The current macroeconomic environment with soaring inflation and rising interest rates has raised questions in the mind of investors about the retail sector.

However, the recent Q1 results from beverage giants like PepsiCo and Coca-Cola suggest that these companies are weathering this macroeconomic storm quite well.

Using the TipRanks stock comparison tool, let’s compare these two giants and look at what Wall Street analysts are saying about these stocks.

PepsiCo (NASDAQ: PEP)

PepsiCo delivered upbeat Q1 results on Tuesday. The beverage and snacks company delivered $16.2 billion in revenues, up 9.3% year-over-year, beating analysts’ estimates of $15.6 billion. The company’s portfolio of brands includes Lays, Doritos, Cheetos, Gatorade, Pepsi-Cola, Mountain Dew, Quaker, and SodaStream.

PEP reported core Q1 earnings of $1.29 per share, up 7% year-over-year on a constant currency basis, surpassing consensus estimates of $1.23 per share.

Pepsi chairman and CEO Ramon Laguarta commented on the Q1 results, saying, “Given the strength and resilience of our businesses to date, while reflecting higher than expected input cost inflation for the balance of 2022, we now expect our full-year organic revenue to increase 8 percent (previously 6 percent) and we continue to expect core constant currency earnings per share to increase 8 percent.”

However, the company’s management acknowledged on its earnings call that inflation is proving to be more challenging this year. In order to counter this, PEP is investing more in its brands with better revenue and cost management.

PEP also recognized an impairment charge of $193 million when it comes to selling, general, and administrative charges (SG&A) “related to the discontinuation or repositioning of certain juice and dairy brands in Russia,” as the company suspended some of its Russian business.

Goldman Sachs analyst Bonnie Herzog remained bullish on the stock following the “very strong” Q1 results. The analyst stated, “PEP reported a very strong start to the year with Q1 results that delivered an impressive beat on both the top and bottom lines… We believe the stock will react favorably to these strong Q1 results and better-than-expected outlook today.”

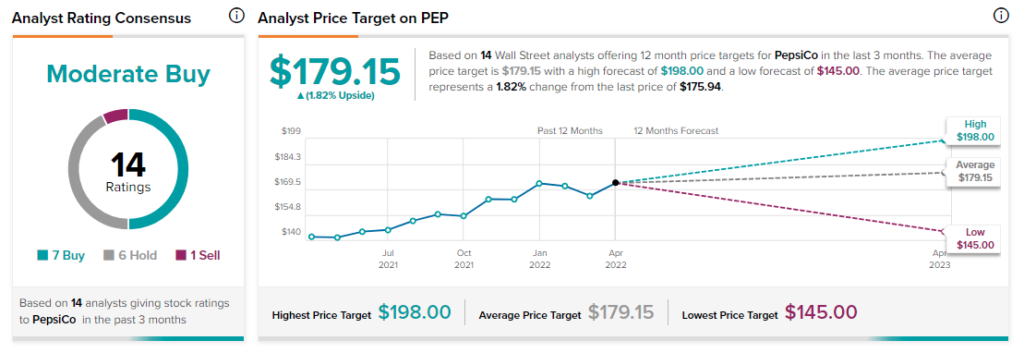

Other analysts on the Street are, however, cautiously optimistic about the stock with a Moderate Buy consensus rating based on seven Buys, six Holds, and one Sell. The average PEP stock forecast is $179.15, implying 1.8% upside potential.

The Coca-Cola Company (NYSE: KO)

Coca-Cola announced its Q1 results earlier this week, with revenues growing 16% year-over-year to $10.5 billion, surpassing the consensus estimates of $9.83 billion. The beverage giant’s earnings were up 23% year-over-year to $0.64 per share, beating the analysts’ estimates by six cents.

On an organic basis, the company’s revenues were up 18% year-over-year, driven by a 7% rise in price-to-mix ratio, and an increase of 11% in concentrate sales. KO generates net revenues by selling concentrates, syrups, and certain finished beverages to its bottlers. Coca-Cola also earns revenues by selling sparkling soft drinks and other finished beverages to retailers, distributors, and wholesalers.

For 2022, KO has projected its organic revenues to be in the range of 7% and 8%, and comparable EPS is projected to grow in the range of 8% to 10% on a currency-neutral basis.

Following the suspension of Coca-Cola’s business in Russia, for FY 22, the company expects net revenues and operating income to be impacted by 1% to 2% while adjusted comparable EPS is anticipated to be impacted by $0.04.

However, Coca-Cola’s management cautioned on its Q1 earnings call that the conflict between Russia and Ukraine “has created further volatility in the world as well as added to the inflationary backdrop and impacted the currency markets.”

Moreover, the increase in the number of COVID cases in China was a “reminder that the recovery path has been and will continue to be asynchronous.”

Wells Fargo analyst Chris Carey seems to think that there is “despite some new headwinds, and the bias to estimates remains up, a notable setup in mega cap Staples amidst a defensive rotation underway.”

The analyst added that even with the strong Q1 results, KO is not raising its outlook as he thinks “KO simply sees too many variables to get ahead of itself so early in the year.”

However, Carey does expect Coca-Cola to raise estimates later this year. As a result, the analyst reiterated a Buy on the stock, and raised the price target to $74 from $72.

Other Wall Street analysts are cautiously optimistic about the stock with a Moderate Buy consensus rating based on 13 Buys and five Holds. The average KO stock forecast is $70.06, implying 5.9% upside potential.

Bottom Line

While analysts are cautiously optimistic about both stocks, based on the upside potential over the next 12 months, Coca-Cola seems to have better upside.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure.