The fear of the U.S. Federal Reserve resuming interest rate hikes soon has reinforced fears of an impending recession. Investors with a long-term horizon could benefit by looking at attractive value stocks – stocks of companies trading at lower prices than what the fundamentals suggest. Using TipRanks’ Stock Comparison Tool, we placed PepsiCo (NASDAQ:PEP), AbbVie (NYSE:ABBV), and General Motors (NYSE:GM) against each other to find the value stock that has the highest upside potential as per Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

PepsiCo (NASDAQ:PEP)

PepsiCo’s stock movement has been unimpressive this year despite better-than-anticipated first-quarter earnings. The company’s pricing power and robust presence in the snack food and beverage space helped deliver upbeat Q1 results and increase the full-year outlook.

Ahead of PepsiCo’s Q2 results (scheduled on July 13), Goldman Sachs analyst Bonnie Herzog reaffirmed a Buy rating on PEP with a price target of $208, saying that he sees a “favorable risk-reward.” The analyst expects a “healthy” revenue and earnings beat, given continued momentum in the company’s businesses, particularly for Frito-Lay North America (FLNA) as noted in recent NielsenIQ data.

Furthermore, Herzog highlighted that the trends in the PepsiCo Beverages North America (PBNA) segment appear healthy, with consumer elasticities being resilient despite a tough macro backdrop. Consequently, the analyst raised his Q2 organic sales growth expectation to 11.1% from 9.8%, mainly to reflect FLNA strength, and also increased his EPS estimate.

Overall, Herzog believes that PepsiCo is one of the “best positioned companies” in the global food and beverage space to generate solid growth over the next ten years due to its impressive exposure to the snack food space and developing and emerging markets.

Is PEP Stock a Buy Now?

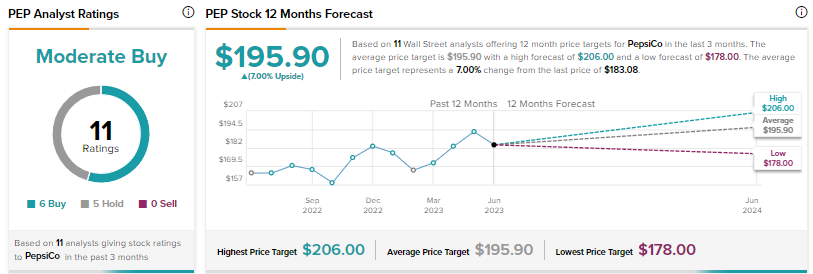

With six Buys and five Holds, PEP stock scores a Moderate Buy consensus rating. At $195.90, the average price target implies 7% upside. Shares have risen 1.3% so far this year. PEP, a dividend king, offers a dividend yield of 2.8%.

AbbVie (NYSE:ABBV)

Shares of AbbVie have been under pressure due to investors’ concerns about the declining sales of the pharma company’s immunology drug Humira due to competition from Biosimilars. Humira sales declined 25.2% to $3.5 billion in Q1 2023, dragging down overall sales by 9.7% to $12.2 billion.

On Thursday, the company lowered its full-year adjusted EPS outlook, citing $280 million in milestone and in-process research and development expenses during the second quarter. The company now expects full-year adjusted EPS between $10.57 and $10.97 per share. Moreover, the company’s Q2 EPS guidance missed analysts’ expectations.

While near-term pressure seems inevitable, AbbVie is optimistic about the road ahead and expects its newer immunology drugs Skyrizi and Rinvoq to deliver sales of over $17.5 billion in 2025. Moreover, as of late May, the company’s pipeline had more than 50 programs in the mid and late-stage development.

It is worth noting that AbbVie has increased its dividend for 51 consecutive years [including the years it was part of Abbott Laboratories (NYSE:ABT)]. The company offers a dividend yield of 4.4%.

Is ABBV Stock a Buy or Sell?

Wall Street is cautiously optimistic on AbbVie stock, with a Moderate Buy consensus rating based on six Buys and five Holds. The average price target of $169.10 implies nearly 25% upside. The stock has declined 16% year-to-date.

General Motors (NYSE:GM)

Legacy automaker General Motors is rapidly moving ahead with its goal to become an all-electric vehicle (EV) company. According to a report by Motor Intelligence, cited by CNBC, Tesla (NASDAQ:TSLA) continued to be the U.S. EV market leader in the first half of 2023 and sold 336,892 vehicles (up 30% year-over-year). A distant second was Hyundai (including the Kia brand) (HYMTF), which sold 38,457 EVs in the first half. Meanwhile, General Motors stood at the third position, with its EV sales rising 365% to 36,322 units.

As part of its goal to accelerate its presence in the EV space, GM entered into an agreement with Tesla last month, which will give its EV buyers access to the Tesla Supercharger network. While GM is cutting costs in several areas, the company continues to invest in its EV ambitions and aims to manufacture 400,000 EVs in North America through the first half of 2024

On Friday, Morgan Stanley analyst Adam Jonas raised his price target for General Motors to $41 from $38 and reiterated a Buy rating. Ahead of the Q2 results, the analyst expects stronger-than-anticipated price and mix and a surprisingly resilient auto consumer to “create beat-and-raise conditions” for the U.S. automakers.

Is GM Stock a Good Buy Now?

Wall Street has a Moderate Buy consensus rating on General Motors stock based on seven Buys and seven Holds. The average price target of $46.85 implies over 18% upside. Shares have risen 18% year-to-date.

Conclusion

Wall Street is cautiously optimistic about AbbVie, PepsiCo, and General Motors amid the ongoing macro pressures. Analysts see higher upside potential in AbbVie from current levels, with the pullback in the stock offering an attractive buying opportunity for the long term. Several analysts are looking beyond the Humira-related headwinds and believe in the growth potential of the company’s newer drugs and an extensive pipeline. The company also offers an attractive dividend yield.