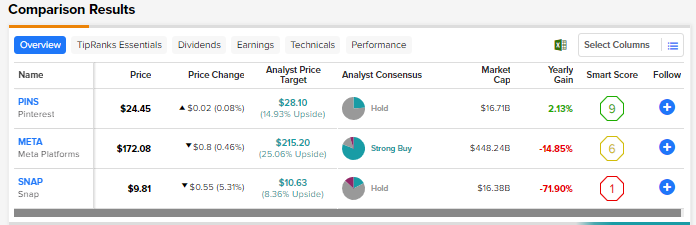

Social media stocks were under tremendous pressure last year due to the impact of macro headwinds on digital ad spending, Apple’s (AAPL) iOS privacy policy changes, and intense competition. Persistent macro challenges are expected to weigh on social media companies over the near term. Keeping in mind this tough backdrop, we used TipRanks’ Stock Comparison Tool to place Pinterest (NYSE:PINS), Meta Platforms (NASDAQ:META), and Snap (NYSE:SNAP) to pick the social media stock that Wall Street favors despite the ongoing headwinds.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Pinterest (NYSE:PINS)

Image-sharing platform Pinterest’s Q4 2022 revenue grew 3.6% year-over-year to $877 million. However, it lagged analysts’ estimates due to a weak ad market and currency headwinds. Adjusted EPS plunged 41% to $0.29 but managed to beat the Street’s expectations. Looking ahead, the company expects Q1 2023 revenue to increase low-single-digits year-over-year.

Pinterest’s global monthly active users (MAUs) came in at 450 million at the end of Q4 2022, up 4% year-over-year. The company is focused on further growing engagement and monetization per user. It is also reducing costs to enhance its margins.

Is Pinterest a Buy Right Now?

Following the Q4 print, Monness analyst Brian White commented, “Pinterest has improved support for advertisers, enhanced the user experience, increased shopping capabilities, and expanded overseas.” That said, White remains on the sidelines with a Neutral rating due to intense competition and “guarded” digital ad spending. He feels that “the darkest days of this downturn are ahead of us.”

Wall Street has a Hold consensus rating on Pinterest stock based on five Buys and 16 Holds. The average PINS price target of $28.10 implies nearly 15% upside. Shares are essentially flat compared to the start of this year.

Meta Platforms (NASDAQ:META)

Meta Platforms’ Q4 2022 revenue fell 4.5% year-over-year to $32.2 billion. This was the third-consecutive quarter in which revenue declined, as an uncertain macro environment continued to weigh on advertising demand. Moreover, investors have been concerned about the impact of the significant investments in metaverse and other ambitious projects on the company’s bottom line.

Nonetheless, investors cheered the Q4 results, as revenue topped the Street’s expectations and the company announced a $40 billion increase in its share buyback authorization. Meta already had $10.9 billion remaining under prior repurchase authorization. Overall, the company repurchased $6.9 billion of its shares in 2022.

Is Meta Platforms a Good Buy?

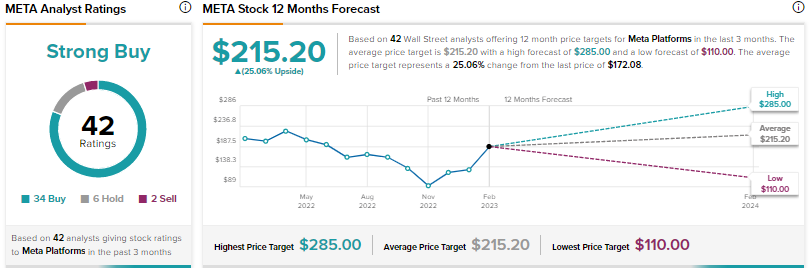

Recently, Tigress Financial Partners analyst Ivan Feinseth raised the price target for Meta Platforms to $285 from $260 and reaffirmed a Buy rating. The analyst highlighted the company’s “massive and ever-growing user base,” with Daily Active People (number of users who visited at least one of the family apps –Facebook, Instagram, Messenger, and WhatsApp in a day) rising 5% to 2.96 billion on average for December 2022. Monthly active people increased 4% to 3.74 billion as of December 31, 2022.

Feinseth feels that the acceleration in top-line growth and cost disciple would drive higher earnings. He added, “META has a significant upside driven by the ongoing potential to monetize many of its critical applications and technologies, including Instagram, Messenger, WhatsApp, and Oculus.”

Overall, Meta scores a Strong Buy consensus rating based on 34 Buys, six Holds, and two Sells. The average META stock price target of $215.20 suggests 25% upside. Shares have rallied 43% year-to-date.

Snap (NYSE:SNAP)

Snap, the owner of the Snapchat platform, ended 2022 on a mixed note. The company’s Q4 2022 revenue increased 0.1% year-over-year to $1.3 billion, but fell short of the Street’s expectations. Adjusted EPS declined 38% to $0.14 but still came ahead of analysts’ consensus estimate of $0.11. The company expects weakness to persist in the first quarter and projects revenue to decline in the range of 2% to 10%.

Snap is reducing its costs and aims to be adjusted EBITDA break-even in Q 1 2023. The company is experiencing continued growth in its community. It ended 2022 with 375 million daily active users (DAU), up 17% year-over-year. Snap projects Q1 2023 DAU in the range of 382 to 384 million.

What is SNAP Price Target?

Following Snap’s recently held Investor Day, Goldman Sachs analyst Eric Sheridan said, “While we came away more constructive on Snap’s long-term revenue growth opportunity, we continue to see Snap as a ‘Show-me’ story over the near-to-medium term.”

Sheridan expects shares to be range-bound due to a “short-term depressed revenue trajectory” along with low visibility into the digital ad market, which is getting more mature and competitive. Additionally, the analyst noted that large-scale players are making significant multi-year investments in artificial intelligence, automation, mixed reality, and short videos. Sheridan has a Hold consensus rating on Snap.

All in all, Wall Street’s Hold consensus rating for Snap is based on four Buys, 16 Holds, and three Sells. At $10.63, the average SNAP price target suggests 8.4% upside. Shares have advanced about 10% since the start of this year.

Conclusion

The fears of an impending recession are expected to adversely impact digital ad spending over the near term. Currently, Wall Street is bullish about Meta Platforms and remains on the sidelines with regard to Pinterest and Snap. Meta’s massive user base is expected to help it maintain its dominance as a leading social media company and grab additional ad dollars.

As per TipRanks’ Smart Score System, Meta scores a nine out of 10, indicating that the stock is capable of delivering market-beating returns over the long term.