Healthcare companies are not completely immune to an economic downturn. Nonetheless, they usually tend to fare better than stocks in other sectors. Generally, people cut down their spending on discretionary items considerably during a recession, while they don’t reduce their healthcare expenditure to that extent. With that thought in mind, we used TipRanks’ Stock Comparison Tool to place Pfizer (NYSE:PFE), Johnson & Johnson (NYSE:JNJ), and CVS Health (NYSE:CVS) against each other and pick the most attractive healthcare stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Pfizer (PFE) Stock

Pfizer’s third-quarter revenue declined year-over-year due to lower demand for its COVID-19 vaccine Comirnaty (developed in partnership with BioNTech (BNTX)). However, the company exceeded analysts’ earnings and revenue expectations. The company also raised its full-year earnings guidance and the low-end of its revenue outlook.

Additionally, Pfizer now expects its COVID-19 vaccine to generate $34 billion in revenue this year, up $2 billion from the previous guidance. It continues to project revenue of $22 billion from its antiviral pill Paxlovid.

Pfizer stock has been under pressure due to concerns about the waning demand for its COVID-19 vaccine. Also, investors are worried about the loss of exclusivity of the company’s key drugs. Pfizer estimates loss of exclusivity of some of its drugs to negatively impact its revenue by about $17 billion between 2025 and 2030.

That said, the company expects to offset the potential loss in revenue with the launch of 19 products over the next 18 months. Of these 19 expected launches, Pfizer anticipates 15 to generate about $20 billion in sales in 2030. Pfizer also expects its long-term growth to be supported by strategic acquisitions, including Arena, Biohaven, Global Blood Therapeutics, and ReViral.

Is PFE a Buy, Hold, or Sell?

Currently, Wall Street is cautiously optimistic on Pfizer stock, with a Moderate Buy consensus rating based on four Buys and eight Holds. The average PFE stock price target of $51 suggests 8.3% upside potential.

Johnson & Johnson (JNJ) Stock

Despite currency headwinds and higher costs, JNJ topped analysts’ Q3 expectations. JNJ’s Q3 revenue increased 1.9% to $23.8 billion, while adjusted EPS declined 1.9% to $2.55. The company expects its full-year sales to rise 2.1% and adjusted EPS to grow 2.6% at the mid-point of its guidance range.

JNJ is optimistic about its long-term growth prospects backed by its strong pipeline. In an effort to focus on its higher-growth pharmaceutical and medical device businesses, last year, JNJ announced the spin off of its Consumer Health division into a separate entity called Kenvue. The separation is expected to be completed by mid to late 2023.

Pfizer is confident about growing its pharmaceutical business to reach sales of $60 billion by 2025. To strengthen its MedTech business, the company recently announced a $16.6 billion deal to acquire Abiomed (ABMD).

Is JNJ a Good Stock to Buy?

Following the Q3 results, Cantor Fitzgerald analyst Louise Chen reaffirmed a Buy rating on JNJ stock with a price target of $215. Chen stated, “We continue to believe that upward earnings estimate revisions and multiple expansion, to 17-20x 2022E EV/EBIT from 15x now, driven by above-market growth in its key franchises, should likely move JNJ shares higher.”

The Street’s Moderate Buy consensus rating on Johnson & Johnson stock is based on four Buys and seven Holds. At $181.60, the average JNJ stock price prediction suggests 5% upside potential.

CVS Health (CVS) Stock

Pharmacy giant CVS Health reported better-than-anticipated Q3 results driven by the performance of its Health Care Benefits and Pharmacy Services segments. Meanwhile, Retail / Long-Term Care segment’s performance was impacted by lower COVID-19 diagnostic testing and vaccinations, persistent pharmacy reimbursement pressure, and growth investments.

Overall, CVS’ Q3 revenue increased 10% to $81.2 billion, while adjusted EPS grew 6% to $2.09. The company raised its full-year earnings guidance following the strong Q3 results. CVS also raised its 2022 cash flow from operations outlook to the range of $13.5 billion to $14.5 billion from the previous guidance range of $12.5 billion to $13.5 billion.

Looking ahead, CVS is further strengthening its presence in the healthcare space with the recently announced $8 billion acquisition of Signify Health. The deal is expected to close in the first half of 2023.

What is the Target Price for CVS Stock?

Following the Q3 print, Mizuho Securities analyst Ann Hynes reiterated a Buy rating on CVS stock with a price target of $120, as she believes that many de-risking events are positive for the stock. The analyst highlighted the Q3 earnings beat, and the company’s reaffirmation of its 2024 adjusted EPS growth rate despite revenue headwinds of $2 billion from a lower Medicare Advantage star rating and the loss of Centene’s (CNC) pharmacy benefits management contract to a rival.

Regarding the $5.2 billion charges recorded in Q3 in connection with the opioid settlement, Hynes stated, “We believe the amount and the timing of payments should be manageable and not impact the company’s ability to fund growth, and we believe this announcement removes a key overhang for the stock.”

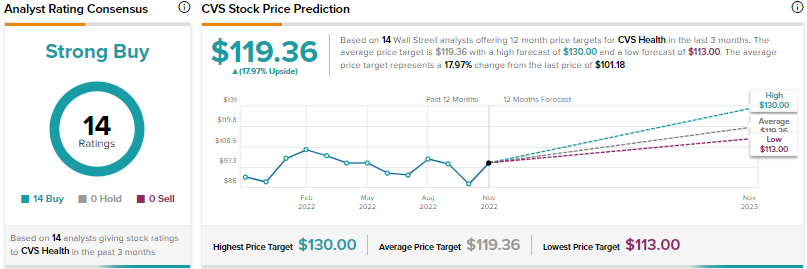

CVS scores the Street’s Strong Buy consensus rating, backed by an impressive 14 unanimous Buys. The average stock price target of $119.36 implies 18% upside potential.

Conclusion

Wall Street is highly bullish on CVS Health stock, while they are cautiously optimistic on Pfizer and Johnson & Johnson. Analysts estimate higher upside potential in CVS stock compared to the other two healthcare stocks. CVS has a well-diversified business across three segments (Health Care Benefits, Pharmacy Services, and Retail/Long-Term Care) and is focused on expanding its primary care delivery capabilities and healthcare offerings.

CVS stock earns a “Perfect 10” as per TipRanks Smart Score System, implying that the stock could outperform the broader market.