The market liked the latest news out of Plug Power’s (PLUG) HQ and considering its potential, that’s hardly surprising; last week, the hydrogen fuel player announced that its working relationship with Amazon had gone up a notch.

The company has signed an agreement with the tech giant to supply it with 10,950 tons per year (30 TPD) of liquid green hydrogen. This will go toward fueling Amazon’s operations and will oust the diesel, gray hydrogen and other fossil fuels used by the company. The supply should be enough to power 30,000 forklifts or 800 heavy-duty long-haul trucks every year.

The deal is a step up from the current one; since 2016, PLUG has been supplying Amazon with gray hydrogen which it uses for the 15,000+ hydrogen forklifts spread across its distribution centers.

Morgan Stanley analyst Stephen Byrd thinks the deal shows Amazon’s “continued commitment to reducing carbon emissions throughout its distribution and fulfillment centers.”

Byrd believes that the cost of green hydrogen to Amazon is basically equivalent to the cost of gray hydrogen – which is being replaced by this deal – and that it consequently won’t significantly affect the company’s EBIT.

More importantly, however, is the impact the deal is set to have not only on PLUG but on the hydrogen industry as a whole.

“In our view,” said the 5-star analyst, “the announcement is a meaningful step in demonstrating the viability of green hydrogen as a decarbonization tool, and would expect similar announcements to materialize across the green hydrogen ecosystem following the recent passage of the Inflation Reduction Act.”

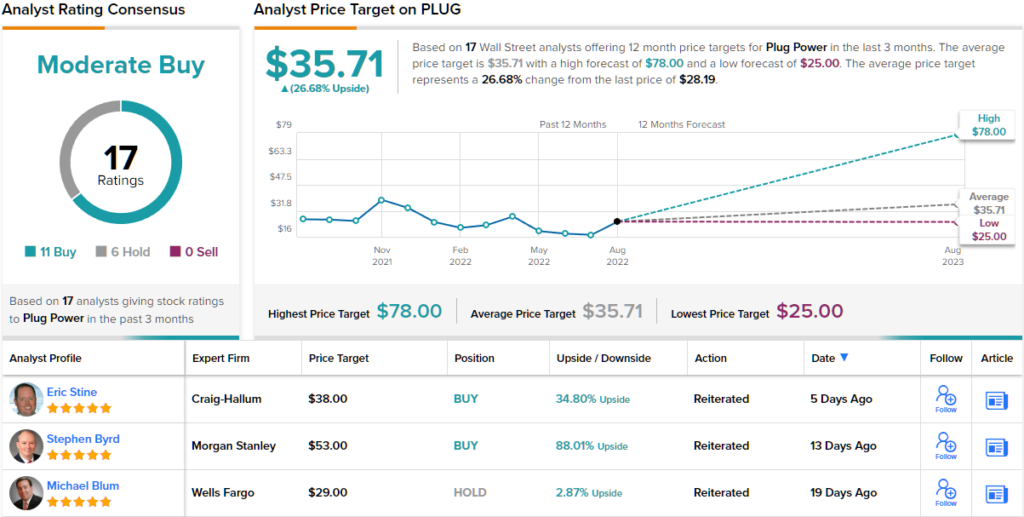

The gains posted following the deal’s announcement have helped nudge the stock into positive territory for the year, yet Byrd is projecting plenty of upside from here; along with an Overweight (i.e., Buy) rating, the analyst’s $53 price target makes room for 12-month returns of 88%. (To watch Byrd’s track record, click here)

And what about the rest of the Street? Of the 17 analyst reviews made during the past 3 months, 6 sit on the fence, while all the rest say Buy, all culminating in a Moderate Buy consensus rating. Going by the $35.71 average target, the shares will be changing hands for ~27% premium a year from now. (See PLUG stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.