Update (September 6)

American healthcare company, CVS Health Corporation (CVS) has entered into a definitive agreement to buy healthcare technology company Signify Health (SGFY) for approximately $8 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Terms of the Buyout Deal

Per the terms of the deal, CVS will pay $30.50 per share in cash for each share of Signify Health. The deal is approved by the Board of Directors of both companies. However, shareholder approval of Signify Health and certain regulatory approval remain pending. Interestingly, private equity funds affiliated with New Mountain Capital, a 60% owner of Signify Health, have agreed to vote in favor of the deal. Upon satisfactory conditions, the transaction is expected to close in the first half of 2023.

Remarkably, CVS expects the deal to be meaningfully accretive to its earnings and is confident in achieving its long-term adjusted earnings per share (EPS) goals.

About CVS Health and Signify Health

CVS Health operates a retail pharmacy chain, acts as a pharmacy benefits manager, and provides health insurance services. Meanwhile, Signify Health leverages advanced analytics, technology, and nationwide healthcare provider networks to create and power value-based payment programs.

Through the acquisition, CVS will add Signify Health’s network of more than 10,000 clinicians across all 50 states and a nationwide value-based provider network, combined with its proprietary analytics and technology platforms. Also, Signify Health’s network of over 50 health plan clients and its members will further bolster CVS’s offerings.

Signify Health’s March 2022 acquisition of Caravan Health also brings over 170 partner providers participating in accountable care organizations (ACOs) serving Medicare beneficiaries.

Commenting on the deal, CVS Health President and CEO, Karen S. Lynch said, “This acquisition will enhance our connection to consumers in the home and enables providers to better address patient needs as we execute our vision to redefine the health care experience. In addition, this combination will strengthen our ability to expand and develop new product offerings in a multi-payor approach.”

Tough Competition in the Healthcare Space

Signify has been looking for strategic options for quite some time. The company boasts unmatched size and a well-established network of doctors that aid in house calls. Notably, CVS seems to have overtaken the other bidders like Amazon.com (AMZN) and UnitedHealth Group (UNH) in the race. Bids for Signify were expected by September 6.

As per data from the Centers for Medicare and Medicaid Services (CMS), growth in national health spending in the U.S. is expected to average 5.3% between 2025-2030 and reach $6.8 trillion by 2030. This represents the humongous growth opportunities for healthcare companies in the space.

Walgreens Boots Alliance (WBA) is also another major player in the space, but it opts for partnerships rather than acquisitions for growth. WBA’s plan to divest its UK drugstore chain, Boots, was shelved due to a lack of attractive bids. Instead, it is now focusing its energy on making the chain profitable.

What is the Forecast for CVS Stock?

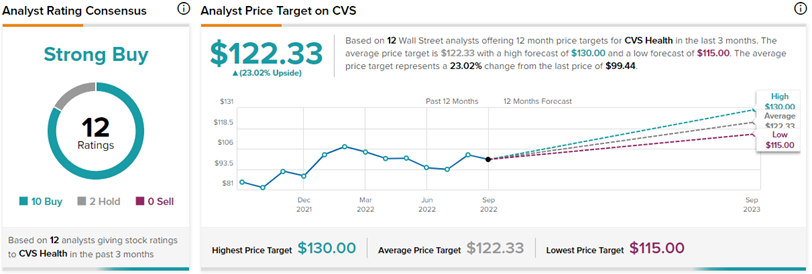

On TipRanks, CVS stock commands a Strong Buy consensus rating based on ten Buys and two Holds. The average CVS Health price forecast of $122.33 implies 23% upside potential to current levels. Meanwhile, the stock has lost nearly 3% so far this year.

Moreover, CVS scores a “Perfect 10” on the TipRanks Smart Score system. This implies that the stock is highly likely to outperform market expectations. Both hedge funds and retail investors have been increasing their exposure to CVS stock recently.

Is SGFY a Good Stock?

Wall Street analysts are highly bullish about SGFY stock. With the chances of a takeover becoming more likely, analysts think SGFY makes for an attractive Buy. Even as a standalone company, Signify Health has made a name in the space and continues to be a profitable and best-in-class healthcare provider.

On TipRanks, SGFY stock commands a Strong Buy consensus rating based on eight Buys and one Hold. The average Signify Health price target of $27.67 implies 3.8% downside potential to current levels. Meanwhile, amid all the buyout buzz, SGFY stock has gained a whopping 91.3% so far this year.

Furthermore, SGFY has a Smart Score of 8 on the TipRanks Smart Score system. This implies that the stock is most likely to outperform market expectations. While hedge funds have reduced their stake in SGFY stock, retail investors have increased their exposure by 9.3% over the last 30 days.