PepsiCo (PEP) stock has been on a steady slide for two years, now trading at levels not seen since 2019. The company’s grappling with some real challenges, like slowing growth, shifting consumer preferences, and the lingering sting of recent U.S. tariff rollbacks that still complicate supply chains. On the bright side, following this rough patch, PEP’s valuation appears dirt cheap at 16.6x earnings, while its dividend yield just hit a record of 4.11%—well above the sector average of 2.4%. This setup has made me feel pretty optimistic about the stock’s prospects from its current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

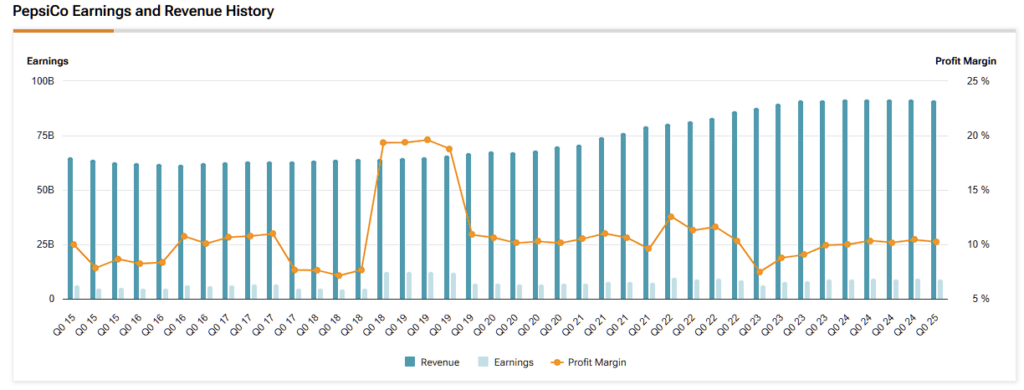

Growth Hits a Speed Bump

PepsiCo, the powerhouse behind Doritos, Gatorade, and that classic cola, has seen its growth engine stall. Figures published last month showed a 1.8% revenue drop, with organic sales barely inching up 1.2%. North America’s been tough, with snack volumes down 2% and beverage sales flat, as budget-conscious consumers cut back. The rise of weight-loss drugs like Ozempic hasn’t helped, as people are snacking less, and Frito-Lay’s feeling it most.

Globally, it’s a mixed bag. Emerging markets like India and Brazil posted 5% revenue growth, but it’s not enough to offset the U.S. slump. PepsiCo’s been investing heavily in marketing and acquisitions, like the prebiotic soda brand Poppi, to reignite demand, but results are slow to materialize. Investors are getting antsy, and the stock’s 27% drop over the past year clearly reflects that frustration.

The company’s also dealing with internal hiccups, like supply chain software issues at Frito-Lay, which dented efficiency. While management is optimistic about fixing these, the lack of quick wins has kept pressure on the stock. In any case, I believe PepsiCo’s global scale and brand strength give it room to maneuver, even if growth’s stuck in low gear for now.

Tariffs Add a Bitter Aftertaste

The U.S.-China trade deal announced early last week may have, for now, sliced tariffs on Chinese imports from 145% to 30% for 90 days, offering PepsiCo some relief on inputs like aluminum for cans. However, a 20% tariff tied to fentanyl concerns persists, and Canada and Mexico still face 25% tariffs on non-USMCA goods, impacting PepsiCo’s North American supply chain. These lingering costs and a now-expired de minimis exemption for low-value Chinese imports keep margins under pressure.

CEO Ramon Laguarta noted on the Q1 earnings call that trade volatility continues to squeeze profitability, with core operating profit down 1%. PepsiCo’s global supply chain, sourcing materials like corn and sugar across 200 countries, makes it vulnerable to these disruptions. Unlike Coca-Cola (KO), which has an edge here due to more domestic production, PepsiCo’s reliance on imports amplifies tariff impacts. PEP is now exploring alternative sourcing, but costs remain elevated for the time being.

Health Trends Stir the Pot

Another headwind worth noting is the ongoing trend of consumers rethinking their diets, and PepsiCo is feeling the squeeze. Weight-loss drugs and growing scrutiny of processed foods, amplified by figures like the U.S. Health Secretary Robert F. Kennedy Jr. has put snacks like Cheetos in the crosshairs of government regulators. And then, in India, water usage concerns have sparked backlash against PepsiCo’s operations, adding PR challenges. These shifts are denting demand for sugary drinks and salty snacks.

PepsiCo’s trying to pivot with healthier options like Bubly and Gatorade Zero, but its core portfolio still leans on traditional snacks and sodas. The recent Poppi acquisition for $1.95 billion—a fast-growing prebiotic soda brand—targets health-conscious consumers, but it’s too small to move the needle yet. Meanwhile, rivals like Coca-Cola, with a stronger low-sugar lineup, are pulling ahead on margins. So naturally, investors worry PepsiCo’s slow shift could cede market share.

A Cheap Stock with a Juicy Dividend

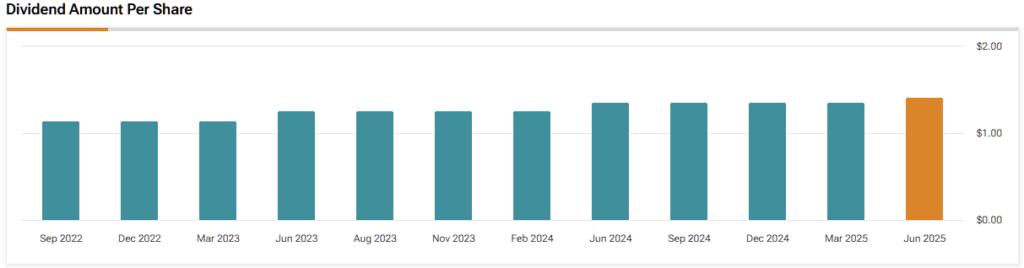

However, it’s not all gloomy in PepsiCo’s investment case. After its two-year slide, the stock is now trading at just 16.6x forward earnings, one of its lowest valuations ever. For context, its five-year average P/E stands at roughly ~25, including high interest rates for most of this period.

For a company with iconic, recession-proof brands like Quaker and Tropicana, that’s a steal. To grab a Dividend King that has raised its payouts for 53 consecutive years, trading at a multi-year low valuation and an all-time-high yield of 4.11%, is a lucrative opportunity to capitalize.

Is PepsiCo a Buy or Sell?

Despite its prolonged underperformance, Wall Street analysts continue to have mixed feelings about PepsiCo’s prospects. Specifically, PEP stock features a Hold consensus rating based on three Buys and 10 Hold recommendations over the past three months. Still, it’s worth noting that no analyst rates the stock as a sell today. At $148.33, the average PEP stock price target implies an upside potential of ~14% from the current levels.

Blue-Chip Bargain Poised for Rebound

PepsiCo stock has had a tough run, with growth stalls, tariff headaches, and health trends dragging it back to 2019 prices. But at 16.6x earnings and a 4.11% dividend yield, it’s a blue-chip stock at a discount. Its global brands, 53-year dividend streak, and recession-proof business make it a safe long-term play. With trade talks potentially easing costs, I’m betting PEP’s poised for a rebound.