

Disclosure: On the date of publication, Faisal Humayun did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.