Investors are looking for lucrative value plays and avoiding growth stocks amid rising interest rates and growing macro pressures. The ongoing turmoil has dragged down stocks of many well-established companies with strong fundamentals, creating opportunities for investors to build positions at attractive levels. Using TipRanks’ Stock Comparison Tool, we will compare Pfizer (NYSE:PFE), Ford (NYSE:F), and Target (NYSE:TGT) to pick the most attractive value stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Pfizer (NYSE:PFE) Stock

Healthcare giant Pfizer’s revenue is expected to cross the $100 billion mark this year, thanks to its COVID-19 vaccine Comirnaty (developed in collaboration with BioNTech (BNTX)) and its antiviral pill Paxlovid. The company expects $34 billion in revenue this year from Comirnaty and $22 billion from Paxlovid.

Investors are concerned about the waning demand for Pfizer’s COVID-19 vaccine. Moreover, Pfizer expects to lose revenue of about $17 billion between 2025 and 2030 due to the patent expiration of some of its key drugs. Nonetheless, the company is confident about its future prospects. Pfizer expects to launch up to 19 new products over the next 18 months. It projects 15 of these products, which are developed internally, to contribute $20 billion to 2030 sales.

Moreover, the company’s acquisitions are expected to further boost its prospects. Most recently, Pfizer completed its $5.4 billion acquisition of Global Blood Therapeutics, a biopharmaceutical company that develops treatments for sickle cell disease.

Is Pfizer a Buy, Sell, or Hold?

Goldman Sachs analyst Chris Shibutani upgraded Pfizer to a Buy from Hold and increased the price target to $60 from $47. Shibutani’s upgrade was backed by favorable updates from the company’s pipeline. Also, the analyst feels that the potential for the new product launches to outperform expectations can drive “meaningful upside” to Pfizer’s base business.

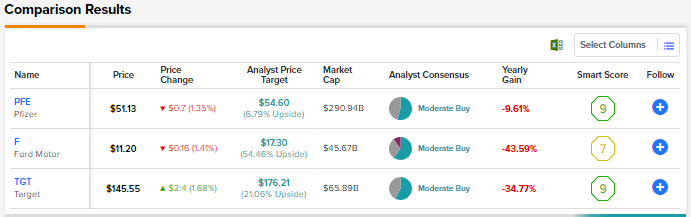

Wall Street’s Moderate Buy consensus rating for Pfizer is based on six Buys and five Holds. The average PFE stock price prediction of $54.60 implies 6.8% upside potential. Shares have declined 13.4% so far this year.

Ford Motor (NYSE:F) Stock

Higher costs, component shortages due to persistent supply chain issues, and macro pressures have impacted the performance of Ford and other automakers. The company was recently in the news when it increased the price of its F-150 Lightning electric pickup truck yet again, citing rising costs and supply constraints. Investors are worried that significant price hikes might impact affordability and hurt the demand for the popular EV model.

Meanwhile, Ford is focused on becoming one of the leading EV players and is making significant investments to meet its goals. The company aims to achieve an annual production rate of 600,000 EVs by the end of 2023 and 2 million by 2026. As part of this plan, Ford recently accelerated the production of Mustang Mach-E electric SUV, with the aim to reach annual production of 270,000 units.

Is Ford Stock Expected to Rise?

Citigroup analyst Itay Michaeli slightly lowered the 2023 and 2024 EPS estimates for Ford based on recent data points and Q3 results. Nevertheless, Michaeli’s estimates are still above the Street’s consensus expectations.

While Michaeli is “generally constructive” on Ford’s fundamental story and sees the scope for its multiple to expand, he feels that the near-term risk-reward profile seems balanced in the ongoing macro situation. Consequently, Michaeli reiterated a Hold rating on Ford stock but raised the price target slightly to $14 from $13.

A higher proportion of analysts covering Ford remain bullish about the stock. The Street’s Moderate Buy consensus rating for Ford stock is based on six Buys, three Holds, and one Sell. The average Ford stock price target of $17.30 implies 54.5% upside potential. Shares have declined 46% year-to-date.

Target (NYSE:TGT) Stock

Target is a general merchandise retailer operating nearly 2,000 stores in the U.S. The company significantly lagged analysts’ Q3 expectations, with adjusted EPS declining 49% year-over-year to $1.54. Higher markdowns, merchandise and freight costs, and increased compensation costs hurt profitability. Revenue grew 3.4% to $26.5 billion and comparable sales were up 2.7% in Q3.

While the company experienced increased sales of beauty and food and beverage categories in Q3, high inflation impacted the spending on discretionary items. Macro challenges affected the company’s Q4 outlook. It expects a low-single-digit decline in comparable sales in the holiday quarter and operating margin rate of around 3%.

Meanwhile, Target aims to deliver cost savings of $2 billion to $3 billion over the next three years to drive operational efficiencies. The retailer is optimistic about its long-term growth, driven by its extensive store network and growing list of partnerships with companies like Starbucks (SBUX), Apple (AAPL), CVS Health (CVS), and Ulta Beauty (ULTA).

Is TGT a Buy or Sell?

Earlier this month, Bernstein analyst Dean Rosenblum initiated coverage of Target with a Buy rating and a price target of $190. Rosenblum is “cautiously bullish” on the U.S. hardlines and broadlines retail sector. The analyst believes that long-term fundamentals “remain sound.” Rosenblum believes that the pullback in the stocks in the sector offers “some potentially compelling entry points.”

Overall, the Street’s Moderate Buy consensus rating for Target stock is based on 15 Buys and 11 Holds. The average TGT stock price target of $176.21 suggests 21.1% upside potential. Shares have declined 37.1% year-to-date.

Final Thoughts

Near-term headwinds are weighing on the performance of Pfizer, Ford, and Target. Nonetheless, Wall Street analysts seem bullish on the long-term prospects of these value stocks. Currently, they see higher upside potential in Ford stock than in Pfizer and Target. Moreover, Ford offers a higher forward dividend yield of 5.4% (current dividend yield stands at 4.4%) compared to Pfizer’s 3.2% and Target’s 3.0%. However, Pfizer and Target have a better track record of consistent dividends than Ford.

As per TipRanks, the Hedge Fund Confidence Signal is Very Positive for Ford. Hedge funds have increased their holdings in Ford stock by 40.4 million shares in the last quarter.